Stage: Seed

Focus: Accounting & Tax

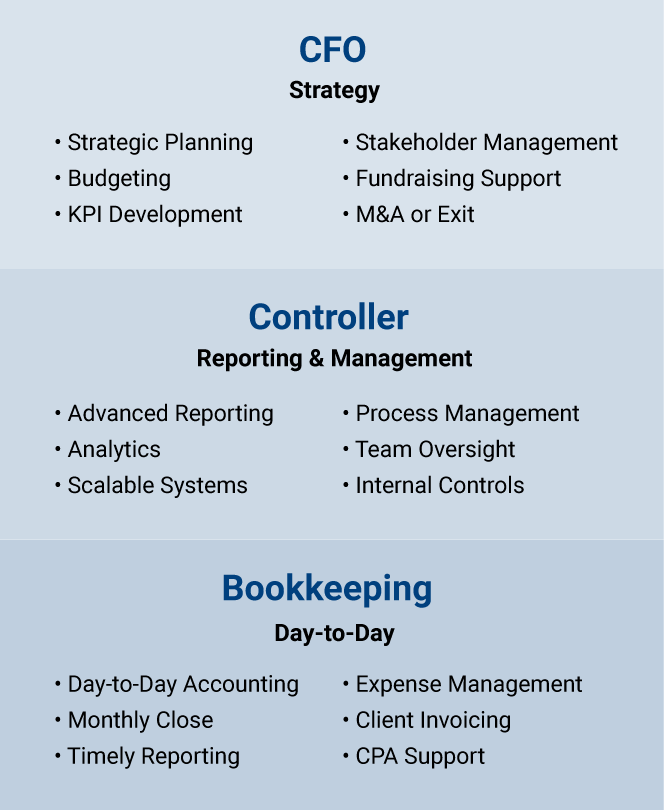

At the earliest stages, startups need to focus on getting their accounting and tax set up correctly, and implementing basic financial systems, controls, and reporting. This work is traditionally done by a bookkeeper or accountant.

Action Steps:

- Implement accrual accounting

- Set up base-level financial systems

- Set up HR and payroll systems

- Select banking partners and set up banking

- Adopt a Treasury Management Policy

- Begin to implement key financial controls

- Ensure corporate tax compliance

- Configure monthly reports

- Set up customer collection systems

Stage: Pre-Series A

Focus: Modeling & Fundraising

The next focus is generally financial modeling, as companies build long-range plans to validate their business model and unit economics and prepare to raise their Series A. This work is often done by a CFO or VP Finance.

Action Steps:

- Financial modeling and long-range planning

- Revenue model and unit economics assessment

- Financial metrics

- Prepare for Series A

- Cap tables, valuation, and equity dilution

Stage: Series A

Focus: Financial Planning & Analysis

At Series A, startups should implement robust planning and reporting processes, whereby they establish financial plans, report on financial results against plan, and regularly update forecasts.

Action Steps:

- Financial Planning & Analysis (FP&A)

- Planning and forecasting processes

- Scenario planning

- Financial reporting

- Venture debt financial metrics / KPIs & data analytics

- Sales compensation structures

- Series B fundraise prep

Stage: Series B+

Focus: Scaling Strategic Finance

As companies move into later stages, their needs for additional strategic finance and accounting areas grow. Key finance needs for startups at Series B and beyond can include more detailed analysis of financial metrics and performance data, M&A, and international expansion.

Action Steps:

- Continuous financial intelligence

- Enterprise-level financial systems

- M&A

- International expansion

- Audit prep

Burkland helps startups scale their finance systems efficiently and effectively through all growth stages. We work with startups to implement day-to-day bookkeeping processes, ongoing reporting procedures, and sound financial strategies for continued growth. Contact us to request more information about how we can help your startup.

Burkland helps startups scale their finance systems efficiently and effectively through all growth stages. We work with startups to implement day-to-day bookkeeping processes, ongoing reporting procedures, and sound financial strategies for continued growth. Contact us to request more information about how we can help your startup.