Financial fraud and embezzlement can drain a startup’s cash and cause lasting reputation damage, making it difficult for the company to raise investments and attract partners. Fraud and embezzlement can also lead to legal issues, costly investigations, and, in the worst cases, criminal charges.

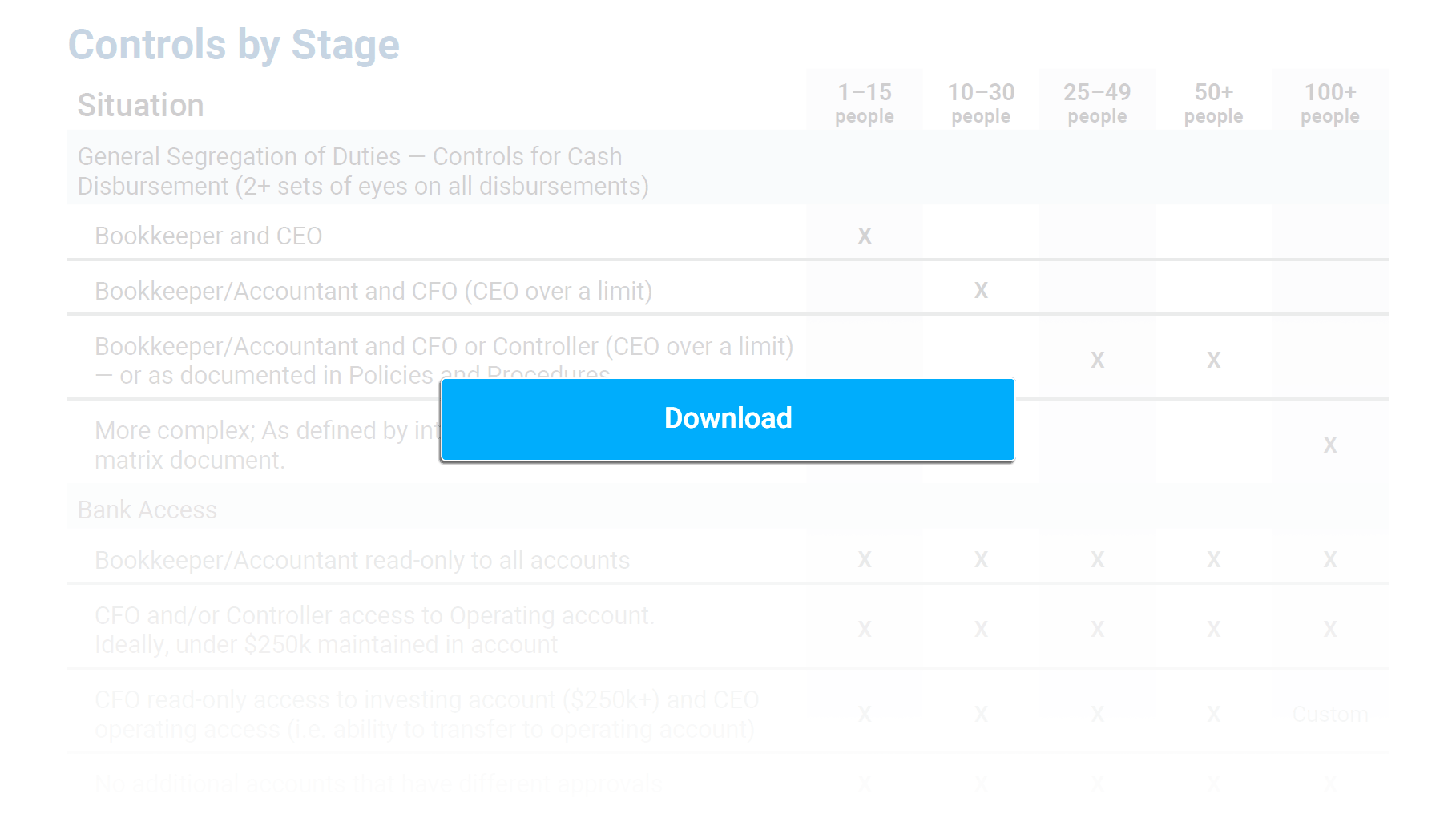

Implementing strong financial controls like the examples in this article will help founders fulfill their duty to protect their startup’s financial resources as the company scales. For a detailed list of financial controls by growth stage, download Burkland’s Financial Controls Matrix.

Segregation of Duties

- At least two people should review all cash disbursements.

- One person should prepare checks, wires or ACHs, and another person should sign or approve them.

Approval Processes

- At the earliest stage, the CEO should approve all cash disbursements. As the business grows, other leaders can take on approval responsibilities. Companies can develop an approval matrix that specifies the level of approval responsibility for different leaders.

- Approval processes can be system supported (e.g. via Bill.com).

- Companies should require approvals for payroll adjustments and commissions.

- Startups should create an Expense Reimbursement Policy that clearly establishes qualifying expenses, non-qualifying expenses, and employee duties related to expenses.

- It’s essential to confirm all requests to update vendor banking information directly with that vendor, to avoid phishing scams.

Banking Access

- Bank accounts should be set up with restricted access, approval limits, dual authorization requirements, and other controls.

- Keep checkbooks securely locked away, with one person responsible for writing checks and another responsible for signing.

- Only the CEO and office manager should have access to corporate credit cards initially.

Financial Statement Review

- Make sure at least two people are involved in the preparation of all financial statements; a preparer and a reviewer.

- Schedule a monthly review with the CEO to look at budget vs. actuals and monthly variances, with a deep dive to review any unexpected variances.