The fractional CFO model has seen a big rise in popularity among startups in recent years. Solid financial guidance is one of the keys to scaling a startup, and a fractional CFO provides easy and cost-effective strategic finance support until a company is ready for a full-time CFO. Just as startups retain an outside law firm for their legal needs instead of hiring general counsel on day one, a fractional CFO makes the most sense for a growing startup.

With all the buzz, you might be asking yourself, “Is my startup ready for a fractional CFO?”.

In this article, I look at what exactly a fractional CFO does and how to evaluate if your startup is ready to hire one.

~ Peter Reinhardt, CEO, Segment

What Does a Fractional CFO Do?

Just like a full-time CFO, a fractional CFO helps manage your company’s strategic finance functions, so your time can stay focused on product development, revenue growth, and building a strong team. A proven CFO also gives board members, investors, and other outside stakeholders extra confidence in you and the company.

Fractional CFOs help startups answer questions like:

- How can we best monetize our ideas?

- What’s the optimal pricing and delivery model?

- How much cash is required to hit our next milestone?

- When should we raise our next round?

- What resources can we afford, and when should we deploy them?

- How do we know if our model is working?

- When and how should we pivot when the market gives us feedback?

Fractional CFO Role & Responsibilities:

- Strategic financial planning

- Financial modeling

- Revenue modeling

- Preparing for funding rounds

- Preparing for mergers and acquisitions

- Strategic decision support

- Financial KPIs and metrics

- Cap tables, valuation and equity

In as little as a few hours a month, a fractional CFO can bring expertise, contacts, and credibility to a growing startup.

Is My Startup Ready for a Fractional CFO?

To help determine if your startup is ready for a fractional CFO, look closely at these three areas:

1. Funding Stage

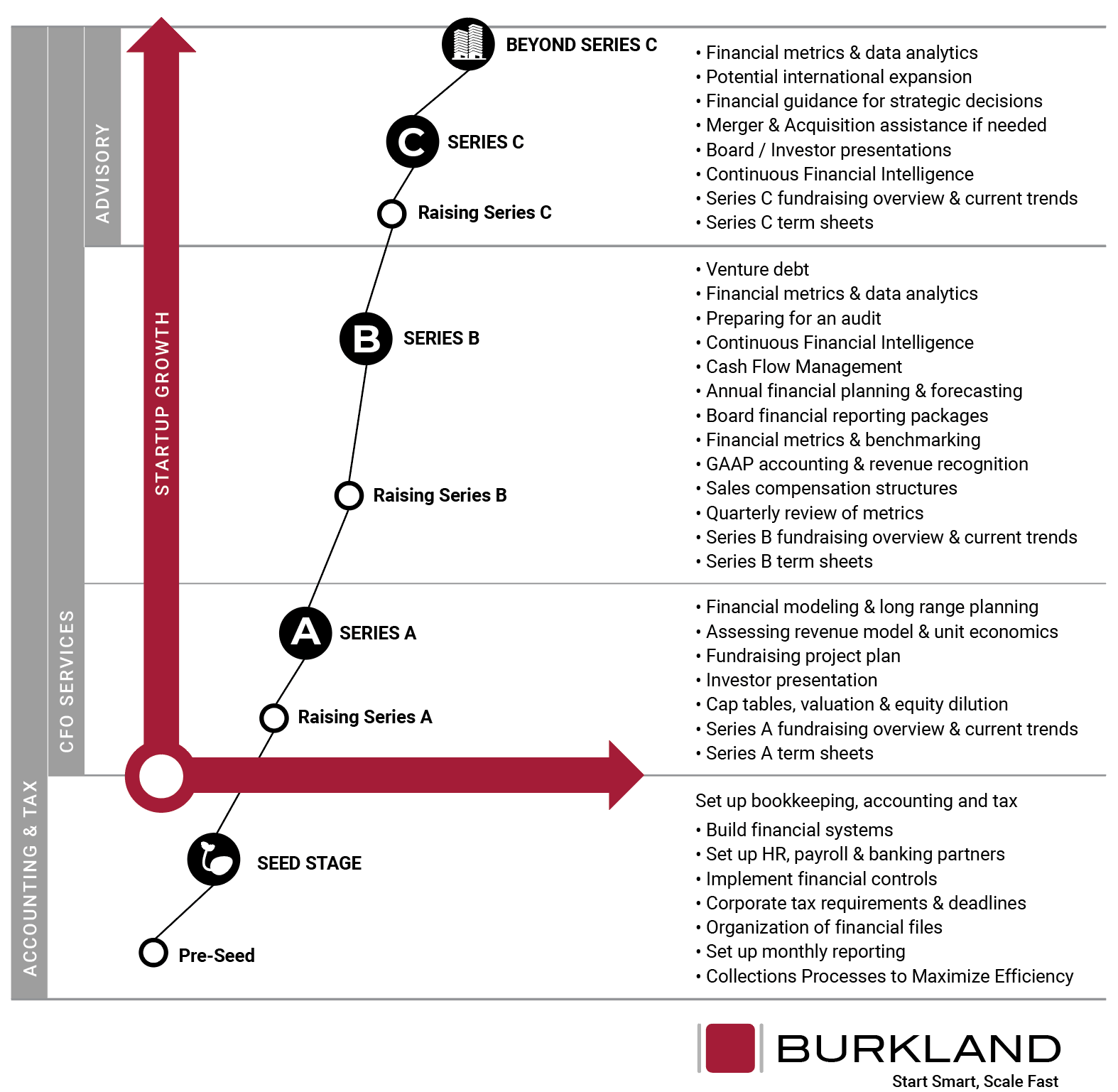

The first thing to look at is your current funding round. Most startups are ready for a fractional CFO somewhere between their Seed round and Series A. At this stage, many startups are ready to benefit from a CFO’s expertise, but not ready to take on the fixed and much higher costs of hiring a full-time CFO.

Most startups are ready for a fractional CFO somewhere between their Seed round and Series A.

Pre-Seed startups usually aren’t quite ready for a fractional CFO. Most startups at this stage really need good tactical finance support around accounting and tax.

On the other end of the spectrum, by the time a startup hits Series D, they’re often ready to hire a full-time CFO.

These aren’t hard rules—Burkland’s fractional CFOs work with a handful of Series D and pre-Seed startups—but funding stage is a good first place to look. You’ll also want to consider factors like the size of your funding round and the strategic support needs described in the next section.

2. Strategic Support Needs

Growth Plans

After considering your funding stage, growth plans are usually the next best place to look to help determine if your startup is ready for a fractional CFO. The more ambitious your startup’s growth plans, the more you’ll need strategic financial support. A fractional CFO can help you chart the best course in the market and be a key representative for your company during future funding rounds as you scale.

Financial Modeling & Guidance

In the earliest growth stages, focusing on solid accounting and tax practices is enough for many startups. When your finance discussions start to become as much about looking ahead as looking back, it’s time to get serious about CFO support. Creating and updating financial models quickly and efficiently to track KPIs and find the optimal way forward is a major value a CFO provides.

Creating and updating financial models quickly and efficiently to track KPIs and find the optimal way forward is a major value a CFO provides.

Mergers & Acquisitions

Any startup with a merger or acquisition on the horizon should have a fractional CFO on its side. From performing due diligence, to developing the transaction plan, to working with management, the Board and investors on cap table impact, your CFO is indispensable throughout an M&A process.

Venture Debt

Venture debt financing has evolved dramatically in recent years, and is being strategically leveraged by startups. A good fractional CFO can help you determine if, when, and how to approach a venture debt round.

Audit Prep

Third-party audits can easily become a big drain on a startup’s time, energy, and focus. If your startup has hit a point where you’re undergoing audits, you should have a good CFO on your side.

Cash Management

Managing cash flow and deploying cash wisely is a key challenge that grows along with your business. Once the complexity of your cash management hits a certain level, a CFO becomes a must.

Board Meeting Support

As your startup grows, so do your board’s expectations. A fractional CFO can take care of the heavy lifting preparing for board meetings and even presenting on your behalf.

Sales Compensation Planning

A CFO can help your sales team tie the right rewards to the right outcomes to incentivize the optimal mix of revenue growth, profit, and customer satisfaction at your startup.

3. CEO’s Time & Focus

Last but not least, you should look at where your CEO’s time and focus has been recently. In the early days of a startup, it’s natural for a CEO to spend a lot of time on financial matters. As the company grows, however, finance can become a big distraction, pulling the CEO’s time away from organizational development, product innovation, and other valuable leadership activities.

As CEO, if you are spending increasing time on finance, you are ready for a fractional CFO.

To make matters worse, this usually starts to happen just as the complexity of finances and cost of financial mistakes is increasing. As CEO, if you are spending increasing time on finance, you are ready for a fractional CFO.

To learn more about how a fractional CFO can help a growing startup, I recommend reading Startup Finance for Founders — Part II, Strategic Finance. This article shares real-world examples from Burkland’s fractional CFO engagement with Segment, prior to the company’s $3.2B acquisition by Twilio.