Venture Debt is not for every startup Founder, but it should at least be considered, discussed and evaluated. Pretending venture debt does not exist is shutting one’s eyes to a source of capital that has grown its slice of the venture industry in the past few years.

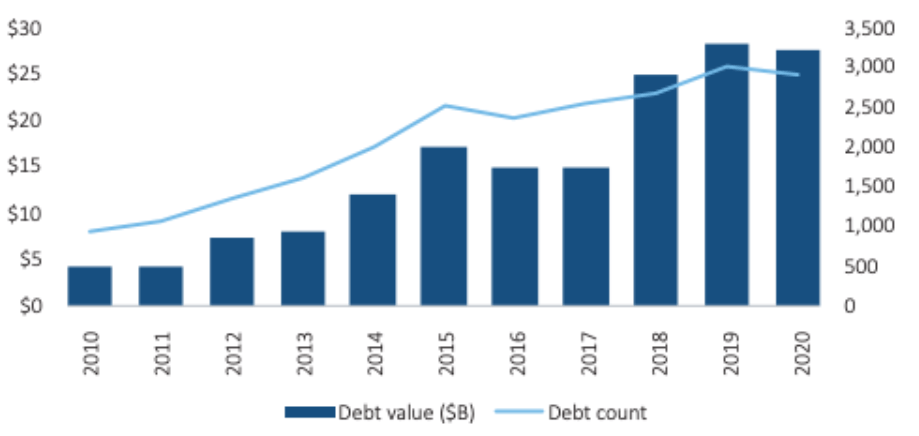

Venture Debt Deal Activity

Source: PitchBook | Geography: USA. As of December 31, 2020

What is Venture Debt?

At its simplest, venture debt is a claim on future cash flows until the debt is paid off, while equity is a claim on the future value of the company. Venture Debt is not designed to supplant equity but when added to a capital stack it can lessen the dilution of the founders’ shares. Combined with equity it gives startups increased availability of capital at a lower cost than equity.

When & Why Should a Startup Consider Venture Debt?

Venture Debt is best done right after a VC raise. At this juncture, you can usually structure the terms to pull the funds at a much later date and pay back the principal primarily with the next round’s raise. The goal is to have this funding available in the future in order to buy more time for growth so that the next round comes a bit later, giving the founder more time to increase the value of their company.

The #1 reason to consider venture debt is to extend your runway, giving you more time to hit milestones that will result in a higher valuation at the next round.

An added benefit of doing venture debt at the time of the raise is that all the information the venture debt provider will ask for has already been prepared.

In Conclusion:

A growing number of startups are using venture debt effectively to buy time (increase runway) for a higher valuation, making it a cheaper form of financing (lower founder equity dilution) while the value of your company rises.

But before you run out and get your first Venture Debt Term Sheet, we want to arm you with a greater depth of understanding of this growing source of startup funding. Because all venture debt is not created equal.

This is the first in a series of Founder Focused Venture Debt Blogs, Tools and Toolkit. Topics and Tools will include:

- How to model the impact of VD in different scenarios

- How to raise a VD round

- An overview of the different sources of Venture Debt

- Reviewing a VD Term Sheet

- How to sell VD to your Board

- Venture Debt War Stories from Founders

For more information on venture debt check out the Startup Success Podcast: Venture Debt, How It Has Changed for Startups.