Summary:

- Three Years is the New Two: Fundraising timelines have stretched. Founders must plan for longer runways and start raising earlier.

- Runway Starts with Real Numbers: Understand your true burn rate, revenue projections, and scenario risks before investing in growth.

- Efficient Growth > Explosive Growth: Focus on strong unit economics. CAC, LTV, gross margin, and payback period matter more than ever.

- Show the Path to Profitability: Investors want capital efficiency and clear financial models, not hockey-stick projections.

The fundraising landscape has shifted dramatically. Gone are the days of seemingly limitless capital and sky-high valuations. Startup founders are facing a very different fundraising environment than they did just a few years ago; one defined by longer timelines, more scrutiny, and far fewer blank checks. Investors are cautious. Valuations are down. And the path between rounds is longer than ever. The question on every founder’s mind: how do we balance investing in revenue growth with the need to conserve cash and extend our runway?

The founders who will make it through this cycle aren’t just the ones with the best ideas. They’re the ones who understand how to balance growth with discipline, invest wisely, preserve runway, and show a clear path to profitability.

1. Plan for Longer Stretches Between Raises

For venture-backed startups, the traditional rule of thumb was to raise enough capital to secure about two years of runway between rounds. However, over the past few years, it’s become increasingly challenging to raise subsequent rounds. For startups that have been able to raise subsequent rounds, the timeline between capital raises has increased significantly. As of Q1 2025, the median time between Series A and Series B stands at nearly three years—a record high, according to data from Carta. If you’re raising now, raise for a longer time horizon than you would have in the past. Three years is the new two.

If you’re raising now, raise for a longer time horizon than you would have in the past. Three years is the new two.

Founders should also adjust their fundraising lead times. Whereas it was once common to start raising 6–9 months before running out of cash, the new reality demands planning at least 12 months in advance, and startups should effectively be continuously fundraising.

2. Get Real About Your Runway

Before making any decisions about growth investments, you need a clear understanding of your cash runway. This means going beyond “we have 12 months of runway” and getting into the details:

- Calculate your monthly burn rate: How much cash are you actually spending each month on average?

- Project your revenue growth: Be realistic and conservative. Don’t rely on hockey-stick projections. (Spoiler: most founders overestimate.)

- Model different scenarios: What happens if your revenue flatlines? What if your churn increases? What if you raise less than planned?

- Determine your runway: How many months can you operate before you run out of cash?

Knowing your runway provides a crucial foundation for making informed decisions about growth investments.

3. Adjust Your Growth Rate Expectations & Strategy

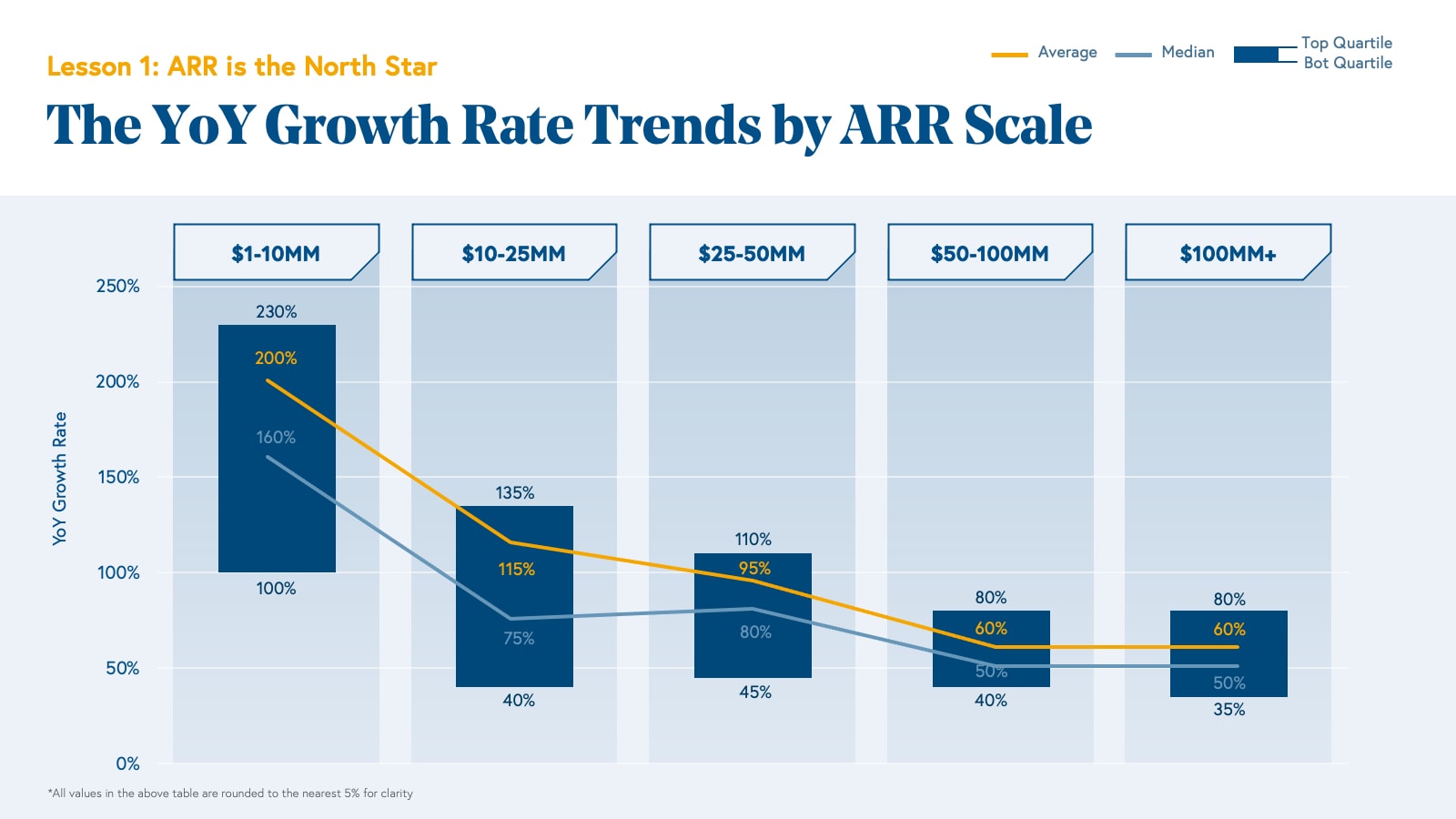

Remember when everyone was chasing the T2D3 growth curve? Triple-triple-double-double-double growth to $100M ARR in five years?

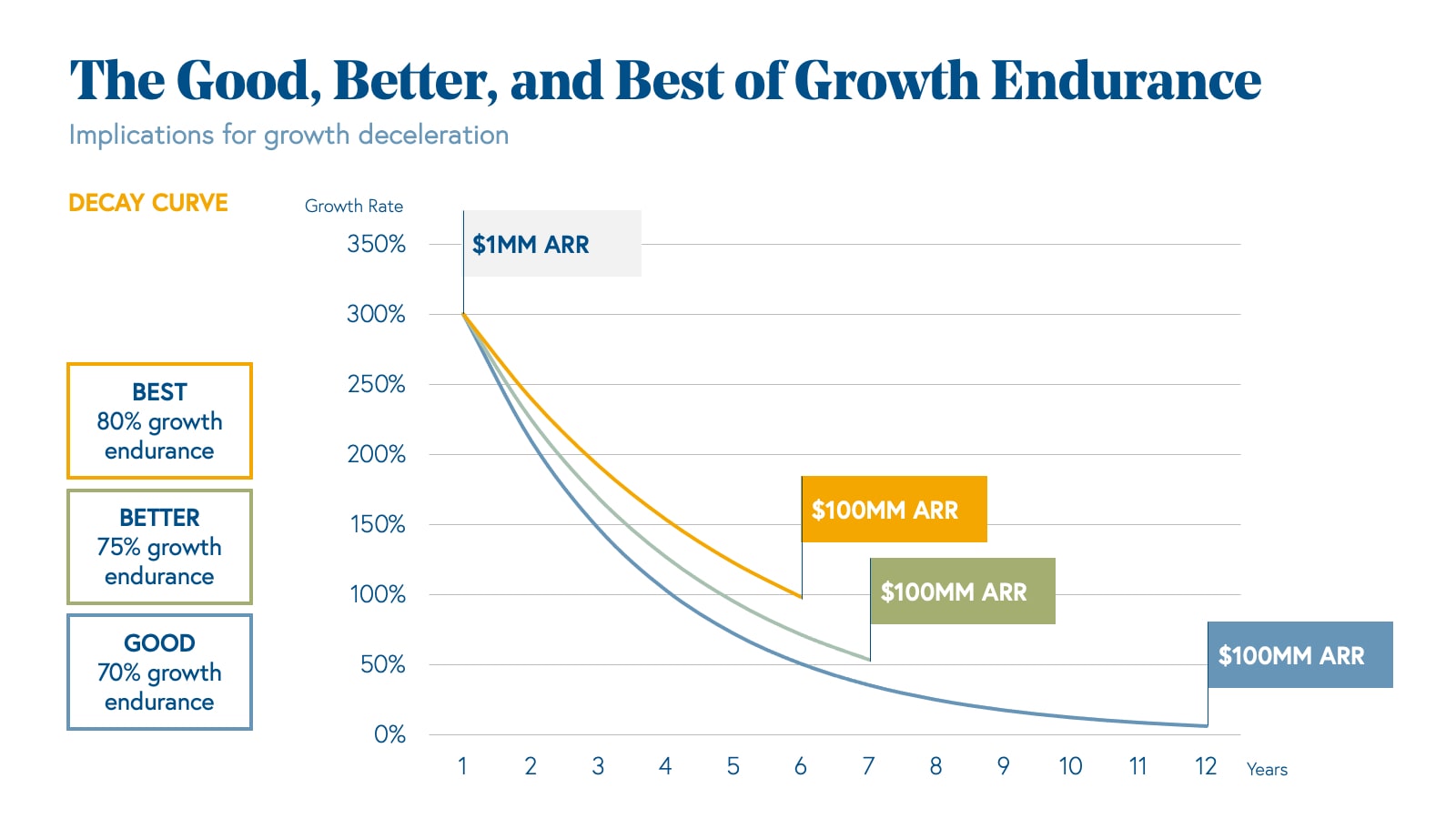

Bessemer’s growth endurance benchmarks charted a similar course, with the “best” performers growing to $100M ARR within 5 years of achieving $1M ARR.

Source: Bessemer Venture Partners

Source: Bessemer Venture Partners

For a handful of AI startups, that trajectory is still real. OpenAI, Perplexity, and others are raising massive rounds and achieving outsized growth.

But for most startups, especially those outside the AI spotlight, aggressive growth has taken a backseat to capital efficiency. That doesn’t mean growth isn’t important. It means growth needs to be sustainable and strategic.

In a capital-constrained environment, it’s essential to prioritize investments that offer the highest ROI and contribute most directly to sustainable revenue growth. Consider these four factors:

- Customer Acquisition Cost (CAC): How much does it cost to acquire a new customer? Is this cost sustainable, relative to the value you generate from the customer? Are there opportunities to lower your acquisition costs, e.g. can you leverage new AI tools for lead generation?

- Lifetime Value (LTV): How much margin will you generate from each customer over their lifetime? Focus on increasing LTV through improved customer retention and upselling.

- Gross Margin: How profitable are your products or services? Are there opportunities to raise prices, increase your mix of more profitable business or reduce your cost of goods sold?

- Payback Period: How long does it take to recoup your investment in acquiring a customer? Aim for a short payback period to quickly generate positive cash flow.

Focus on investments that improve these key metrics. For example, investing in customer success to reduce churn can have a significant impact on LTV and profitability. Conversely, scaling a marketing campaign with a high CAC and a long payback period might be a risky proposition.

Growth is no longer just about top-line metrics. It’s about unit economics. Investors want to see proof that you are building a business that can drive to long-term profitable growth. Having strong unit economics demonstrates that you are achieving this goal, even if your company is not bottom-line profitable in its early years.

Growth is no longer just about top-line metrics. It’s about unit economics.

4. The Role of Efficiency: Doing More With Less

Efficiency is the name of the game right now. Startups need to find ways to do more with less, optimize their operations, and leverage technology to improve productivity.

For example, look for smart ways to:

- Automate repetitive tasks: Use AI and other software applications to automate tasks like data entry, customer support, and marketing automation.

- Negotiate better deals with vendors: Review your contracts and look for opportunities to reduce costs. Vendors are more flexible than you think, especially in this climate.

- Optimize marketing spend: Scrutinize your paid channels for ROI. Double down on what works, pause underperformers, and explore low-cost, high-impact strategies.

- Focus on core competencies: Outsource non-core functions, particularly those that can be hired cost-effectively on a fractional basis, such as finance and accounting

5. The Fundraising Perspective: Showing a Path to Profitability

Finally, remember that investors are looking for startups that can demonstrate a clear path to profitability. Show them that you understand the importance of capital efficiency and that you’re making smart decisions about growth investments. Highlight your progress on improving unit economics, reducing cash burn, and extending your runway. A well-defined financial model that demonstrates a clear path to profitability supported by realistic growth projections will be much more compelling than a hockey-stick growth chart.

A well-defined financial model that demonstrates a clear path to profitability will be much more compelling than a hockey-stick growth chart.

Balancing the tradeoff between cash burn and growth in today’s fundraising environment takes discipline, smart planning, and clear financial visibility. Growth-at-all-costs is no longer a viable strategy—founders need to focus on building sustainable, capital-efficient businesses.

Burkland’s fractional CFOs and FP&A experts can help you extend your runway, model smarter growth scenarios, and prepare for your next raise with confidence. Get in touch with us today to learn how we can support your startup’s financial strategy.