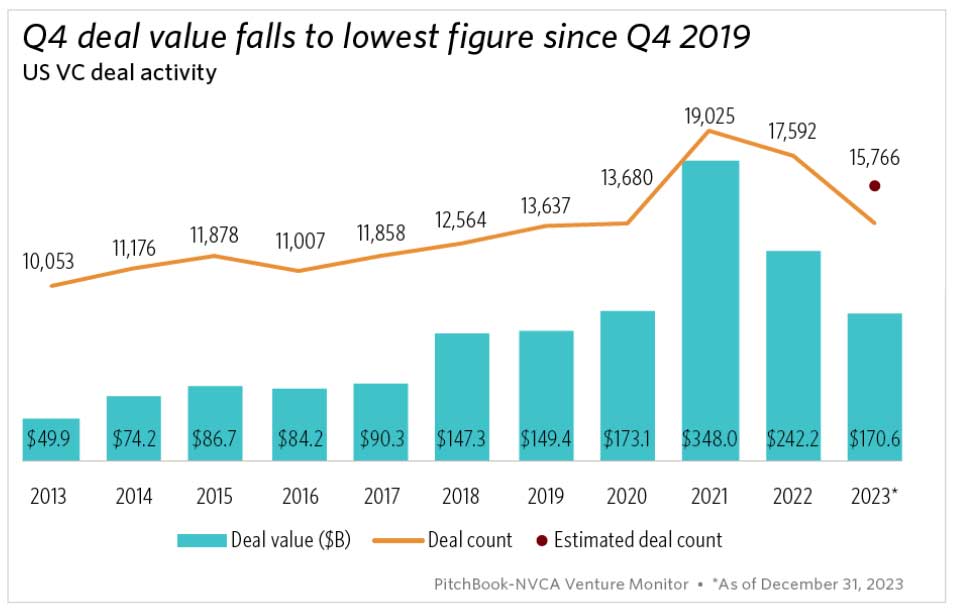

VC fundraising continues to be challenging in the current market, particularly for post-Seed stage companies. As the chart below from Pitchbook shows, deal value and total deal count were both down significantly in 2023 compared to their recent peak in 2021.

Recognizing the challenges of raising capital in the current environment, startups have had to pivot toward more efficient business models to extend their runways.

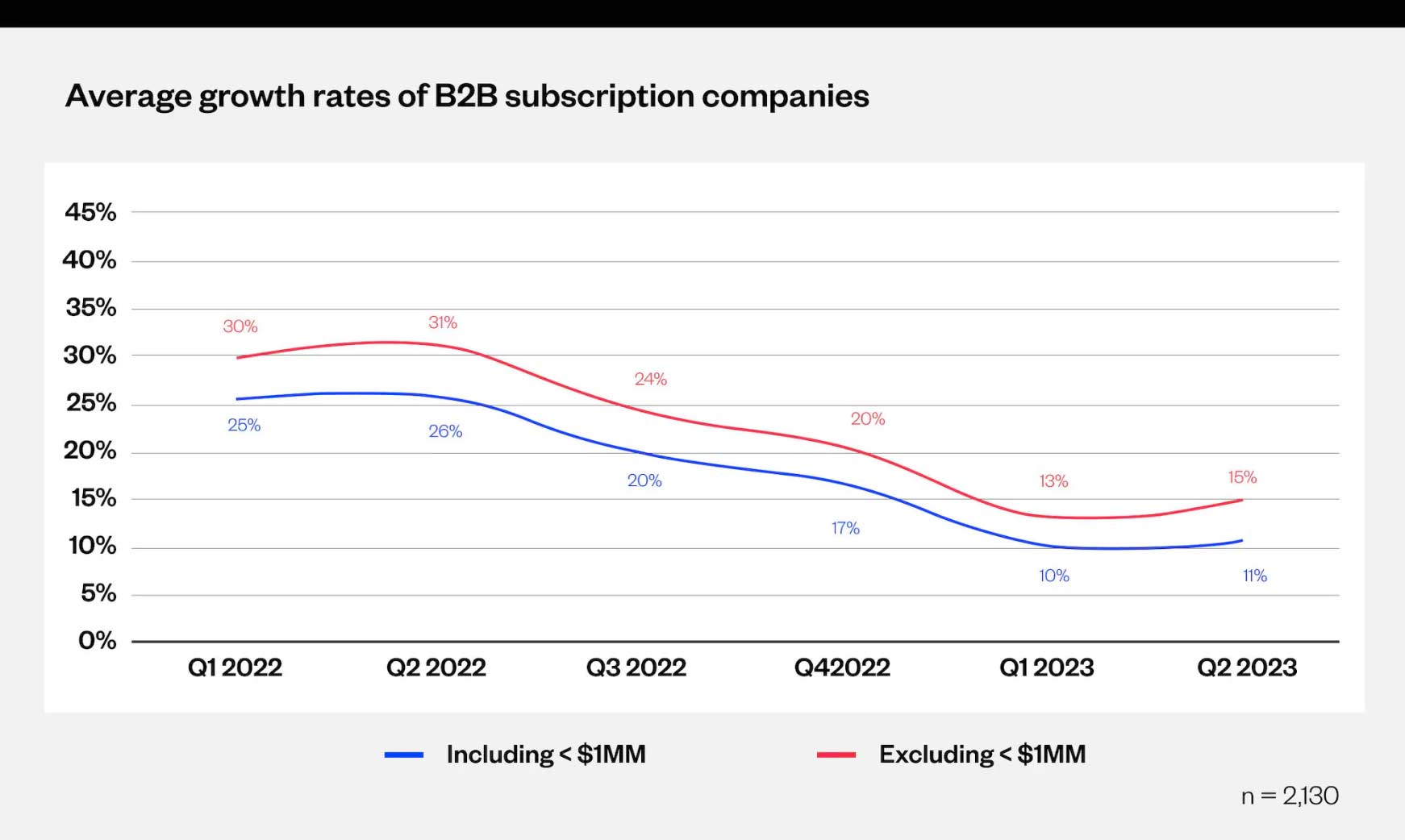

As companies have pulled back on investments to preserve cash, revenue growth rates have also slowed:

Source: Maxio

At the same time, investors are still looking for startups that can grow at the historically aggressive growth rates while tightly managing their cash burn. This is putting tremendous pressure on startups to find the optimal balance between investing in growth vs. driving efficiency.

At Burkland, I’ve been the fractional CFO for a dozen Seed through Series B SaaS startups over the past 10 years. Up until 2022, the primary metrics investors focused on at these stages were revenue growth and retention, with some focus on gross margin, and obviously a tight focus on cash burn and runway. Less attention was typically given to efficiency metrics.

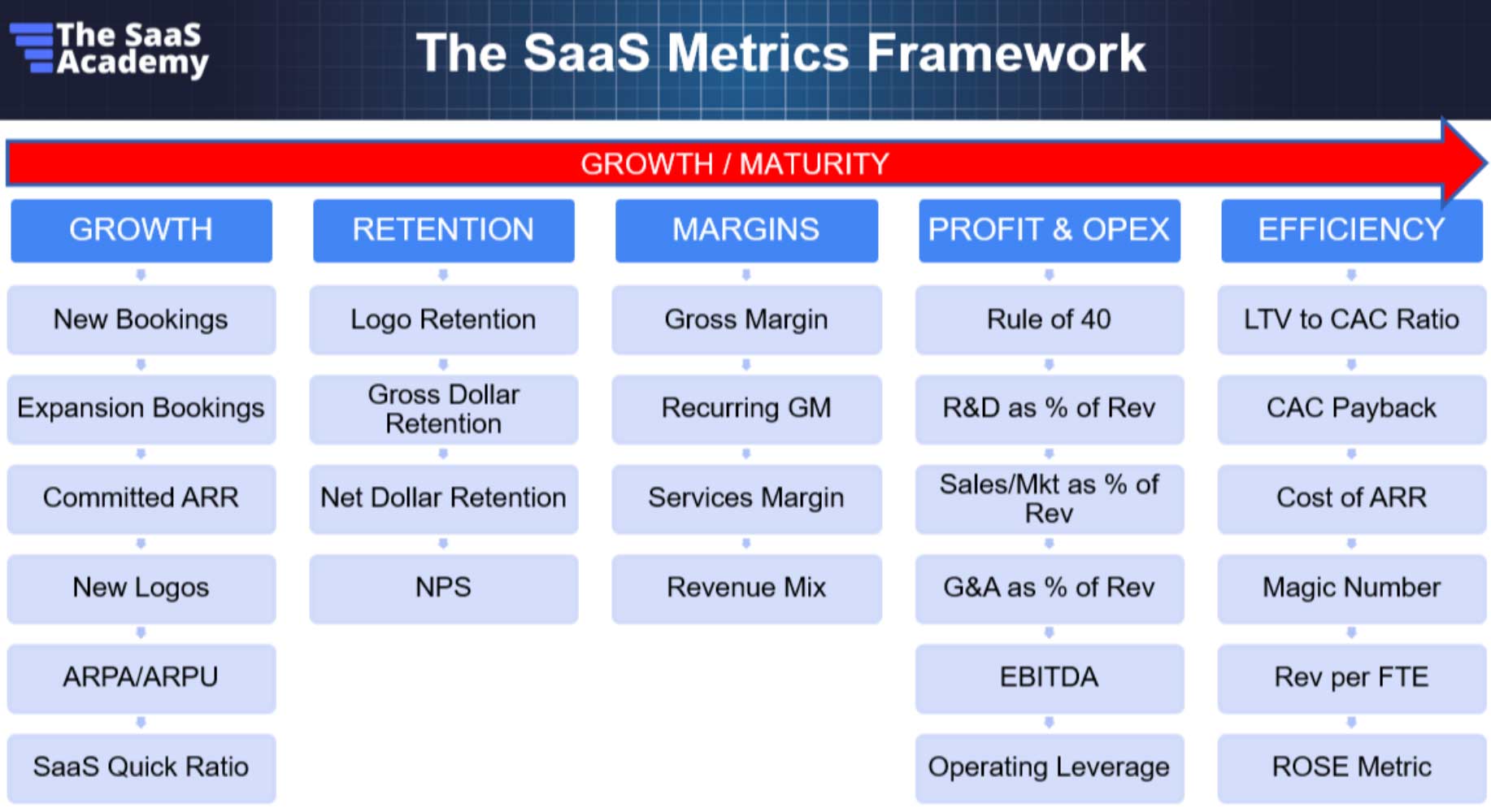

The SaaS Framework below, developed by The SaaS Academy, does a great job highlighting key SaaS metrics, grouped based on categories that become relevant as companies grow and mature. As you can see, growth and retention are the focus at the earlier stage, whereas profitability and efficiency metrics traditionally become a focus later in a company’s maturity.

So what does this all mean for early-stage, early revenue SaaS companies?

In today’s environment, it behooves early-stage SaaS companies to understand and track profitability and efficiency metrics at an earlier stage, even if they are not yet able deliver performance that rivals later stage companies. By learning to measure and track these metrics, companies build the muscle of understanding these metrics and ingrain them into their business model development.

In today’s environment, it behooves early-stage SaaS companies to understand and track profitability and efficiency metrics at an earlier stage, even if they are not yet able deliver performance that rivals later stage companies.

Example #1 – The Rule of 40

One good example is “The Rule of 40”, a metric popularized by venture capitalists Brad Feld and Fred Wilson. The Rule of 40 suggests that companies should strive to achieve 40% or greater when adding their annual ARR growth rate plus their profitability margin.

The SaaS Metrics Standards Board provides the following Rule of 40 formula:

Annual ARR Growth Rate + Annual Free Cash Flow¹

¹Free Cash Flow Margin as a percentage is calculated by using Cash from Operations minus Capital Expenditures, divided by Average ARR in the period.

This metric may not be a perfect one to apply to very early-stage start-ups, as % revenue growth and % profit calculations might not be statistically meaningful when calculated off a low revenue basis. However, it can still be instructive for these companies to consider where they are relative to the 40% target and use it as a guidepost as they build out long-range financial goals that ultimately meet or exceed this benchmark as revenue scales.

SaaS startups should also keep in mind Bessemer’s new Rule of X, which supersedes the rule of 40. The Rule of X recognizes that, particularly for public and late-stage private companies approaching or passing breakeven, it is not appropriate to equally weigh the value of growth with profitability. Instead, Bessemer’s statistical analysis suggests that, on a relative basis, growth drives 2-3x more value to a company than does profitability.

Startups should consider this growth vs. profitability valuation weighting when considering trade-offs between growth and efficiency in the current market. While I have seen many startups aggressively push to get closer to or even reach cash flow positive (which is an understandable goal in the current funding environment), if the trade-off is a low growth rate that is not attractive to investors, they may be shooting themselves in the foot over the long run.

Example #2 – LTV/CAC

LTV/CAC is another efficiency metric that is worthwhile for startups to understand from an early stage. In a recent blog article I explored the nuances and challenges of measuring LTV/CAC at early-stage SaaS startups. In the article, I suggest startups look to Customer Payback Period as a more meaningful efficiency metric during the earliest stages of growth. Nonetheless, I think it is quite valuable to model your expected future LTV/CAC as you grow your customer base, and track your performance against these targets as you scale. This can serve as an important reality check to ensure you’re building a business model with solid unit economics that can ultimately drive the business to profitability.

Example #3 – Operational Efficiency

A third efficiency metric that I think is helpful for early-stage startups to consider is Operational Efficiency, popularized by Bessemer, and calculated as follows:

Net New ARR Growth / Net Cash Burn over a specified time period

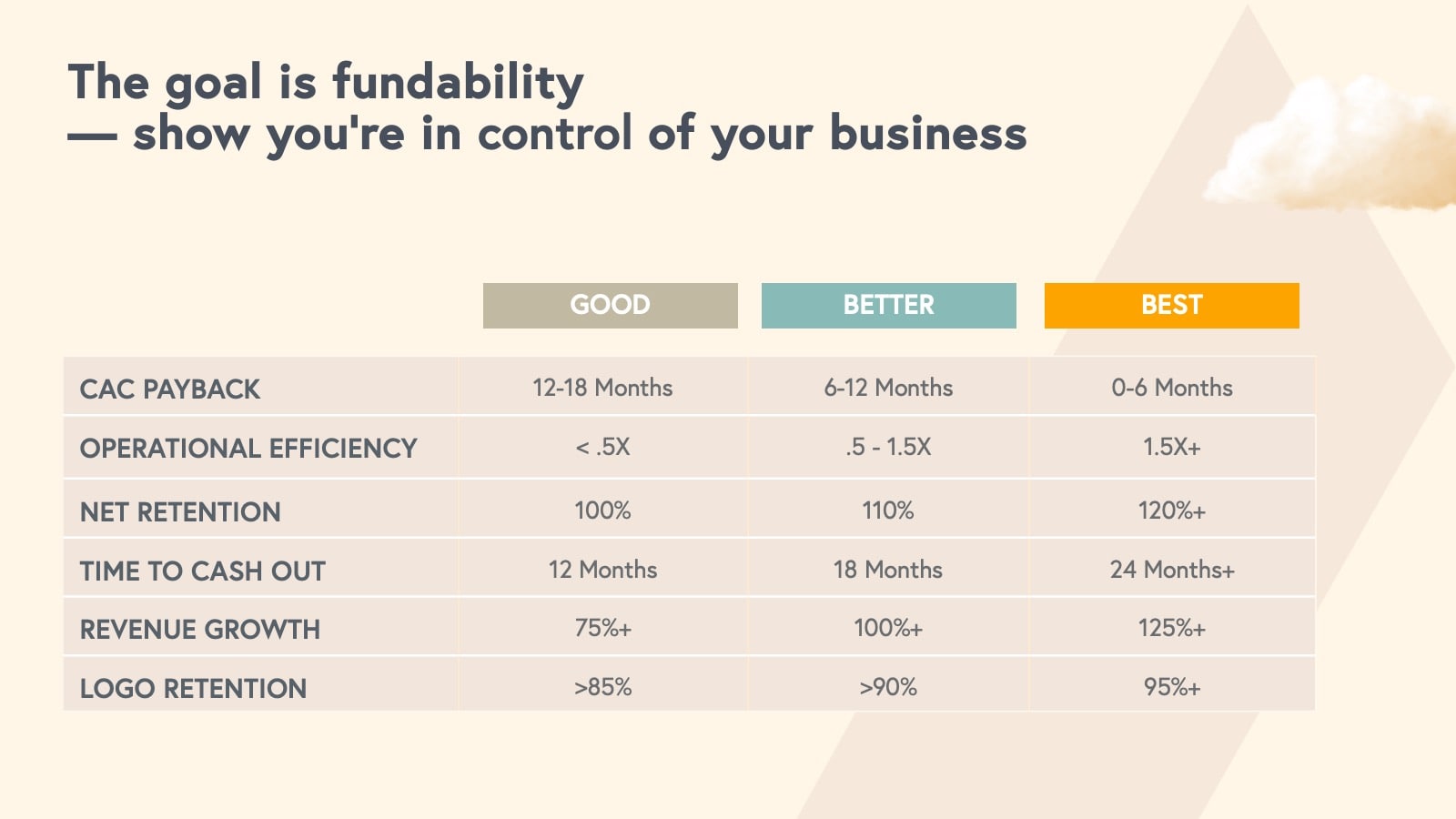

Under Bessemer’s guidelines, achieving a 0.5x ratio is “good”, a ratio between 0.5-1.5x is “better” and over 1.5x is “best. Bessemer’s 2023 state of the cloud references this guideline, along with a number of other helpful “good/better/best” guidelines, as reflected in the exhibit below.

When building financial plans for my Seed-Series B stage SaaS clients, I always look at the ratio of ARR growth against cash burn. And, if I’m building a long range plan, I like to see that by the out-years the company is at minimum achieving a 1x ratio of ARR growth to cash burn.

In summary, I recommend that even the earliest stage SaaS startups understand their key efficiency metrics and ensure they’re building business models that drive an appropriate balance of revenue growth and profitability. The three efficiency metrics I recommend startups considering at an earlier stage are:

- Rule of 40 / Rule of X

- LTV/CAC

- Operational Efficiency