The ratio of Lifetime Customer Value to Customer Acquisition Cost (LTV:CAC) has long been a gold standard metric for SaaS startups, and for good reason. When properly used, this metric has proven to be one of the best ways for SaaS companies to measure unit economics and one of the most reliable gauges of a startup’s efficiency.

LTV:CAC is a KPI that VCs and other investors are almost guaranteed to focus on when evaluating a SaaS startup, and most founders do their best to measure and improve this number as the company grows.

As a rule of thumb, startups are advised to maintain an LTV:CAC ratio of around 3:1 or greater. A lower ratio is a warning sign that the company isn’t growing efficiently and could have difficulty reaching profitability at scale.

As a rule of thumb, startups are advised to maintain an LTV:CAC ratio of around 3:1 or greater.

It seems like a simple and straightforward metric to calculate—to determine your LTV, just divide your monthly customer gross profits by your monthly revenue churn rate, using a formula like this:

(ARPA = Average Revenue Per Account)

To determine your CAC, divide the sum of all your Sales & Marketing expenses during a period by the number of new customers added during that period, using this formula:

As a SaaS CFO, I don’t disagree with any of this general guidance. But I can tell you that, in reality, measuring LTV:CAC is more nuanced and complex than applying a one-size-fits-all formula or benchmark.

Let’s explore two unique challenges when it comes to measuring LTV:CAC…

Challenge #1 – Early-Stage Startups

Thanks to the heavy emphasis on LTV:CAC in the VC community and the SaaS sector in general, most SaaS startups are eager to start tracking this metric from day-one. This is a good practice I encourage, but the numbers need to be taken in context with a grain of salt. At the earliest stages of growth, both sides of this ratio (LTV and CAC) are likely to be skewed considerably up or down.

At the earliest stages of growth, both sides of this ratio (LTV and CAC) are likely to be skewed considerably up or down.

Take CAC, for instance. On the one hand, I’ve worked with SaaS founders who are insiders with strong connections in the industries they’re looking to break into. They’ve been able to land their first handful of customers easily and inexpensively due to existing industry relationships and the inherent passion that a founder brings to the table when selling. These startups will naturally have a very low CAC at the beginning, but this isn’t at all indicative of what long-term CAC will be once existing relationships are exhausted and the sales responsibility is transitioned to a sales team. On the other hand, some SaaS startups are completely bootstrapped without any existing industry connections, and are introducing a new product that is not yet well-understood in the market. These startups are likely to have a high CAC at the beginning, which should hopefully come down over time as the value proposition is proven, name recognition is established, relationships are forged, marketing messages are honed, websites and campaigns are optimized, etc.

LTV is also often an unreliable number for early-stage companies. At the earliest stages of growth, SaaS startups haven’t invested enough in areas like onboarding, customer success, new features, and up-sells/cross-sells to maximize the lifetime value of customers. On the other hand, some startups are able to land a very large client as their first customer due to the founder’s existing industry relationships, but this customer may not be representative of the average future customer.

Considering these example caveats, it’s easy to see how LTV:CAC can be misleading for early-stage SaaS startups. My advice for these companies at the earliest stages is:

- Focus Initially on Customer Payback Period – I’ve found that this metric is usually a better gauge of efficiency for companies under $5M ARR.

- Model Your Expected LTV:CAC – Even though your actual data might not be reliable enough yet, modeling what you expect your LTV:CAC to be going forward is an excellent reality check on your overall business model.

- Track Revenue by Customer – Ensure you’re accurately tracking and storing your monthly customer revenue data from the beginning, so that as your startup grows, you’ll have good historical LTV data to leverage for your LTV:CAC formula. You’ll want to understand your initial starting revenue, as well as the expansion, contraction, and churn trajectory over each customer’s lifetime.

Challenge #2 – “One-Size-Fits-All” Approach

For mid-stage startups (usually somewhere between $5M – $10M ARR and beyond), LTV:CAC becomes a much more reliable metric, and often the best efficiency gauge and measure of unit economics. Still, challenges remain, particularly when using a one-size-fits-all approach to formulas or benchmarks.

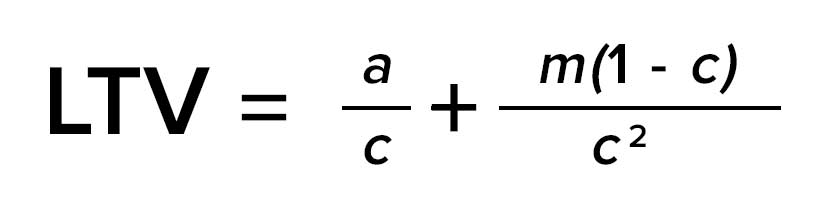

For example, many SaaS startups today employ a “land and expand” strategy. New account sign-ups often start small at one price and expand over time via upgrades, etc. A customer’s month-one revenue isn’t indicative of their revenue 6 or 12 months down the road. Factoring for this expansion is one of the key challenges in accurately measuring LTV. Similarly, what are the direct costs associated with this expansion, and how will they impact CoGS and Gross Margin? David Skok from Matrix Partners wrote a great blog article several years ago that addresses the complexity of calculating LTV for a company with a land and expand strategy. In the blog, he proposes using a discounted cash flow (DCF) analysis or considering a more detailed formula that takes into account the expansion opportunity over the customer’s lifetime:

- a = Initial ARPA per month x GM%

- m = Monthly growth in ARPA per account x GM% (note this is a $ figure, not a percentage)

- c = Customer Churn Rate % (in months)

Measuring CAC also presents its own unique challenges. Some issues I see here are discrepancies around what should be included in customer acquisition costs. For example, some companies include Sales & Marketing team compensation, contractors, and marketing/ad spend when determining customer acquisition costs. However, it also makes sense to include the Sales & Marketing team’s other expenses, such as travel and software costs like CRM systems. In addition, if the Sales team works on customer upsells, should the associated portion of the Sales team time be considered a customer acquisition cost? Some companies choose to separate out the costs associated with upselling customers, and apply them against the ongoing customer profitability as part of the gross margin portion of the LTV calculation, instead of including it as part of the CAC calculation.

As you can see, there can be many nuanced differences between how different SaaS companies calculate their LTV:CAC. I’ve worked on LTV:CAC calculations for over a dozen SaaS companies, and none of the approaches have been identical. This can make it difficult for investors and other stakeholders to compare apples-to-apples, especially between different companies. What’s most important is to 1) design a methodology that is right for your company, 2) be transparent with your investors and stakeholders on your approach, and 3) remain internally consistent in your methodology so that movements in your LTV:CAC over time will provide meaningful insights on business performance. While comparisons against outside benchmarks and the 3:1 LTV:CAC target may not be a perfect apples-apples comparison, it can still be a directional reference point that you use to guide your business decisions.

For more articles and resources like this, see the SaaS section of Burkland’s blog. Plus, stay tuned this year for more articles on SaaS KPIs and benchmarks as I continue to share insights from this exciting and rapidly evolving startup sector.