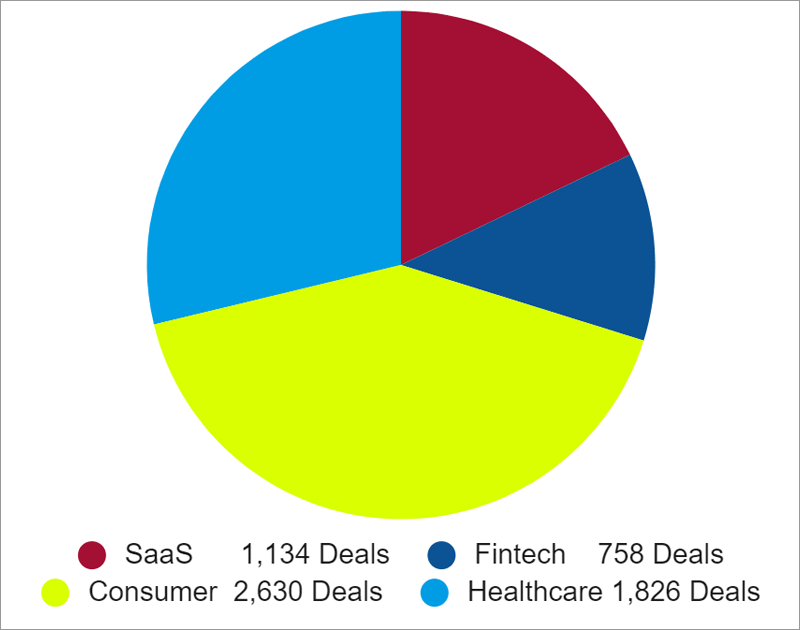

The numbers are in for 2020, and once again Consumer is the Deal Flow winner for startups. The consumer startup sector may not get the press that SaaS, Healthcare, or Fintech sectors receive, but when it comes to VC deal flow, consumer startups accounted for well over 40% of all deals in 2020 and a whopping 46.6% in Q1 2021.

VC Deals in 2020 (TAM)

Source: Pitchbook

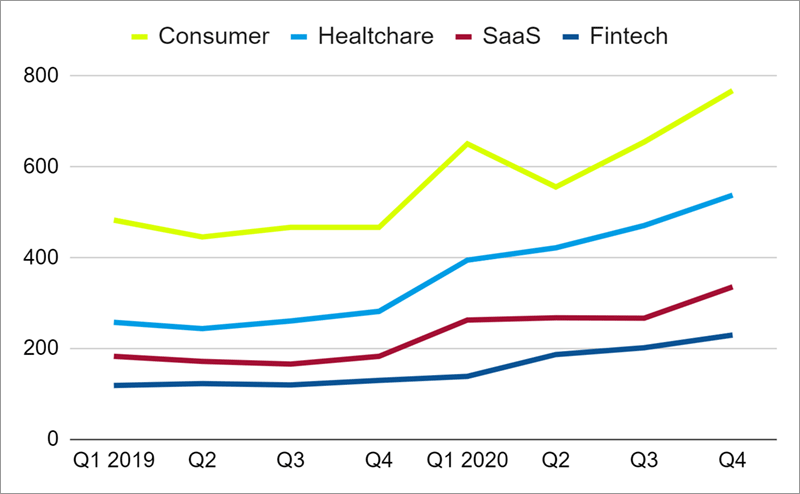

This is not a new trend either. For the last 9 quarters Consumer has dominated VC deal flow.

VC Deal Flow: 2019-2020

Source: Pitchbook

VC Deal Flow to Consumer Startups is Not Geography-Bound

Consumer is the #1 VC deal sector in The Bay Area, New England and in the Rest of US for both 2019 and 2020. In fact, outside of The Bay Area and New England, Consumer accounted for a staggering 58.7% of all VC deals in Q1 2021.

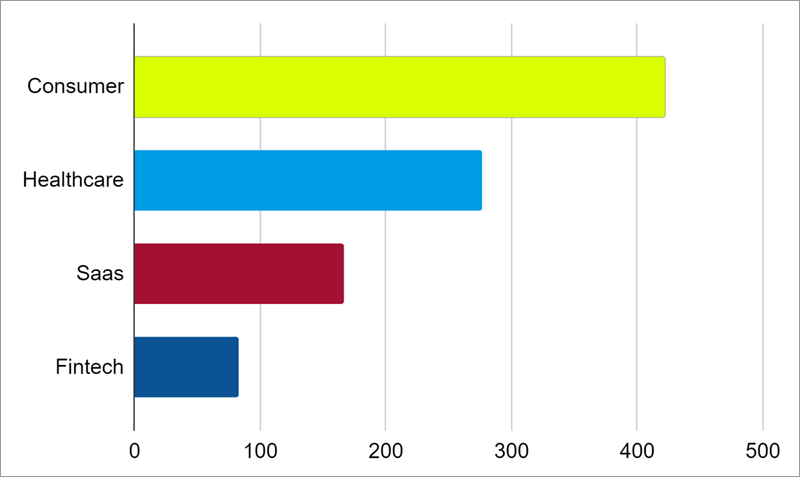

Consumer Also Leads for Accelerator and Incubator Deal Flow

Consumer was #1 in 2020 and remains so in 2021, representing an astounding 49.3% of all A/I deals in Q1 2021.

2020 Accelerator/Incubator Deal Flow

Source: Pitchbook

To put things in perspective relative to other key VC Sectors: Consumer had 2.3X the deals of SaaS, 3.5X the deals of Fintech and 1.4X the deals of Healthcare in 2020.

Consumer had 2.3X the deals of SaaS, 3.5X the deals of Fintech and 1.4X the deals of Healthcare in 2020.

Why the dominance?

I could get in the weeds about consumer adoption of disruptive technology, or the shift of consumer spending online. But I think a macro view paints a clean picture. Consumer spending (personal consumption) accounts for 70% of GDP.

Consumer spending drives the the US economy; it also drives investor deal flow.

In other words, Consumer spending drives the the US economy; it also drives investor deal flow.