According to PWC’s Global Economic and Fraud Survey, 47% of companies experienced fraud in the past 24 months, and more than $4.5 trillion are lost to fraud globally each year. These are staggering numbers.

What’s particularly concerning to the startup community is that fraud is most prevalent among small companies. According to the Association of Certified Fraud Examiners’ (ACFE) 2018 report, organizations with fewer than 100 employees see the largest share of fraud cases. When they do fall victim to fraud, the median losses are nearly double the size.

Small businesses under 100 employees lost almost twice as much per scheme to fraud than businesses with more than 100 employees.

Source: ACFE Report to the Nations 2018 Global Study on Occupational Fraud and Abuse

There are three primary categories of corporate fraud:

- Asset misappropriation, including theft of cash or other assets or fraudulent disbursements, is the most common type of fraud.

- Corruption schemes, such as bribery or illegal gratuities

- Financial statement fraud

Internal Controls Mitigate Fraud Risk

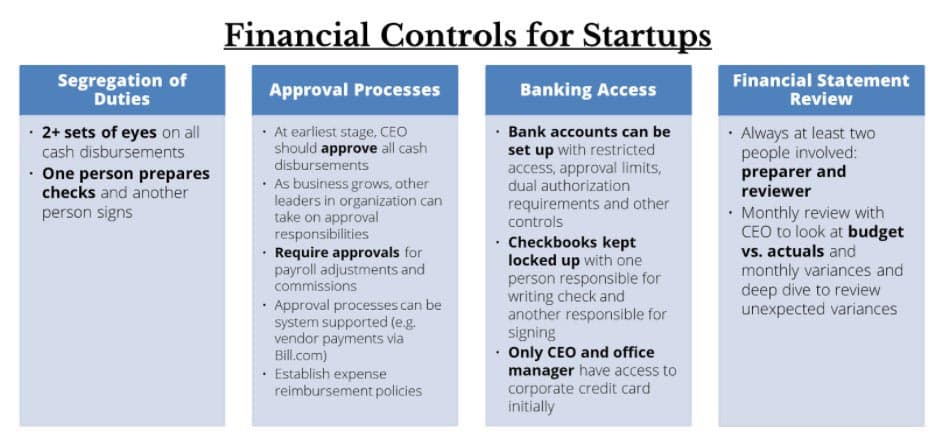

Financial fraud can be particularly devastating for startups, which often have fewer resources to both prevent and recover from fraud. One of the critical steps that a startup should take to mitigate the risk of fraud is to put in place financial controls as early as possible. The ACFE estimates that a lack of internal controls contributed to nearly 1/3 of frauds. Some key recommended financial controls are summarized below. Burkland also has a more detailed recommended controls matrix broken out by business stage that you can download here.

The ACFE estimates that a lack of internal controls contributed to nearly 1/3 of frauds.

Detection Measures to Prevent Fraud

In addition to preventative measures such as financial controls, it is important to implement measures to detect fraud as early as possible. Timely detection is critical, as fraud schemes that go on for longer periods are much costlier. The most common way to detect financial fraud is via internal tips.

According to the ACFE, companies that implement the following programs significantly mitigate the financial impact of fraud by increasing the likelihood of receiving tips:

- Employee and manager fraud awareness training

- Anti-fraud policy

- Anonymous reporting mechanisms (hotline, online form, etc.)

Conducting criminal background checks on all new hires is also a good practice to implement and is relatively inexpensive. However, keep in mind that most occupational fraud perpetrators do not have a criminal history. It is also interesting to note that many companies that are victims of corporate fraud do not report the crimes to authorities due to reputational concerns, cost considerations, or other factors. This may, unfortunately, limit the effectiveness of background checks.

Financial Fraud and Startup Investors

In addition to the damaging impact on startups, the occurrence of fraud can also have terrible consequences for their venture capital investors, who can potentially lose the entire value of their investment in the company.

There are two key things that investors should do to prevent and mitigate the risk of fraud among their portfolio companies:

- Conduct extensive due diligence before investing with an eye toward fraud detection. Burkland can support VCs with their financial due diligence efforts.

- Ensure appropriate oversight and governance at the board level to prevent and detect fraud. Some recommended measures include:

- Annual board-level review of financial controls and anti-fraud measures

- Detailed review and scrutiny of financial reports by board members

- Ensure that company has an appropriately staffed finance/accounting department, enabling segregation of duties and approval processes

- Ensuring that the “tone at the top” is appropriate. Startups with a “fake it ‘til you make it” culture can be more at risk of financial statement fraud

In Summary

The impact of fraud on the global economy, and startups, in particular, is devastating. Some of the concrete measures discussed in this blog, including Burkland’s recommended financial controls, can dramatically reduce the prevalence and impact of fraudulent activity.