Welcome to the third and final article in Burkland’s three-part series on annual financial planning for startups. I opened this series two weeks ago by focusing on annual financial planning objectives and processes. Then, in last week’s article, I walked through the deliverables from an annual financial plan and shared examples along the way. In today’s article, I’ll close the series with tips and tools for executing on your plan in the new year, including updating forecasts throughout the year and putting in place scenario plans so you can quickly respond to major shifts or pivots.

Executing on Your Financial Plan Throughout Year

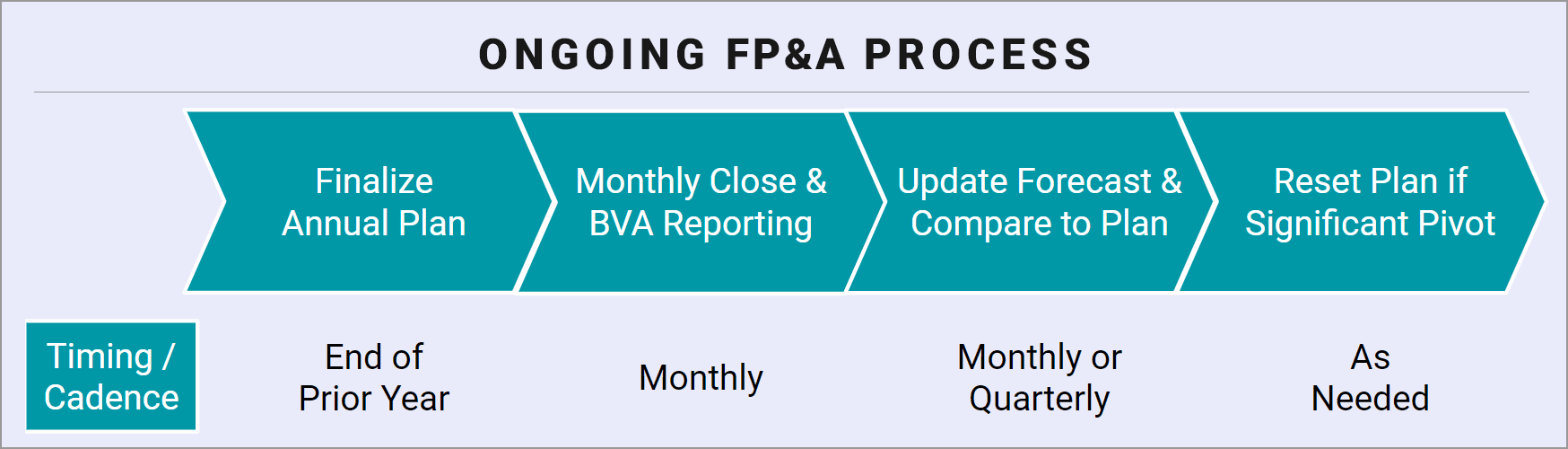

As discussed in the first part of this series, annual plans are ideally finalized just prior to the start of a fiscal year. The financial plan is then continuously leveraged throughout the year as part of the Financial Planning & Analysis (FP&A) process, as highlighted in the exhibit below. Companies should close their books on a monthly basis and prepare a budget vs. actual (BVA) analysis that compares actual results against the plan. It is helpful to review the variances against plan and understand what is driving the variances, as this will help the company identify gaps & opportunities and then quickly respond. On a periodic basis (typically either monthly or quarterly), the company should prepare an intra-year forecast, which takes into account year-to-date actual performance and rolls forward the outlook for the balance of the year. It is helpful to compare the variance between the intra-year forecast and the annual plan so that you can identify adjustments that are needed to meet or exceed the plan.

In general, startups should stick to their annual plans once they’ve been developed and approved. However, even the best laid business plans are subject to change due to things like major world events, economic changes, industry shifts and business pivots. Companies whose financial outlook has significantly changed during a year may want to consider resetting their plan during the year. In consideration of this, it is helpful for companies to prepare scenario plans with contingencies to proactively plan how they will respond to a changing landscape.

Scenario Planning

Scenario planning is a crucial tool for navigating the uncertain business environment. By anticipating various future scenarios, including the most optimistic and pessimistic possibilities, startups can create a flexible business plan that can adapt to changes. Thoughtful scenario planning not only increases a startup’s resilience but also improves its capability to seize new market opportunities.

In a startup, financial planning is not about predicting the future; it’s about preparing for various scenarios and being agile in your approach.

Scenario Planning Approach:

The first step in building scenario plans is to identify your key uncertainties and bucket them into scenarios. It’s common for a startup to build three scenarios. Traditionally, a startup would build an upside, base case and downside scenario, and the base case would represent the financial plan that a startup would operate against day-to-day. In the recent volatile environment, many companies have focused more emphasis on downside scenarios, and instead choose to build out a base case, downside and worst case scenario.

Once you have identified the scenarios, you should identify contingency plans to apply against each scenario, which represent the levers that you will pull to address each scenario, such as expense cuts or strategic shifts. Next, you should build out a separate financial model for each scenario. You’ll need to ensure that each scenario is financially viable, such that it affords sufficient cash runway and the achievement of necessary milestones for any future fundraises.

Once you have your scenario plans in place, you should identify trigger points which indicate when you should shift between the scenarios. As part of your regular financial planning & analysis process, you should update your forecast on a monthly or quarterly basis. Your forecast review process should include an assessment of whether you have hit the trigger points and need to implement contingencies and shift to a different scenario.

Scenario Planning Resources:

- The Importance of Scenario Analysis in Financial Planning

- The Founder’s Field Guide for Navigating a Crisis by First Round Capital

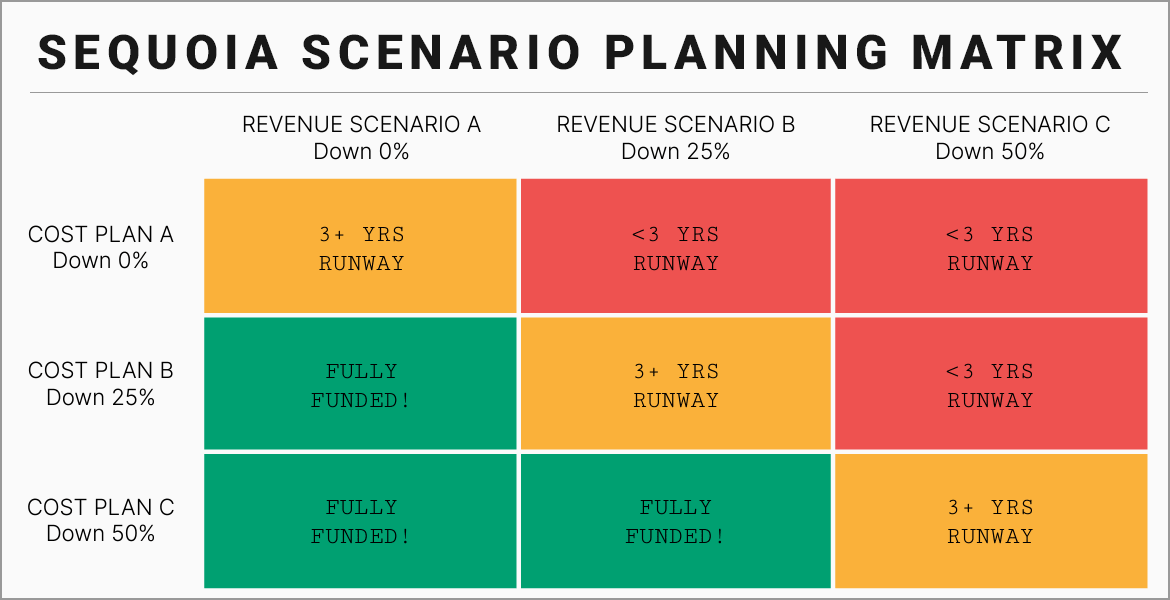

- Sequoia published a helpful guide on forecasting and scenario planning in the current market climate, including the framework below which highlights the relationship between revenue scenarios, expense plans, and cash runway.

Source: Sequoia Capital

I hope this blog series provides you with a good overview of the financial planning process and some actionable tips and useful templates you can use to create your company’s plan.

Burkland’s startup CFOs and FP&A experts are available to assist with your company’s financial planning and budgeting. Contact us to request more information.