Welcome to the second article in Burkland’s three-part series on annual financial planning for startups. Last week’s article focused on financial planning objectives and processes. In today’s article, I’ll walk you through the deliverables from your annual financial plan. In the final article, I close the series with tips and tools for executing on your plan in the new year, including updating forecasts throughout the year and responding to major shifts or pivots.

Annual Financial Plan Deliverables

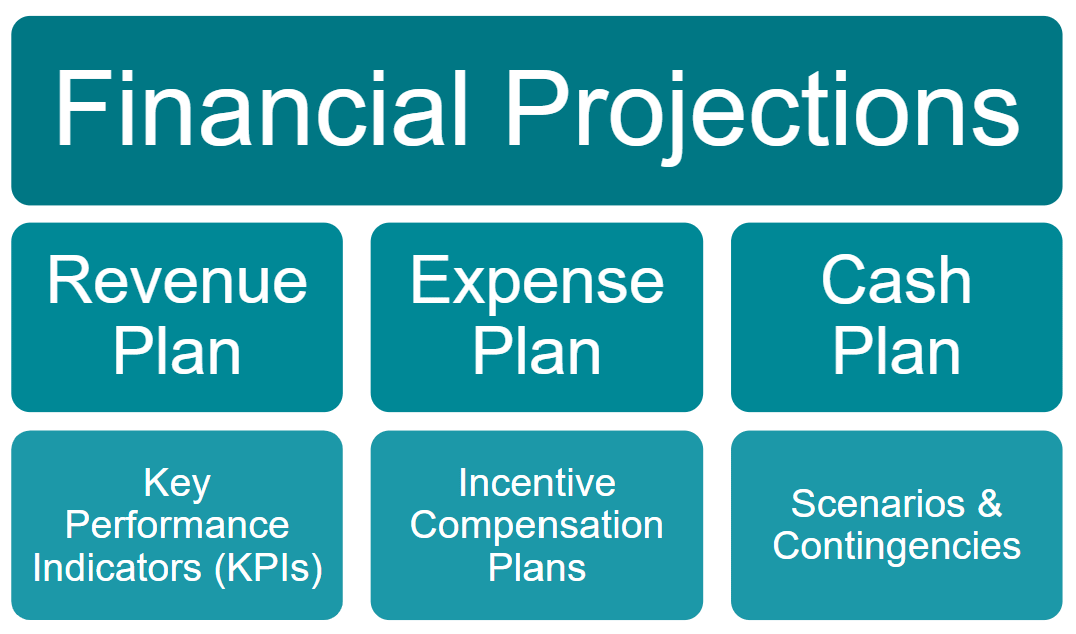

The core output from a financial plan are financial projections for the next fiscal year. In this article I’ll review what is involved in pulling together these financial projections, and I’ll also double-click down on the detailed components that make up the financial projections, including the revenue plan, expense plan and cash plan. I’ll also discuss two related key outputs from the financial plan: KPIs and incentive compensation plans.

Don’t underestimate the power of a well-thought-out financial plan. It can make or break your startup.

1. Financial Projections

A startup’s financial plan should include monthly projections for the year ahead with income statement, balance sheet and cash flow. For early-stage startups, I recommend building the financial plan in Excel or Google Sheets because these tools are cost-effective and enable easy customization for your business model. More robust financial planning systems become important as startups scale.

The financial model should align with the company’s Chart of Accounts to facilitate updates for actual results and enable budget vs. actual tracking. Many startups find it valuable to hire experienced finance support to build their financial model.

It is important to set a plan that is achievable, but also pushes the company to stretch further to achieve ambitious goals. My recommendation is to adopt a “50/50” plan (50% chance to beat, 50% chance to miss) for revenue goals, and a higher level of certainty – 70% or more – for profitability and cash flow. Bessemer recently wrote a good article about how to think about setting a plan and probabilities of achievement.

📝Download an example forecast model spreadsheet (.xls)

2. Revenue Plan

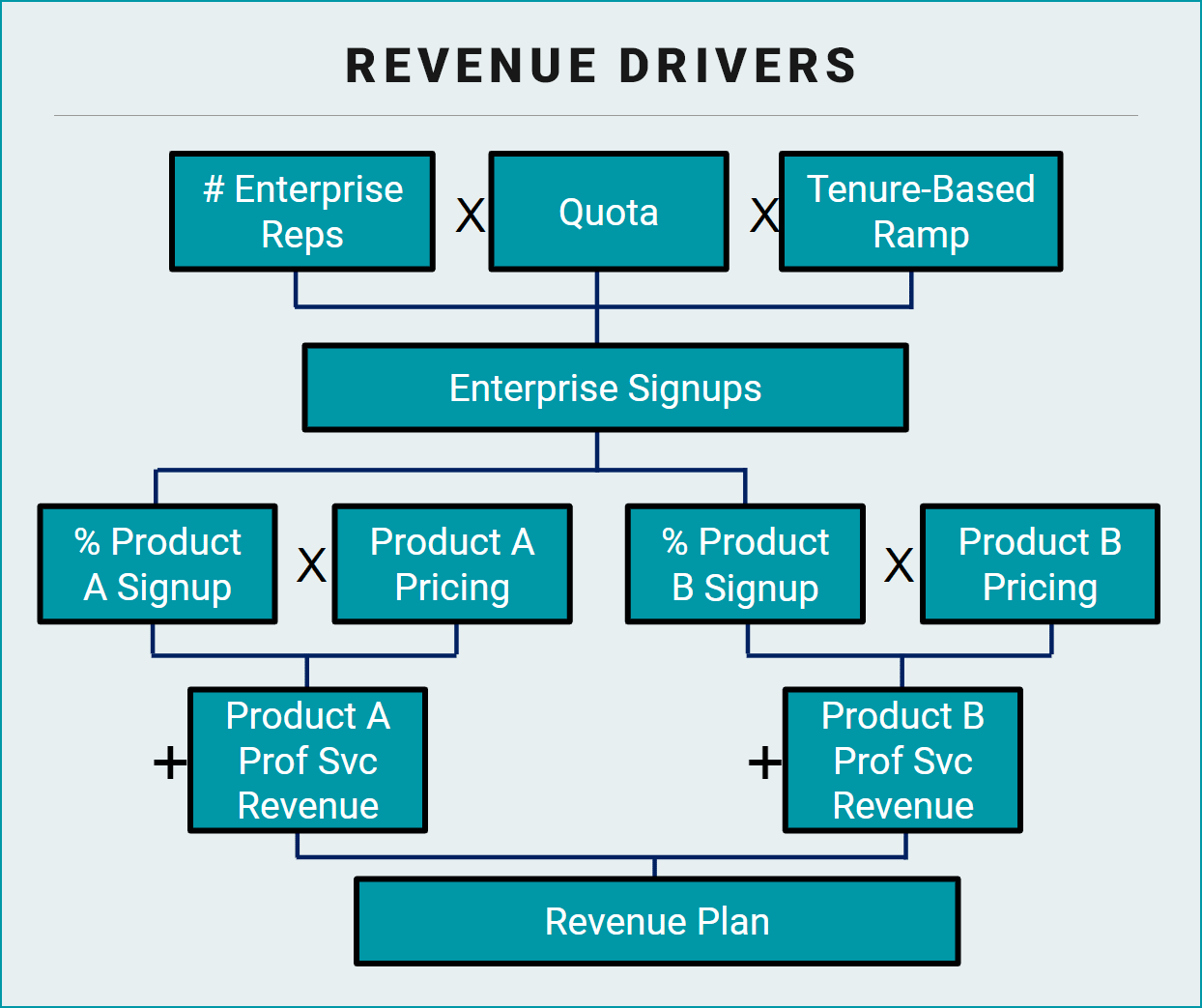

A solid revenue plan should include a buildup by revenue drivers and/or detail on revenue growth by segment.

Revenue drivers help a company understand the key components of what is driving their growth. Revenue drivers are unique for each company, but they often include the sales and marketing funnel, product line and pricing, and expected distribution of new customers between different products. Subscription-based companies should also consider expected net retention of customers over time – particularly for companies that are focused on a land and expand strategy). Some of these revenue drivers may become KPIs that are closely tracked throughout the year when looking at a company’s revenue performance – for example the sales’ team quota attainment.

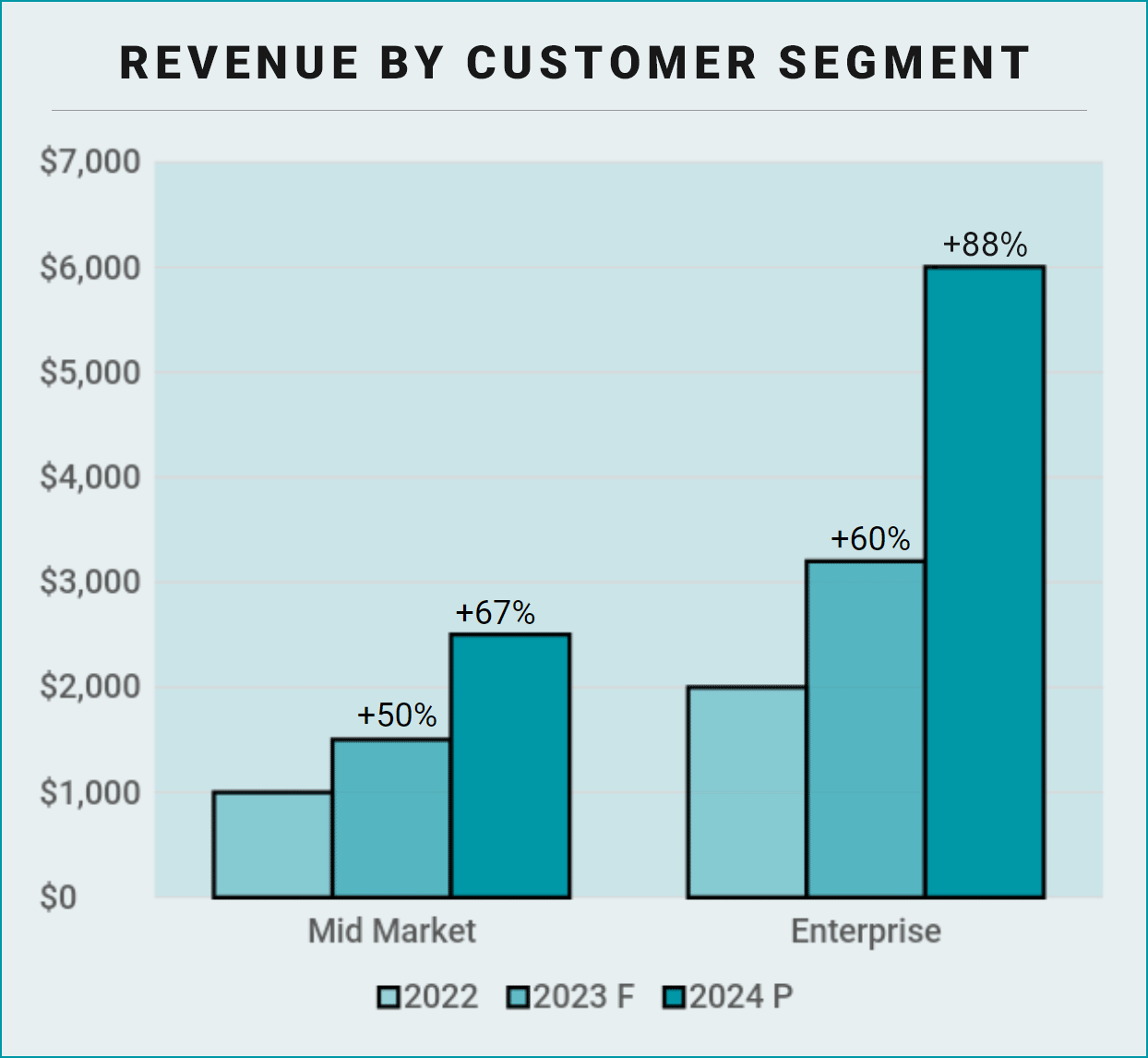

For many companies, it is also important to understand revenue growth broken out by segment. There are various ways that it may make sense to segment revenue. The example below shows revenue broken out by mid-market vs. enterprise customers. For some companies, it may make sense to break revenue out by industry and/or by product. The key is to break out where you expect to drive growth throughout the year by segment, and ensure you have a way to measure revenue growth by segment against that plan. By understanding your revenue segmentation, you can ensure that you are directing your investments toward the areas that you can drive the most growth and get the best return on your investment.

3. Expense Plan

In startups, people-related expenses are often the largest expense category, and will represent the lion share of your expense planning efforts. In building your staffing plan, you’ll want to ensure that your hiring and headcount plans support your strategic growth objectives and that your employees are appropriately compensated. This is an important time to review salaries, benefits, variable compensation, equity, cost of living and merit adjustments, and promotions.

Compensation Planning Tips & Resources:

- Use a free tool like Pave to benchmark market rates.

- Establish an option refresh plan once you have employees with a 2.5+ year tenure. Learn more about option refresh plans with these insightful articles from Thomas Tunguz and First Round Capital.

- Executive compensation should be reviewed annually with the Board.

Non-people-related expense planning should reflect your company’s strategic priorities and historical trends. Invest some time to plan your more significant expense categories, such as marketing, technology/hosting, and consultants. Other less significant expenses can be planned at a higher level, based on historical trendlines or planned initiatives, e.g. office, travel.

In a startup, every dollar spent should be an investment in the future, not just an expense for today.

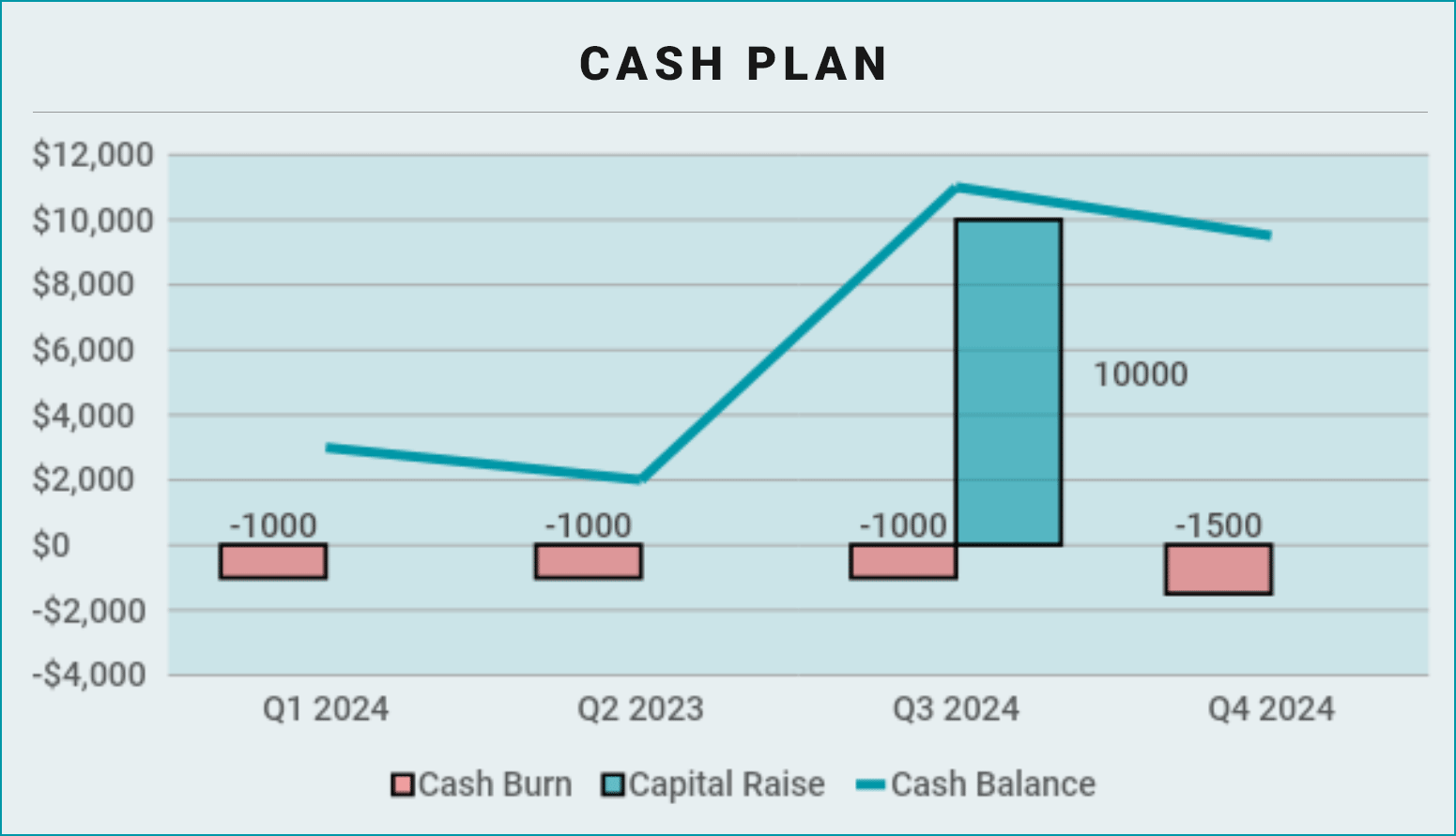

4. Cash Plan

The financial plan should give visibility to cash runway and the targeted timing for your next fundraise. You may wish to extend your financial outlook beyond the next fiscal year if your runway extends beyond that timeframe. In the current economic environment, startups should begin fundraising efforts at least 9-12 months prior to cash out.

Related Resource: See Burkland’s Cash Runway Extension Toolkit

Cash flow is the lifeblood of a startup. Annual financial planning helps us keep it flowing.

5. Key Performance Indicators (KPIs)

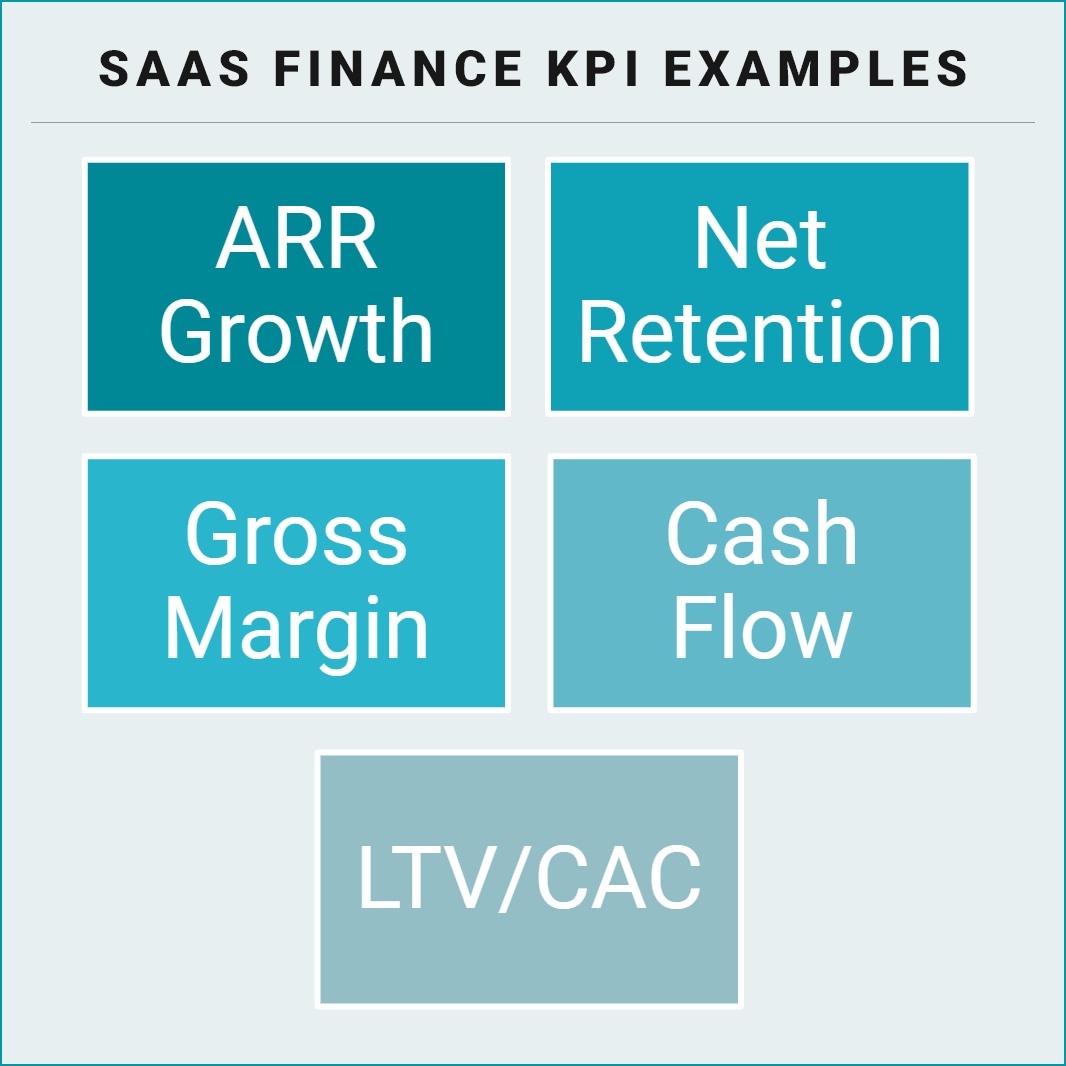

The financial plan should establish targets for the company’s financial and non-financial KPIs. Performance against KPI targets should be tracked throughout the year via dashboards, monthly reporting, and Board reporting. Employee performance reviews and incentive compensation plans can be tied to KPI goal attainment, such that employees get measured based on the performance of KPIs that they can influence. It is important to identify the KPIs that are the best to gauge performance over time for your company’s highest priority goals. For example, the exhibit below outlines some KPIs that are typically tracked by SaaS companies.

Related Articles

- SaaS Metrics Simplified, Part One: Launch Metrics

- SaaS Metrics Simplified, Part Two: Optimize & Scale

- Sixteen Metrics You Need to Master as You Eye Your Series B

- Metrics Matter: Five KPIs for Fintech Startups

- How to Measure Marketplace Success: Stage 1, Marketplace Metrics

6. Incentive Compensation Plans

Startups should develop incentive company plans annually as part of the planning process. Quotas for the sales team are a critical output of the financial planning process, as well as rules around commission payouts. Sales commission plans should be formally documented and approved each year, with clearly communicated goals, rules and processes.

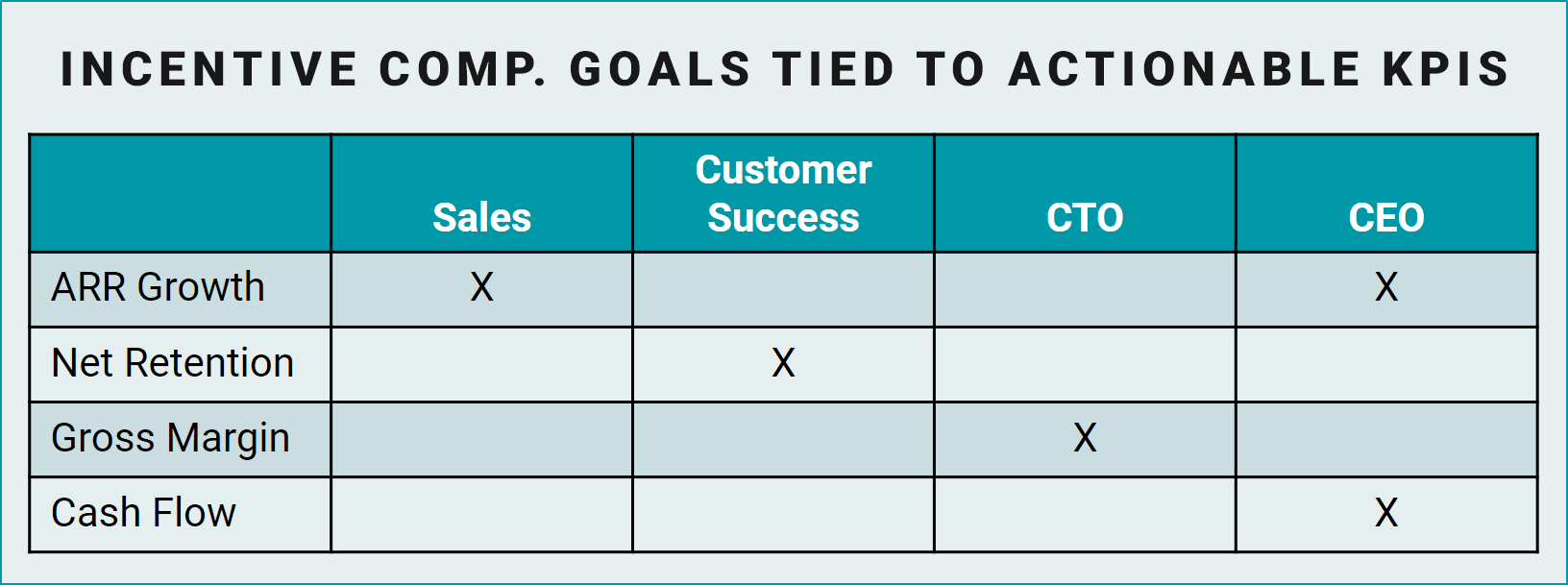

For the earliest-stage startups, employee options are usually the only type of incentive comp that is offered.The first employee at a startup offered a cash incentive comp plan (commission) is often in Sales. As startups grow, they may choose to more broadly offer variable cash incentive compensation, with payouts tied to KPI performance – see matrix below for an example of mapping KPIs by department.

See the conclusion to this annual planning series for guidance on scenario planning and executing on your financial plan throughout the new year.

Burkland’s startup CFOs and FP&A experts are available to assist with your company’s financial planning and budgeting. Contact us to request more information.