Q4 is here and companies of all sizes are starting to prepare for the new year ahead with annual budgeting and financial planning. For startups, this is a critical time to focus on evaluating resources, setting meaningful goals, and developing realistic and actionable plans to reach those goals.

Startups don’t succeed just by dreaming big; they succeed by planning smart.

This is the first article in a three-part series focused on annual financial planning process and related best practices for venture-funded startups. To begin the series, today’s article focuses on a) understanding the objectives behind financial planning and b) helping startups design an efficient and productive planning process. See part-two for guidance on developing projections and planning deliverables along with some examples. Then, see the final article for tips and tools for executing on your plan in the new year, including updating forecasts throughout the year and responding to major shifts or pivots.

Annual Financial Planning Objectives

Building an annual financial plan is essential for a startup’s success. The objectives of creating such a plan include:

- Goal setting: A financial plan sets specific, measurable financial goals for your startup. Having clear objectives ensures everyone is on the same page and allows you to measure your performance throughout the year against these targets

- Resource Allocation: A financial plan requires a company to take a holistic look at their financial picture; including their revenue, expense, cash runway and fundraising plans. In doing so, it forces companies to make strategic decisions on where to invest their limited resources.

- Cash runway management: A financial plan should include monthly cash flow projections, which ensures startups understand their runway and when or if they need to close on their next fundraise. Particularly in the current climate over the past couple years, where fundraising has become more challenging, it is critically important for companies to have solid visibility to their runway and a proactive fundraising plan.

- Organization alignment: A financial plan serves as a communication tool within the organization. It helps align the team’s efforts and provides transparency about financial goals and priorities.

- Contingency planning: By forecasting and scenario planning, startups can anticipate potential challenges and plan for contingencies, reducing the impact of unexpected financial setbacks.

- Investor and stakeholder confidence: A well-prepared plan demonstrates that the startup has a clear understanding of its financial situation and a strategy for achieving its objectives, which can instill confidence.

In a startup, annual financial planning isn’t just about survival; it’s about positioning the company for rapid growth and innovation.

Financial Planning Process By Startup Stage

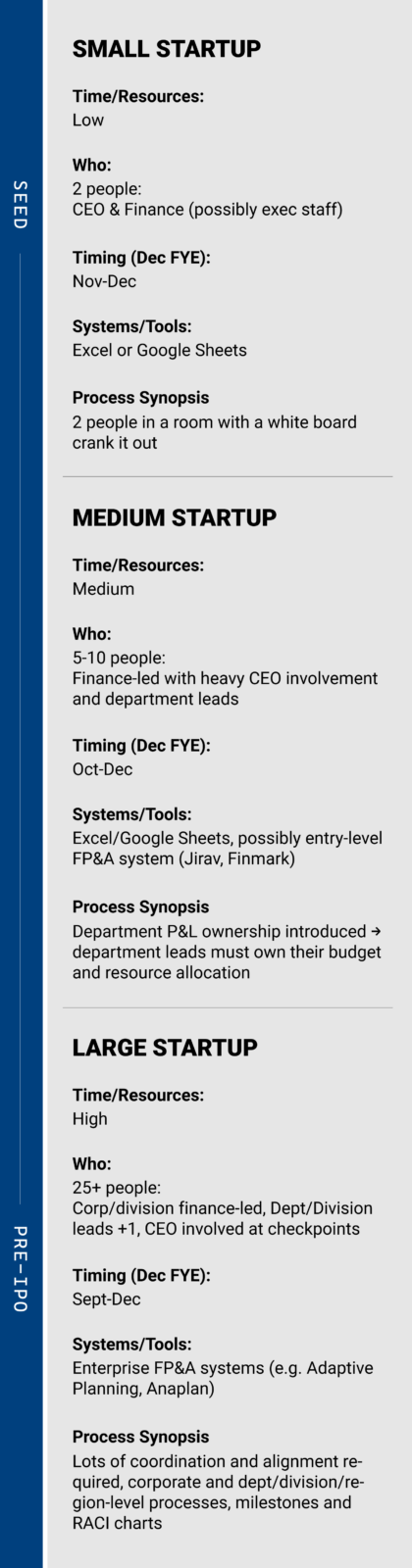

The approach to building a financial plan evolves as a startup grows and scales. At the earliest stage, the financial planning process should be quite simplified and streamlined. It likely will only require involvement of the CEO and the finance lead, and it will be completed in Excel, possibly with just one or two iterations. As your startup grows, the planning process will involve more people and require more coordination, effort, and iterations. When you hire your first sales lead, they will likely be a key contributor to the sales plan and will need to be tightly involved in the planning process. As a startup grows, it will eventually introduce department level ownership of P&Ls, such that department leads own their budget and resource allocation. At that point, your planning process will require coordination over a larger group of people, and you’ll need to build out a more detailed calendar that outlines the process, milestones and roles/responsibilities. The coordination needs and resource requirements for financial planning continue to expand as you grow to a larger, potentially multinational or multi-division organization.

The table below outlines some key shifts in the planning process as a company grows from a Seed-stage startup to pre-IPO.

Financial Planning Process for a Mid-Stage Startup

At the earliest stages, a financial plan can be thrown together quickly by the CEO and Finance Lead, and there’s not much need for a process calendar or coordination. Once P&L ownership has been distributed to Department/Division Leads, there is a need to coordinate the planning process among a much larger group of stakeholders, and it is helpful to design a planning process that clearly lays out the objectives/targets, milestones, deliverables, responsibilities and timelines. The table below outlines the planning process for a mid-stage startup that requires cross-departmental coordination.

| 1. Design Planning Process | |

| Outputs |

|

| Who |

|

| When |

|

| 2. Set Goals and Initiatives | |

| Outputs |

|

| Who |

|

| When |

|

| 3. Build Dept/Division-Level Plans | |

| Outputs |

|

| Who |

|

| When |

|

| 4. Review/Finalize Recommended Plan | |

| Outputs |

|

| Who |

|

| When |

|

| 5. Approve Plan | |

| Outputs |

|

| Who |

|

| When |

|

Download an example of a detailed financial planning calendar template to leverage for your startup’s annual financial planning.

Burkland’s startup CFOs and FP&A experts are available to assist with your company’s financial planning and budgeting. Contact us to request more information.