In the first article, we focused on scenario planning and ended with how VCs are now advising startups to extend their current runway to 24+ months, regardless of when they last raised capital. In this second article, we focus on the “how” – forecasting, modeling, and waterfall analysis. The third article focuses on strategies for reducing costs and bringing in capital.

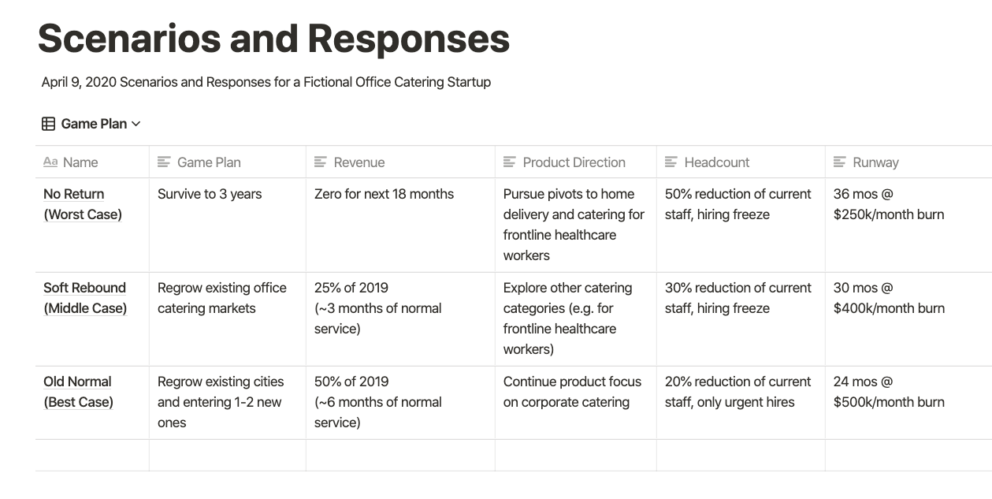

Tool #1 – Scenario Response Planner

Here’s First Round’s Scenario Response Planning Template. Or check out a completed example below for a fictional startup provided by First Round below.

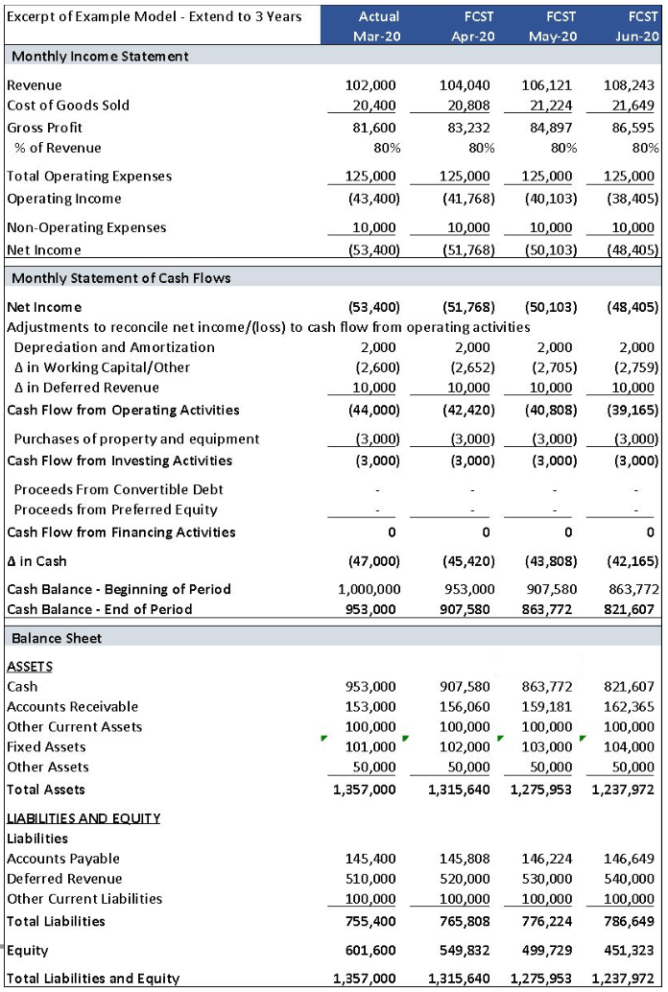

Tool #2 – Three-Year Financial Model

Build separate models for each of your scenarios and associated contingency plans to determine the cash runway.

- An optimal financial model includes the income statement, balance sheet, and cash flow.

- The plan should be built out monthly, allowing determination of # months cash runway.

- Can you answer, how much cash do you have on hand and how many months is it going to keep you operational?

- Reports should tie in with your chart of accounts, facilitating monthly updates of actual results.

- Financial models need to be customized for each company’s industry and business model – no standard templates!

We created this example 3-year Financial Model at Burkland:

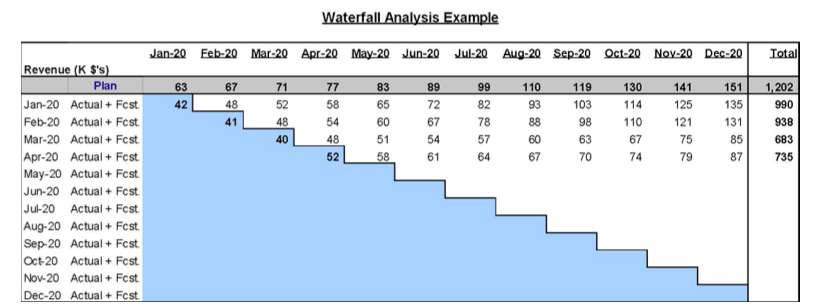

Tool #3 – Regular Forecasting and Waterfall Analysis

We recommend implementing a monthly (or more frequent) forecasting process and tracking changes via waterfall analysis.

- Forecast based on “most likely” scenario

- Identify trigger points that will drive you to shift to an alternate scenario and implement associated contingency plans.

- Waterfall analysis is a helpful tool to track the trigger points and not get misguided by small incremental monthly changes that in aggregate are large variances to the original plan; choose several key metrics to monitor

We created this example Waterfall Analysis at Burkland:

Read other articles in this 3-part series: The first article focuses on scenario planning. The third article focuses on strategies for reducing costs and bringing in capital.