One of the most frequent questions Burkland CFOs receive from our SaaS startup clients and their investors is, “how do we compare to other SaaS startups?”.

It is a good question. Benchmarks around financial metrics are an excellent indicator of performance.

Key Financial Metrics to Use for Benchmarks

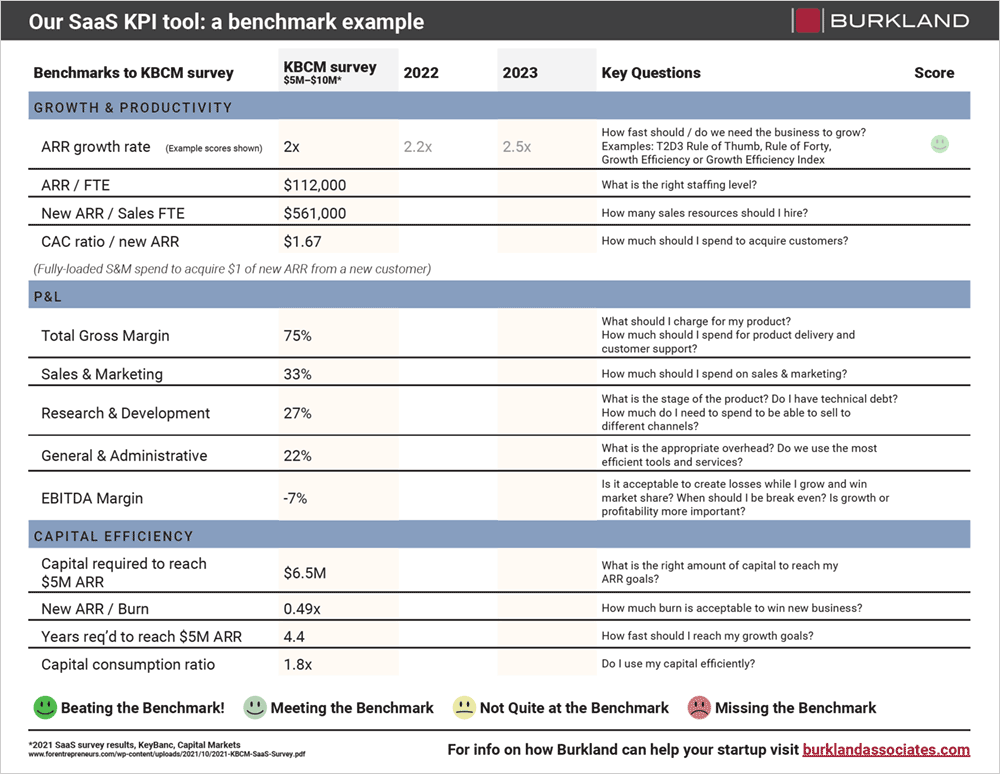

Choosing which financial metrics to use for benchmarks is critical. I find it is important to look at three areas:

- Growth & Productivity

- P&L

- Capital Efficiency

I created an easy-to-use table with a few key metrics around each area, with KeyBanc Capital Markets’ SaaS benchmarks* listed for comparison.

Download a PDF of Burkland’s SaaS Benchmarking Tool

To make it even easier for my startup founder and CEO clients, I use emojis to convey how their performance compares to the benchmark. Clients like it because they can quickly get a good grasp of their company’s financial health and receive guidance for budgeting and decision-making in one easy-to-understand table. If there are problem areas, we can then dig deeper.

*There are many benchmarking studies to use for comparison. At Burkland, we use KeyBanc Capital Markets’ SaaS survey for benchmarking. KeyBanc’s report is detailed, and they survey over 500 private SaaS companies annually. KeyBanc 2021 SaaS survey (the 12th year) is here, and the 2020 SaaS survey is here.