Burkland outsourced CFO Debbie Rosler looks at the COVID-19 impacts and responses across a sample group of 25 startup clients.

When the COVID-19 shutdowns initially hit in February, there was a lot of uncertainty and fear about a deep and sustained economic recession. Startups were advised to batten down the hatches and extend their cash runways to 18-24+ months, and to make deep expense cuts as necessary to achieve this objective. There was fear that venture funding would completely dry up. While there was certainly a blip for many startups in the initial period after the shutdowns, many have recovered or are on the path to recovery. Venture funding is down vs. 2019 and deal terms are somewhat less favorable, but overall, the venture capital market continues to be quite robust.

Venture funding is down vs. 2019 and deal terms are somewhat less favorable, but overall, the venture capital market continues to be quite robust.

There’s been talk in the media recently about whether we are in the midst of a K-shaped economic recovery. In a K-shaped recovery, certain sectors of the economy (such as technology and retail) recover while other sectors (such as leisure and hospitality) continue to suffer. It seems that many startups are positioned to benefit from the upside within the K-shaped recovery.

It seems that many startups are positioned to benefit from the upside within the K-shaped recovery.

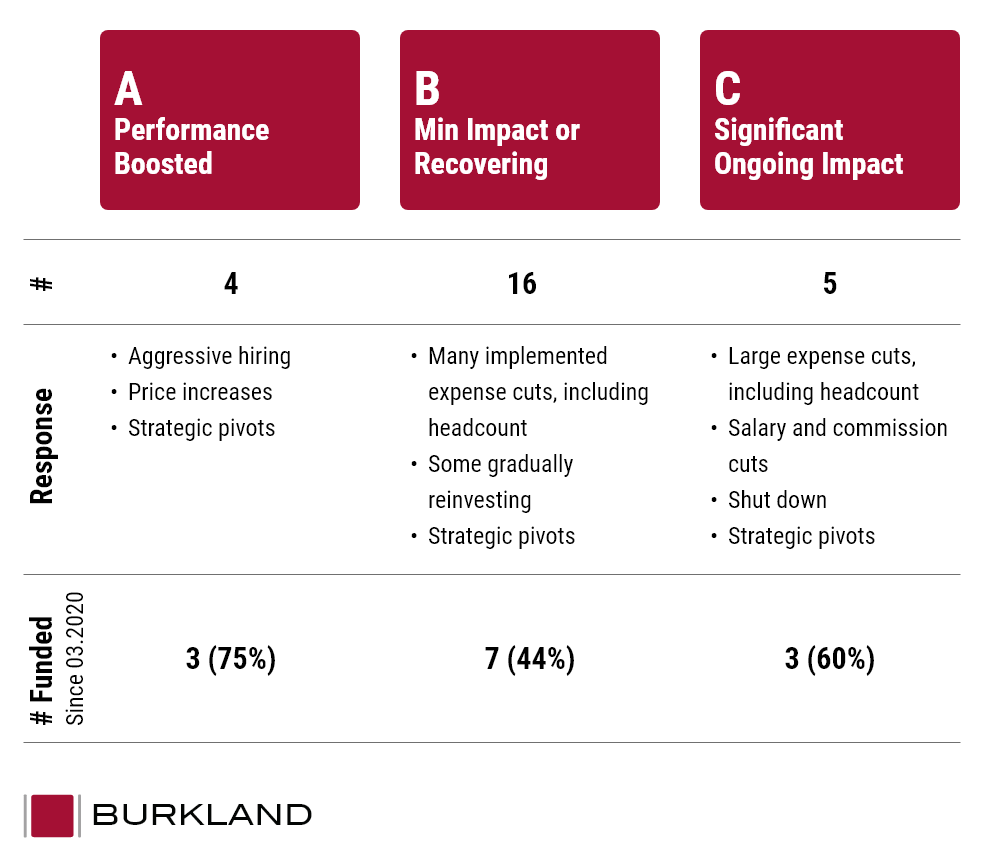

We completed a non-scientific survey of 25 Burkland startup clients, and we gathered some insights about their post-COVID-19 impacts and responses. There is a range of impacts and responses.

We grouped companies into three categories:

- A: Performance boosted in post-COVID environment

- B: Minimal Impact Due to COVID and/or Recovering

- C: Significant and ongoing impact.

We also synthesized some key themes around the responses, as reflected in the Exhibit below.

It is interesting to note that 80% of companies surveyed fall within the A or B category. This supports the idea that many startups are beneficiaries of the K-shaped recovery. It should be noted that 19 of the 25 companies surveyed are SaaS companies. Overall, SaaS has fared quite well in the current environment.

Impacts of Covid-19 on Startup Fundraising

Thirteen of the companies, just over half, have raised funding since February. While it’s not too surprising to see that 75% of A companies raised funding, it is noteworthy that 60% of C companies also raised funding. However, after digging a little deeper, we learned that two of the C group companies raised capital early in the post-COVID era, based on term sheets that were agreed to prior to the COVID-shut downs. The third that raised capital raised a very small round, with far less capital raised than initially targeted.

Startup Responses to Covid-19

Strategic Pivots

In terms of company responses to the changing environment, it appears that a general theme, regardless of performance category, is that many companies are pursuing strategic pivots and/or launching new product lines to better position themselves for the current landscape. A good example of this is a software company in the event management vertical that initially lost all of its business but pivoted to a virtual offering, for which demand has skyrocketed.

…many companies are pursuing strategic pivots and/or launching new product lines to better position themselves for the current landscape.

Expense Cuts

Another theme is that most companies, except some of the A category companies, initially pursued expense cuts. While some companies needed to cut headcount, many companies took a wait and see approach to see if the initial churn/loss of revenue would be recovered. Nine of the companies received PPP loans, which in some cases enabled this wait and see approach.

Within the B category companies, many are gradually starting to reinvest in the company and increase headcount or other expenses. It appears many companies are proceeding cautiously and are slower to invest than in the past, given ongoing uncertainty associated with the pandemic and economy.

Summary

In summary, our survey of Burkland clients supports the idea that the startup ecosystem has been quite resilient in the post-COVID economy. However, with the upcoming elections and the ongoing fear of a potential Covid-19 second wave, we are still facing significant uncertainty as to how the recovery from the current recession will progress. Startups certainly hope to see a continued strong recovery in their sectors, but it seems wise to proceed cautiously as companies shift their focus from cash conversation back into growth mode.