Walt Spevak, Managing Director of Burkland’s CFO Services group, shares important economic indicators that startups should be watching in the coming months and how to prepare.

Anyone who has ever sailed in San Francisco Bay knows that the tide turns roughly every 6 hours. With regard to COVID-19, two of the most frequently asked questions are “When will the economic tide turn?” and “Has it already begun?” Tidal changes are generally predictable and steady. The post-COVID-19 tide turn will surely be anything but.

This article focuses on what to look for when the economic tide is turning and how to prepare. Tide turns first along the shoreline, as that is where there is less mass/energy. Where will the economic tide turn first?

Leading Economic Indicators – What to look for?

Sailors are always looking ahead with the phrase “Get your head out of the boat”. So let’s get our head out of email or Slack and look at some leading macroeconomic indicators like:

- The consumer confidence index (which has plunged).

- Nearer term, and very real, is the unemployment rate. May was lower than April, although both have been adjusted upward by the BLM and are still massively high.

- Interest rates are a third leading indicator, with 10-year Treasury bills being a common benchmark. They are still very low, with a slight uptick. Be careful not to be swayed by daily movements.

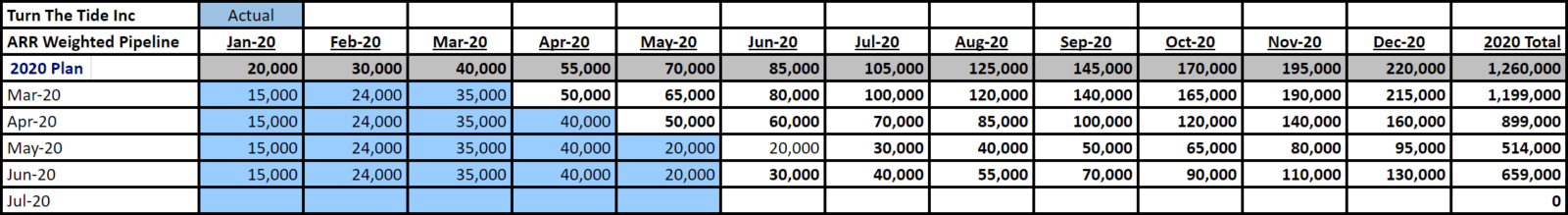

Looking more at start-up land and company-specific factors, for revenue based companies it’s all about the funnel. Use a monthly waterfall table to track:

- All leads at the top of the funnel

- Sales-qualified leads/# of demos

- Weighted pipeline

- Close rates

- Days to close

- Contract value

For existing customers, are churn rates stabilizing/reducing? Are customers paying in full? Are days to collect getting shorter? Pre-revenue companies should be tracking leads as well as engagement, active users and churn.

VC activity is also an excellent economic indicator. What’s the mix of investments, and are investment dollars going into shoring up existing portfolio companies versus investing in new companies? Greg White, Partner & COO at Sway Ventures is seeing some portfolio companies accelerate through the crisis as “their value propositions and products have never been more applicable. We’re quite bullish.”

How to prepare?

March through May was all about redoing financial models, running scenarios and applying for PPP loans. While we’d all like a V-shaped recovery, that looks unlikely. Even a U seems optimistic.

- Priorities remain preservation of cash and extension of your runway.

- Know your business and where your ROI comes from. Cut costs wisely. For example, don’t kill R&D services with positive returns. Do have that hard look at divesting longshot projects.

- Love your customers to reduce churn. Call them. Thank them.

- Love your prospects as well. Offer discounts or free trials. Think like a customer. What would you value?

- Continue to simplify processes. You have made the easy/obvious changes. (Have you?) Now take a 2nd pass at where you can simplify. As a finance consulting business, we are encouraging our clients to prioritize finance automation through cloud-based services.

- Now more than ever, focus on your people. Assess your current team. Are people in the right/best roles? Hire desired talent. There are some highly skilled people looking for work.

- Seek non-dilutive investments if your business valuation merits it. Have you been loving, thanking your investors? Now’s a good time to evaluate buying opportunities. Some businesses with good products, services and people have sadly run out of funds – these may be opportunities

- Prioritize growing EBIT or reduce losses more than you might have been planning when the year started. Winners from previous downturns did this. Spend wisely.

And Then What?

After you’ve looked at the indicators and prepared — then what? What’s next? When you decide (or start to decide) that your economic indicators are saying that things are looking markedly up, it’s time to get back to a growth mindset and action orientation (after a conversation with your board). Ramp up hiring, product development and marketing while watching your metrics carefully in the event of a dip or perhaps downturn.

In Summary

Where do you want to be? Sailors are always looking ahead and planning their strategy. Position your business to be there. Continue to preserve cash, extend your runway, love your customers, love your prospects, simplify processes, and value and thank your employees and your investors.

A rising tide lifts all boats. A rising economy lifts those who prepared.