Article 2 of a 3-Part Series

Current world events are affecting startups in many ways. This article is the second in a three-part series focused on recommendations for startups.

In the first article, we focused on scenario planning and ended with how VCs are now advising startups to extend their current runway to 24+ months, regardless of when they last raised capital. In this second article, we focus on the “how” – forecasting, modeling, and waterfall analysis. The third article focuses on strategies for reducing costs and bringing in capital.

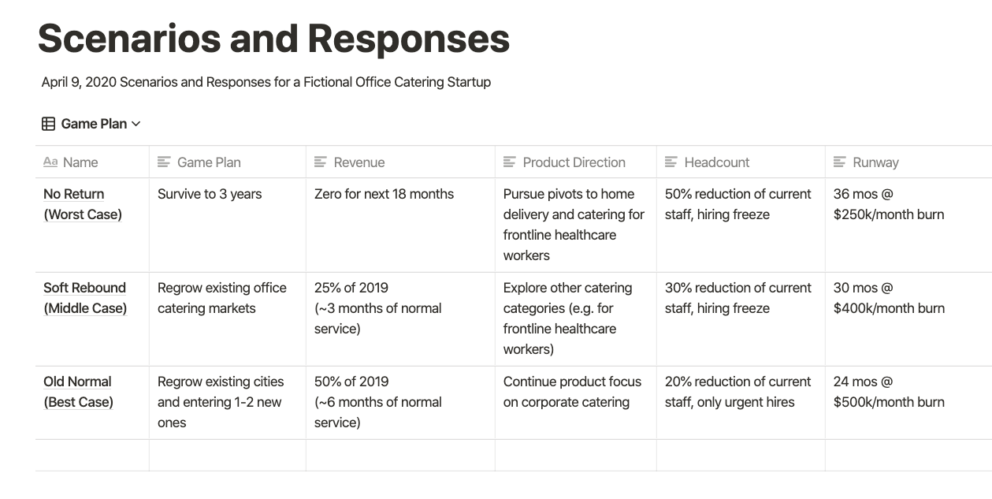

Tool #1 – Scenario Response Planner

Here’s First Round’s Scenario Response Planning Template. Or check out a completed example below for a fictional startup provided by First Round below.

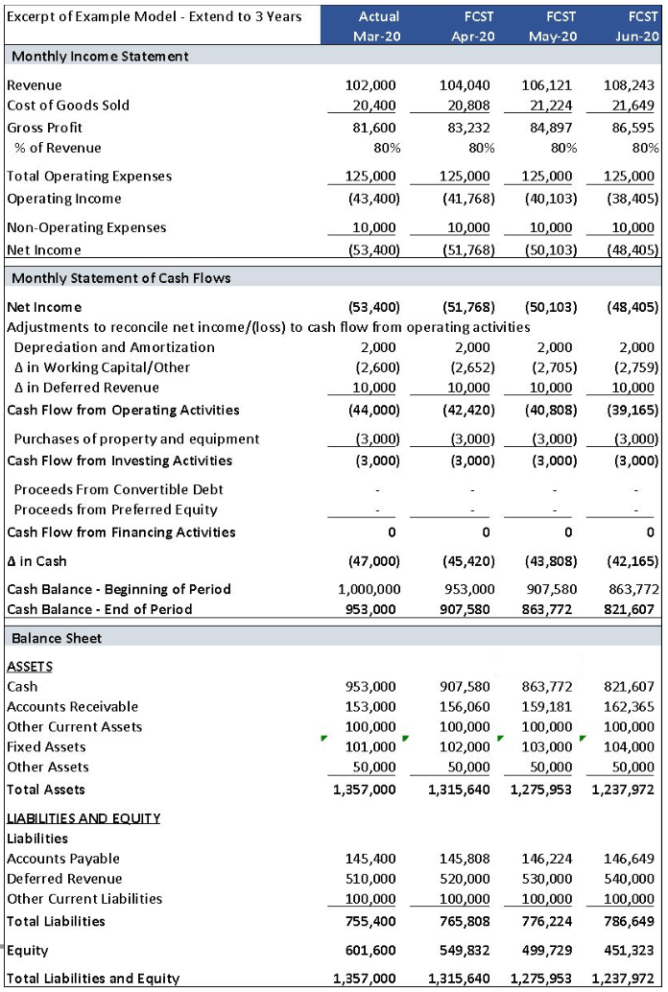

Tool #2 – Three-Year Financial Model

Build separate models for each of your scenarios and associated contingency plans to determine the cash runway.

- An optimal financial model includes the income statement, balance sheet, and cash flow.

- The plan should be built out monthly, allowing determination of # months cash runway.

- Can you answer, how much cash do you have on hand and how many months is it going to keep you operational?

- Reports should tie in with your chart of accounts, facilitating monthly updates of actual results.

- Financial models need to be customized for each company’s industry and business model – no standard templates!

We created this example 3-year Financial Model at Burkland:

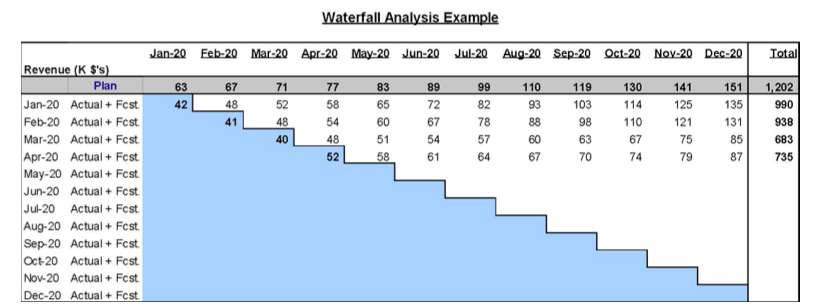

Tool #3 – Regular Forecasting and Waterfall Analysis

We recommend implementing a monthly (or more frequent) forecasting process and tracking changes via waterfall analysis.

- Forecast based on “most likely” scenario

- Identify trigger points that will drive you to shift to an alternate scenario and implement associated contingency plans.

- Waterfall analysis is a helpful tool to track the trigger points and not get misguided by small incremental monthly changes that in aggregate are large variances to the original plan; choose several key metrics to monitor

We created this example Waterfall Analysis at Burkland:

Read other articles in this 3-part series: The first article focuses on scenario planning. The third article focuses on strategies for reducing costs and bringing in capital.