Article 1 of a 3-Part Series

COVID-19 is affecting startups in many ways. This article focuses on scenario planning for startups during the COVID-19 crisis.

In this first article, we focused on scenario planning and end with how VCs are now advising startups to extend their current runway to 24+ months, regardless of when they last raised capital. In the second article, we focus on the “how” – forecasting, modeling, and waterfall analysis. The third article focuses on strategies for reducing costs and bringing in capital.

COVID-19 Crisis Heightening Focus on Scenario Planning

- COVID-19 is a “Black Swan” event and is driving a devastating impact on the global economy, with far-reaching implications for startups

- Many of today’s startup founders have only operated in an environment of aggressive growth and need to understand that the context has shifted dramatically, and they must quickly pivot accordingly

- The immediate economic and financial impact starting to come into view, but the magnitude and duration of the full impact is highly uncertain

- All startups should plan for changes to the fundraising environment

- Given the high levels of uncertainty, startups should seek to conserve cash and extend their runway to weather the storm

- Scenario planning is recommended to anticipate the range of financial impacts and build contingencies to maintain targeted runway

Scenario Planning Framework

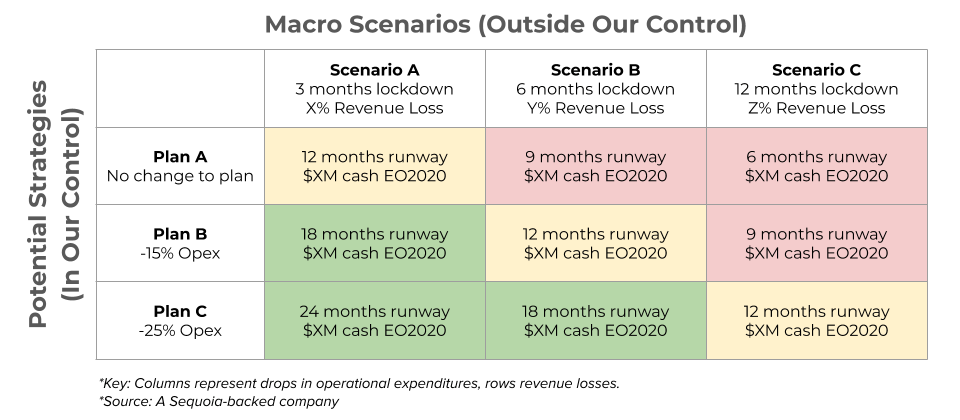

Companies need to identify the range of possible scenarios and the strategies they can employ to maintain a sufficient cash runway. Sequoia Capital created this Matrix for COVID-19 which provides a good framework for evaluating the range of decisions companies are facing.

Startup Scenario Planning Approach

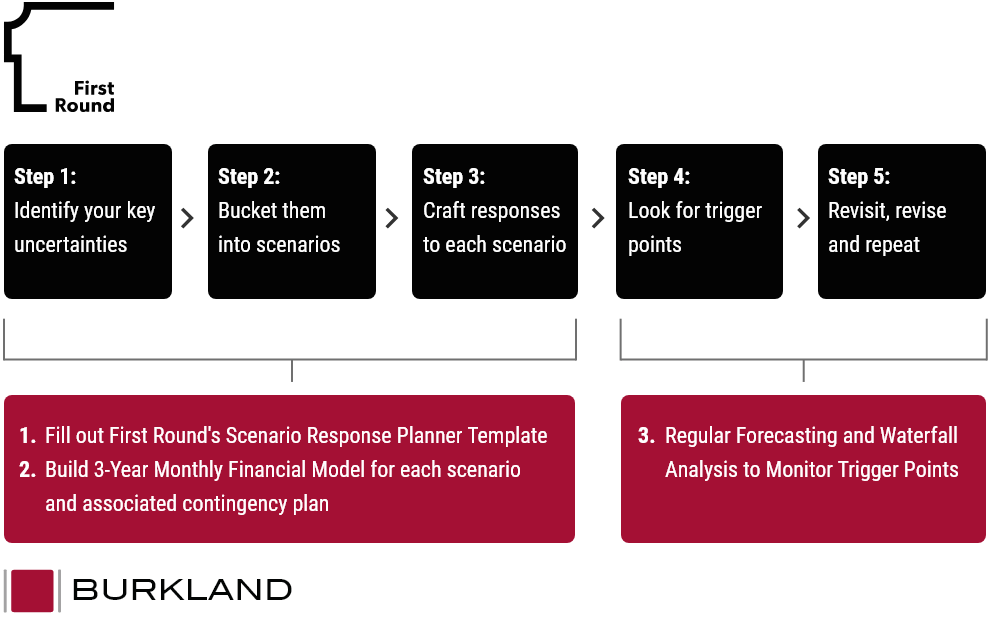

First Round Capital shared a 5-Step Approach to Scenario Planning that we recommend all startups employ. Burkland recommends that startups use three tools to apply this scenario planning approach:

- First Round Capital’s Scenario Planner Template

- A 3-year financial model

- Regular forecast updates, including a waterfall analysis

The five scenario planning steps and three recommended tools are outlined below.

We will review Burkland’s three recommended tools in the second blog post.

Startups Need to Extend Cash Runway

A broad rule of thumb in recent years has been to plan for an 18-24 month cash runway immediately after their capital raise. VCs are now advising startups to extend their current runway to 24+ months, regardless of when they last raised capital.

“We are broadly hearing from our VC partners that they are recommending that startups extend their cash runways to 24 months or more. It will be extremely challenging to raise capital from new investors over the next year, so ideally startups can get any necessary funds from existing investors.” – Jeff Burkland, Burkland

- “We are recommending at least 24 months of runway for all of our companies, preferably more. The reason for that is it could be tough to raise money. It goes from a four-week process for many people to a six-month process in terms of fundraising.” – Bill Trenchard, First Round Capital, The Founder’s Field Guide for Navigating this Crisis,

- “Today, runway ranks as the first consideration in evaluating a company’s strategy. Suddenly, margins matter. Richer margins lengthen runway.” – Tomasz Tunguz, Redpoint, Why Margin Matters

- “Above all, your primary objective is to not run out of cash. There are two ways to do that. Either you can become profitable, or you can survive long enough and grow efficiently enough to be able to raise a new round of financing.” – Pete Flint, NFX, 28 Moves to Survive (& Thrive) in a Downturn

- “Cash is the most important thing companies have to focus on right now because if you don’t survive, obviously there’s no chance for you to build an enduring business.” – Roelof Boetha, Sequoia Capital, Adapting Espiode 2

- “The companies that survived the 2008 recession were the ones that cut expenses early and deep. It’s about survival again, not growth rates or market share. Cut expenses, extend runway, raise additional financing if ever you can – we don’t know when things will get back to normal so 18 to 24 months is your minimum target “- Jeff Clavier, Uncork Capital

Read other articles in this 3-part series: The second article focuses on the “how” – forecasting, modeling, and waterfall analysis. The third article focuses on strategies for reducing costs and bringing in capital.