In my previous article, I focused on best practices for building board financial reporting practices. In today’s article, I’ll share more advanced, tactical guidance for presenting data.

Financial Reporting by Startup Stage

As we saw in part-one, the appropriate reports and key performance indicators (KPIs) will vary depending on your company and industry, but at a minimum, you should include financial statements in your board presentation. As your company grows, your reporting will need to evolve to reflect new challenges and opportunities. The table below highlights some typical reporting that is included in board financial reporting packages, and how this may vary by the stage of the company.

| Pre-Seed / Pre-Revenue | Seed / Initial Revenue | Series A+ | |

| Cash Runway | X | X | X |

| Headcount | X | X | X |

| Financial Statement | X | X | X |

| Revenue | X | X | |

| Key Metrics Reporting | X | X | |

| KPI / Summary Dashboard | X | ||

| BVA / Waterfall Reporting | X |

Let’s take a more detailed look at some examples of the reports listed in the table above.

1. Cash Runway

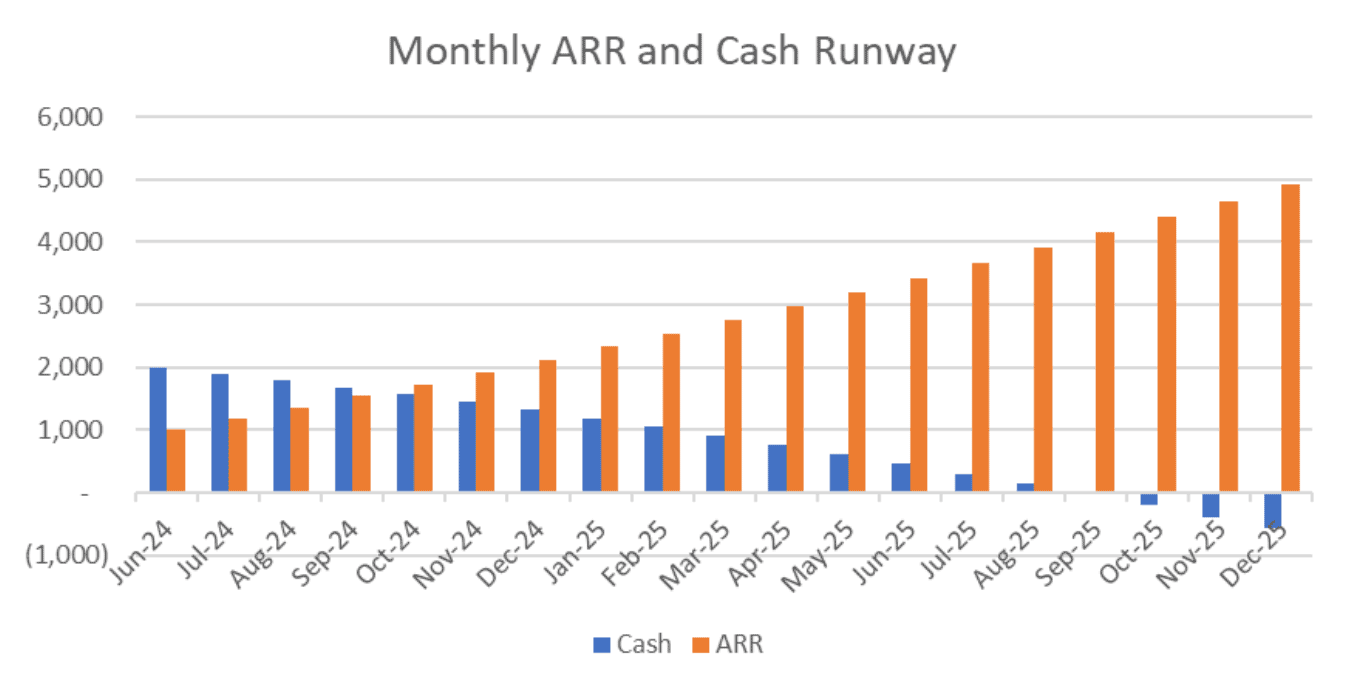

Your cash runway projection should ideally be based on your monthly financial model, but you can also extrapolate based on current monthly cash burn if a monthly forecast isn’t available. You need to ensure the timing of your next anticipated fundraise matches with the expected attainment of required milestones. It can be helpful to present your cash runway alongside revenue attainment. This way, you’ll have a better sense of whether you will have achieved necessary growth milestones to raise a new round of capital prior to running out of cash.

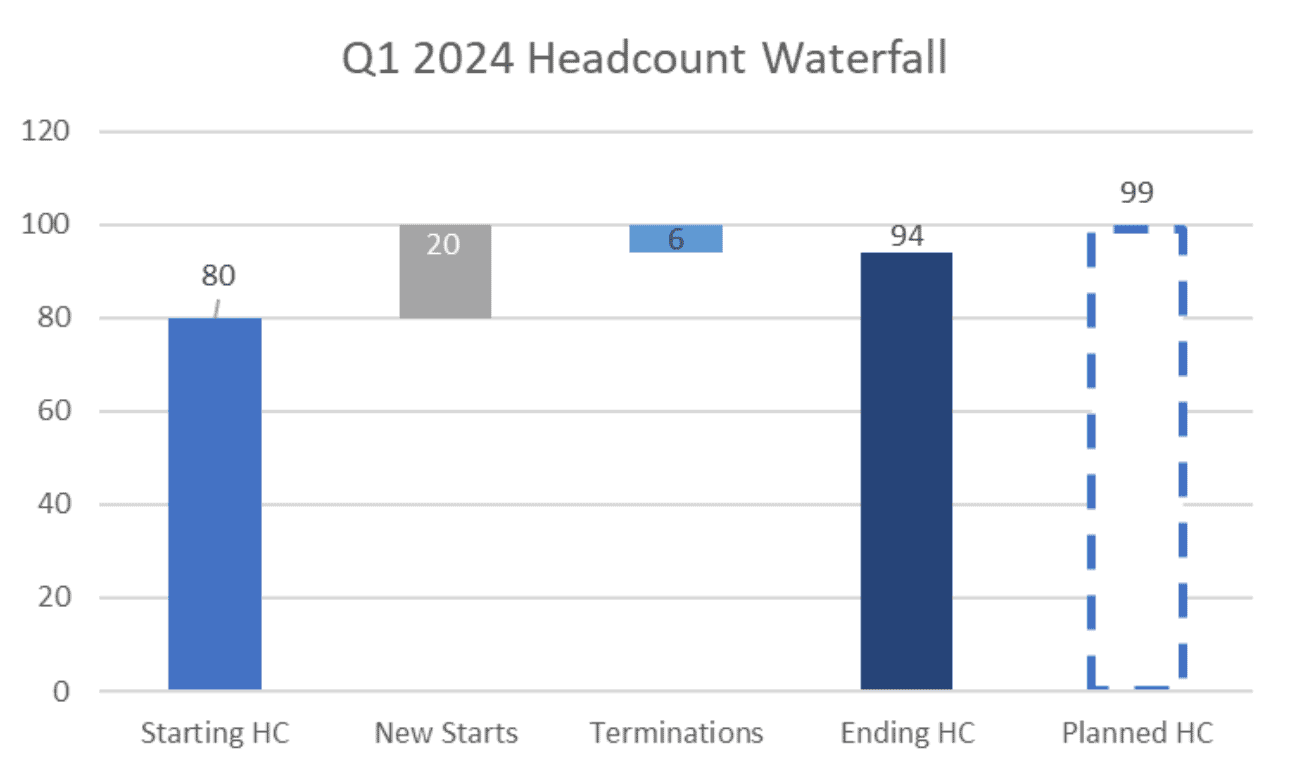

2. Headcount

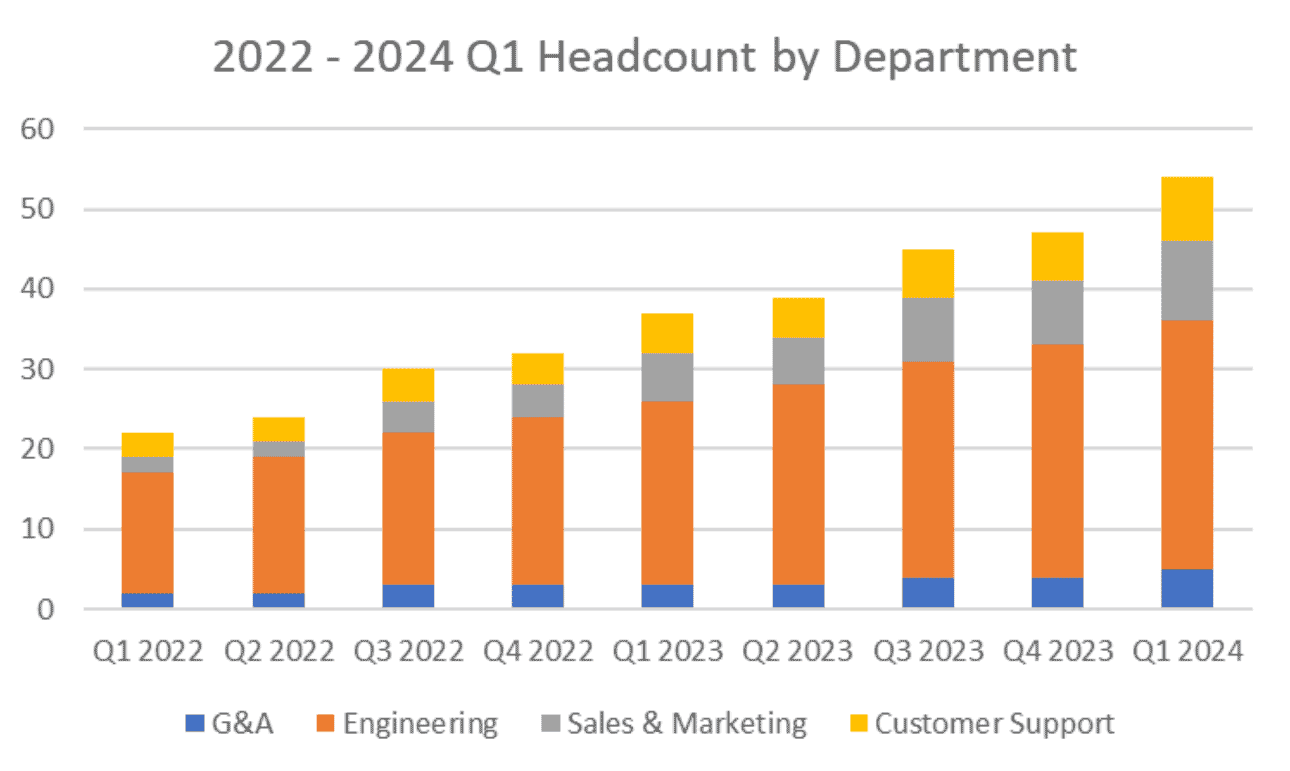

For many startups, people costs are the most significant expense category, making headcount a key report at all stages of growth. Boards like to review headcount reports, as staffing is an important lever to manage company expenses.

Tracking headcount can be tricky, as it isn’t included as part of the company’s accounting records in QBO or similar systems. Most early-stage startups manually track headcount in Excel or Google Sheets and switch to systems-based solutions as they scale. Whatever tools you’re using to track headcount, make sure to retain a history. This can be particularly valuable if you decide to change payroll providers.

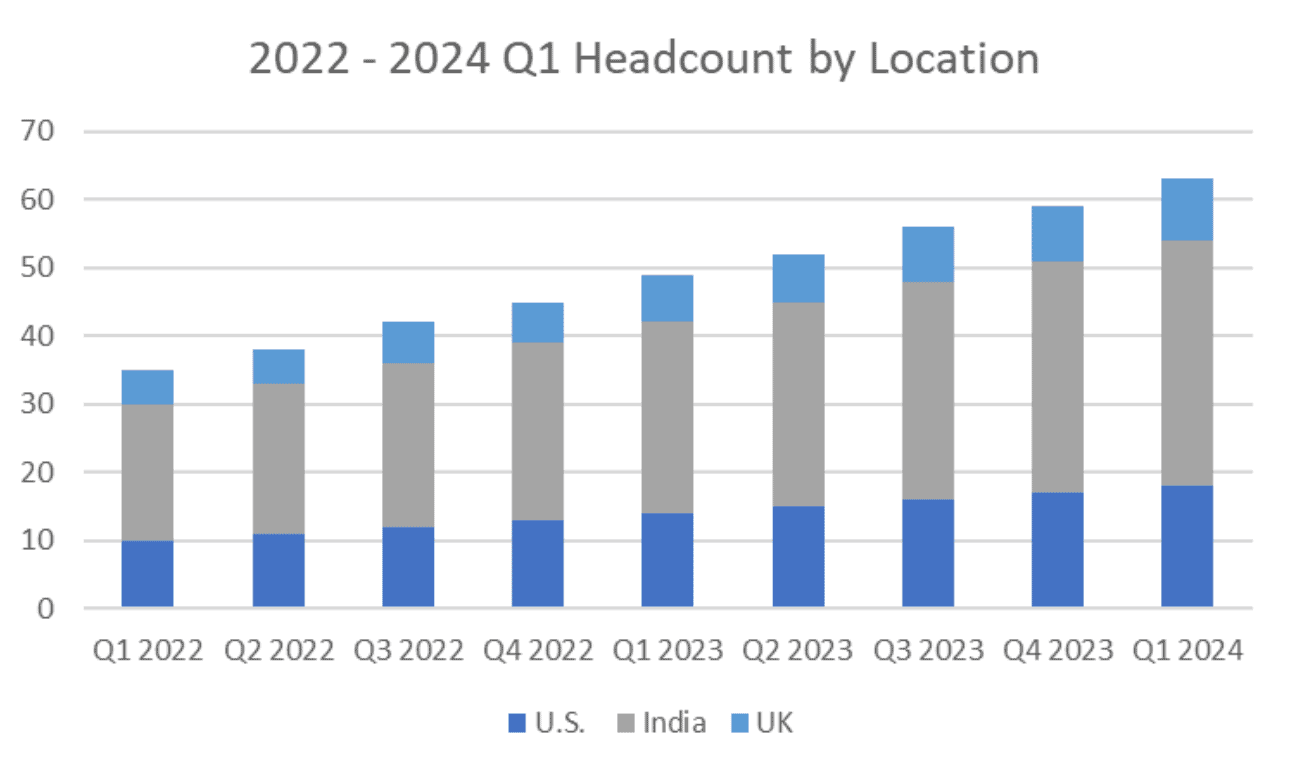

It’s often useful to break out headcount reporting by department and/or geography.

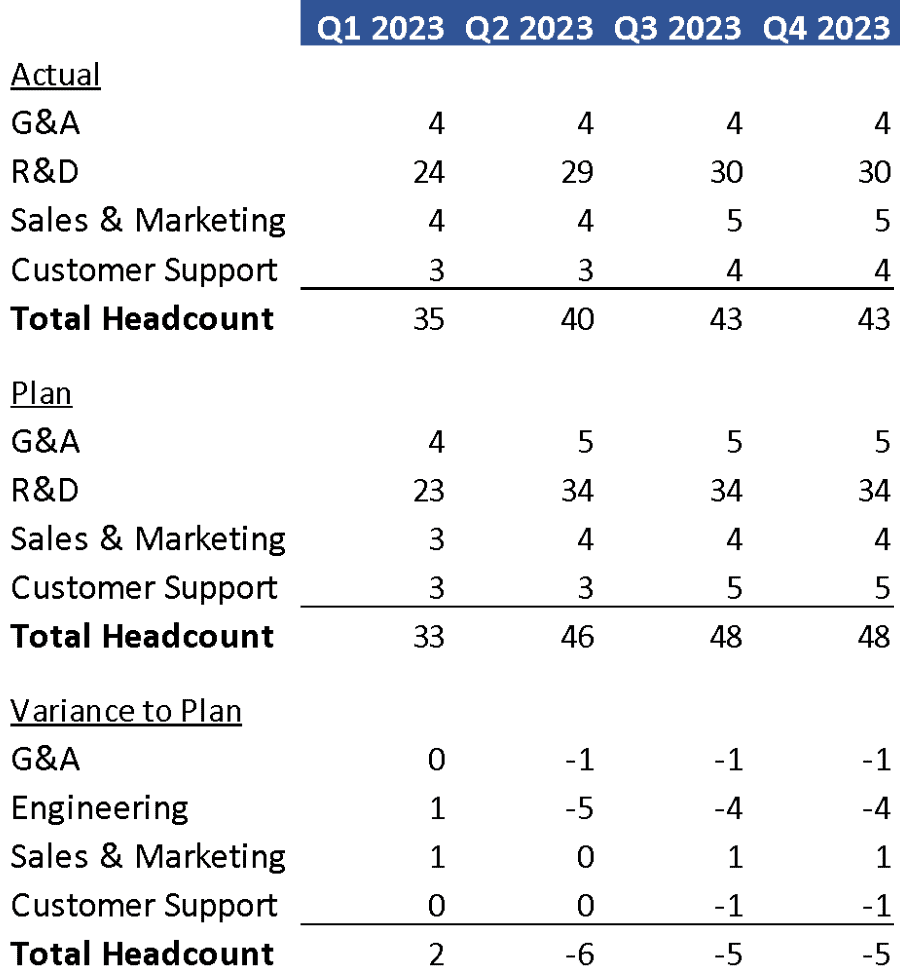

It’s also helpful to look at both hiring trendlines and comparison to plan.

2023 Actual Headcount vs. Plan

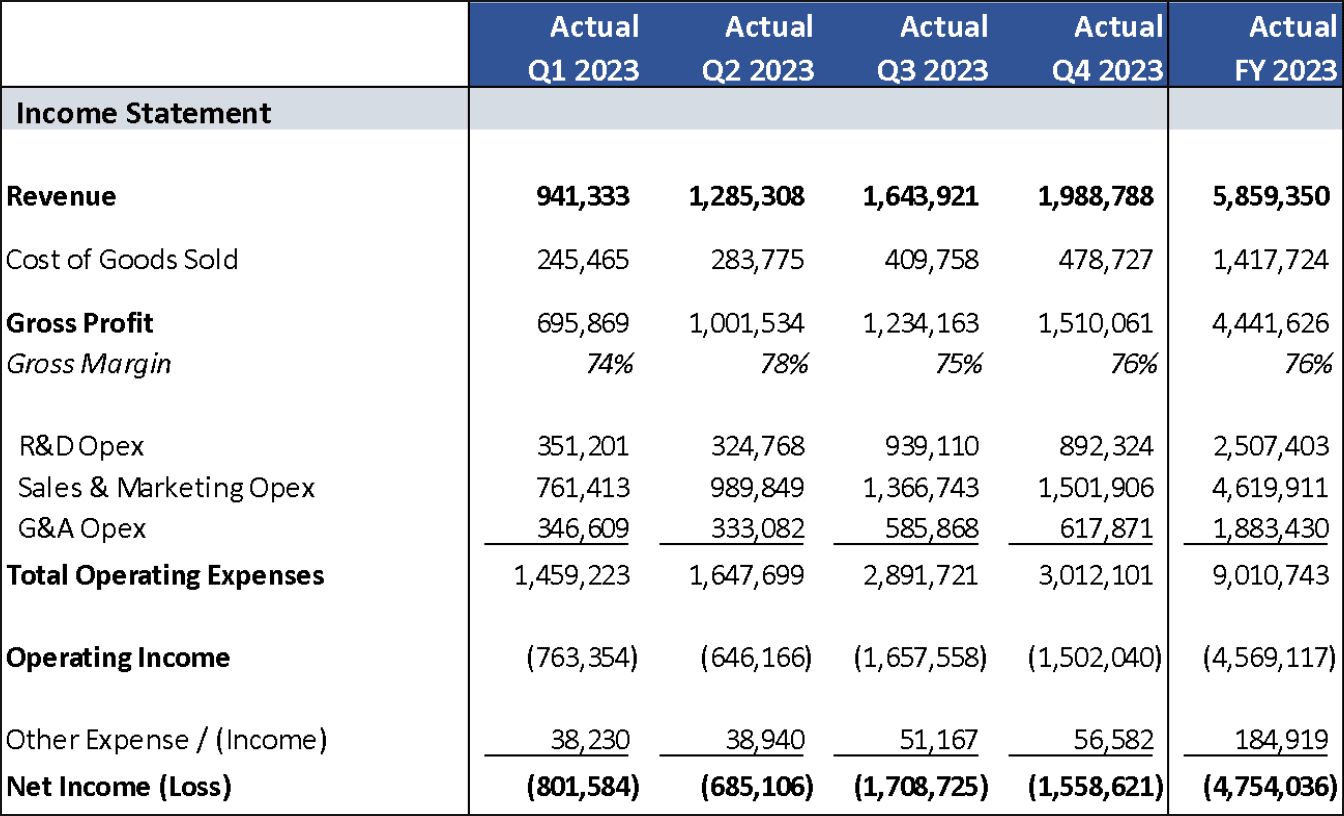

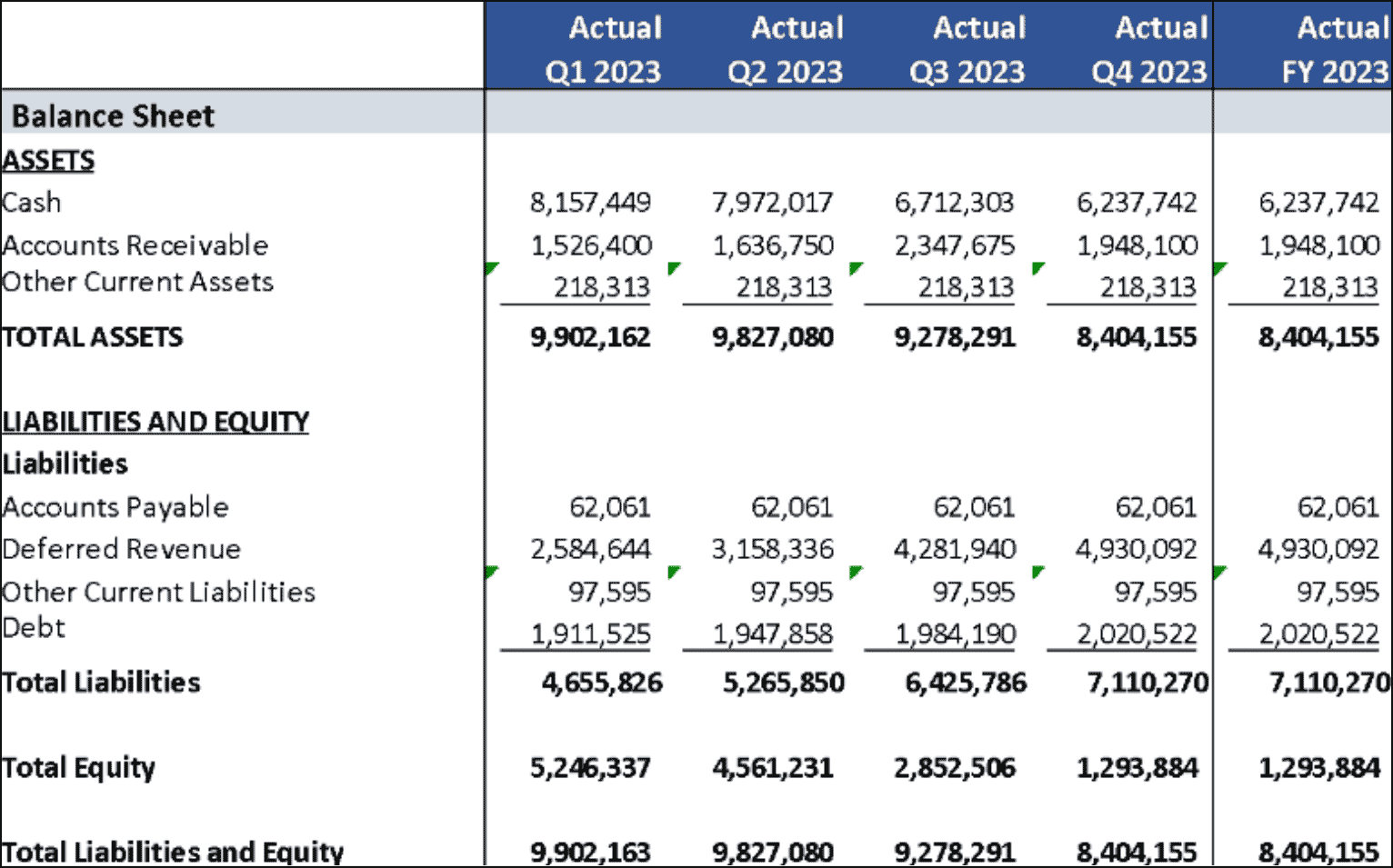

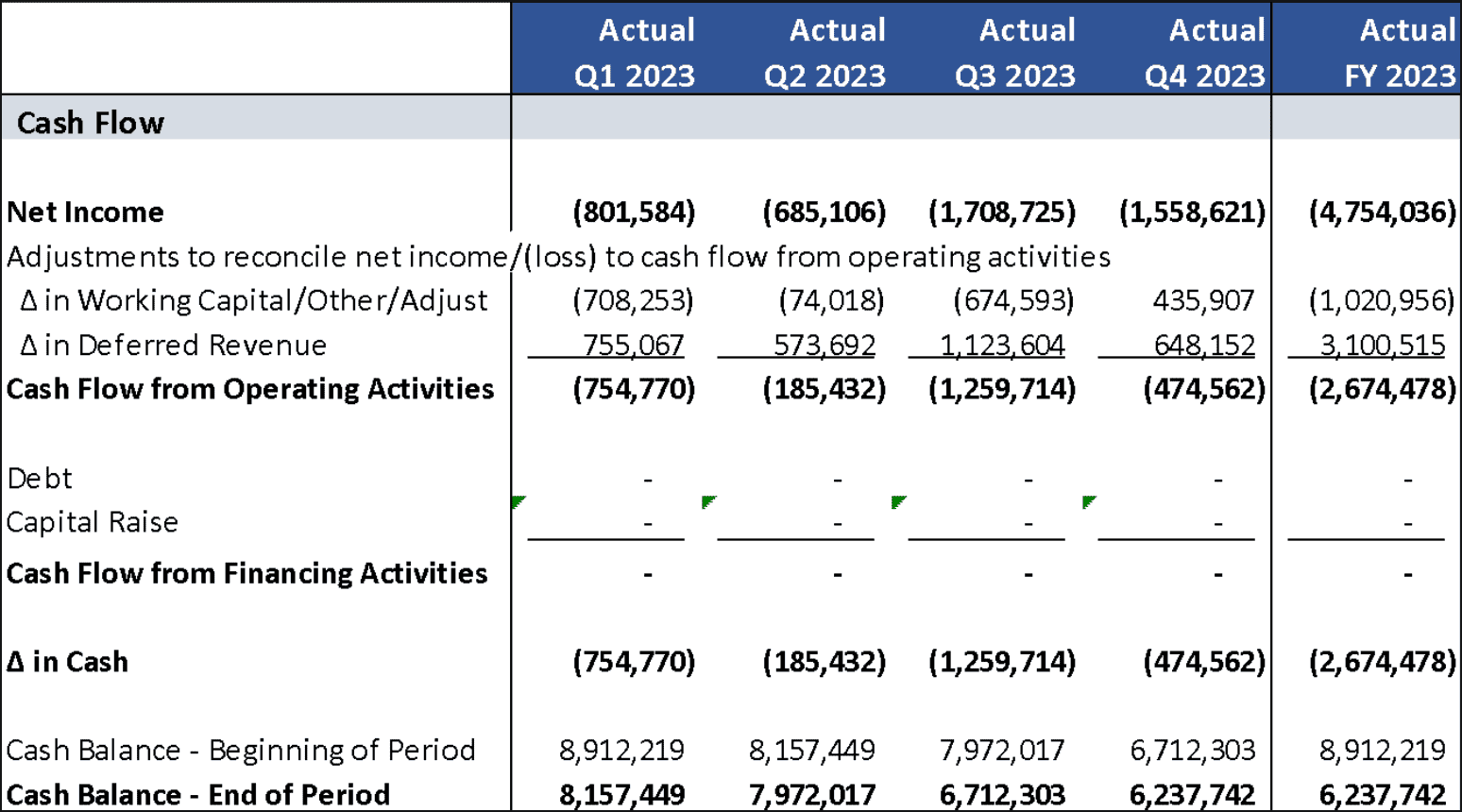

3. Financial Statements

Your board financial reporting package should include your income statement, balance sheet and cash flow statement, presented on a monthly or quarterly basis. Financial statements presented to your board should be summarized from reports pulled from your core financial systems.

Income Statement

Balance Sheet

Cash Flow

It’s essential to implement accrual accounting procedures and ensure you maintain an appropriate chart of accounts that breaks out the following key income statement metrics: Revenue, Cost of Sales, Gross Profit, Opex, Operating Income, and Net Income. Your Opex should ideally be segmented between R&D, G&A, and S&M expenses. This requires your accounting system to be set up to break out department expenses.

4. Revenue

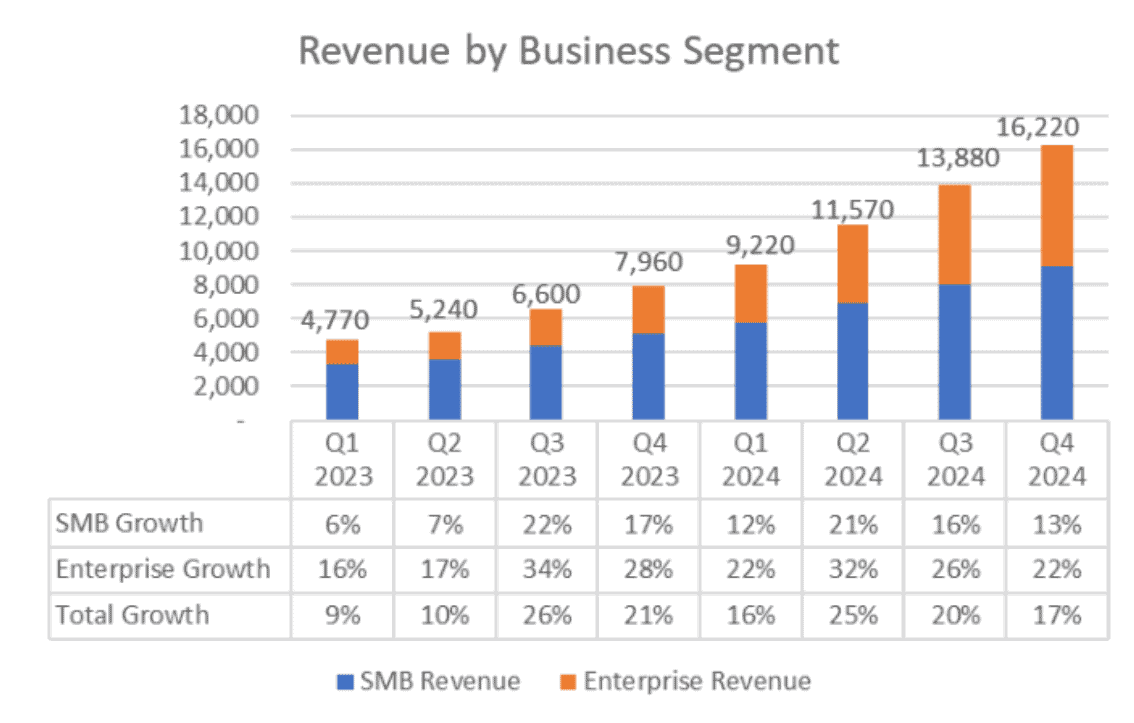

If your startup is generating revenue, show revenue and revenue growth segmented by relevant categories. It’s often helpful to present your revenue data in line or bar graphs to visually show trendlines of revenue growth over time. Add commentary regarding growth drivers (e.g., key accounts closed), variances to planned growth, and upticks/downticks in growth rates.

Useful breakouts often include business/product segments or geographic areas, and it can be helpful to add growth rates.

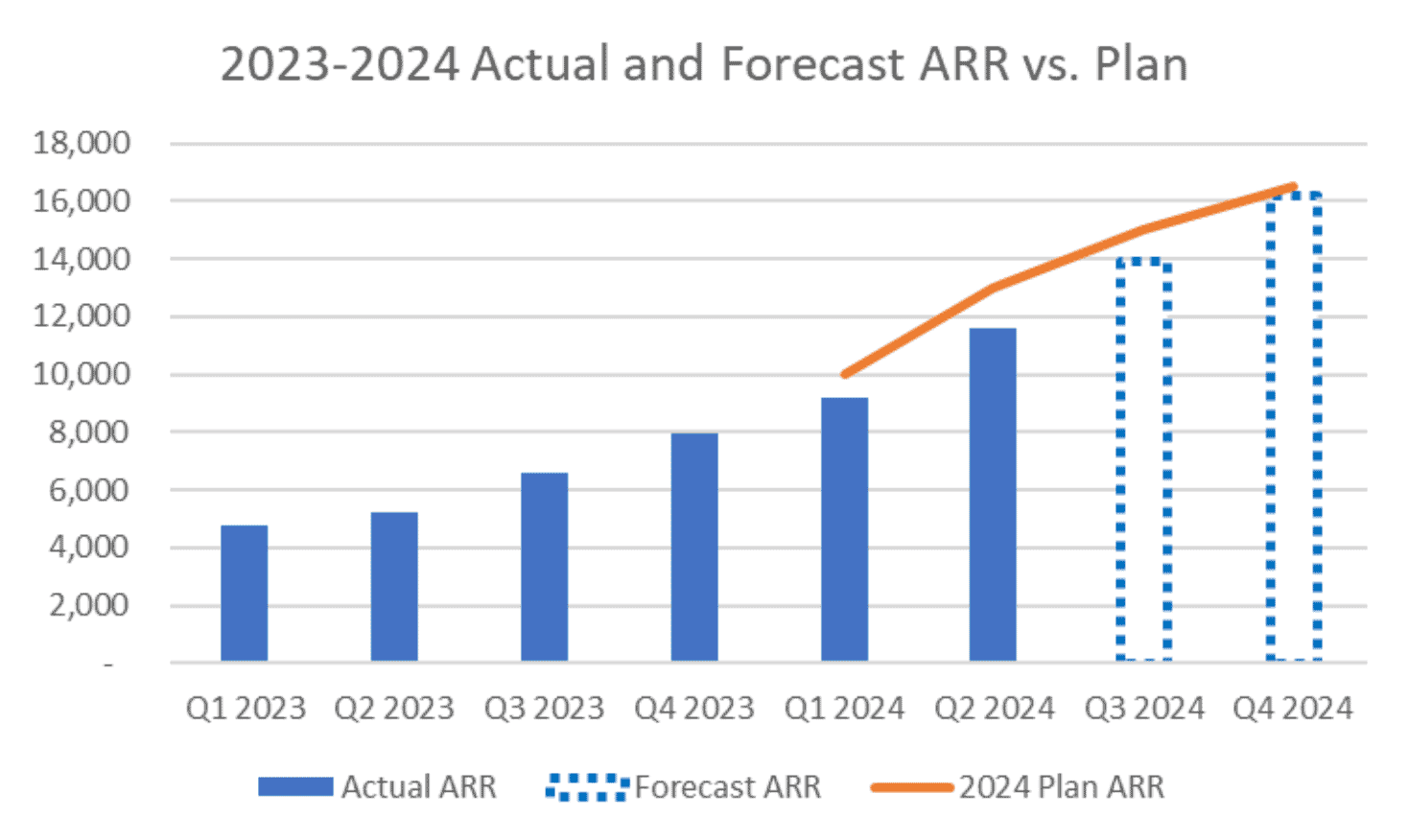

It can be helpful to add reference points such as performance vs. plan.

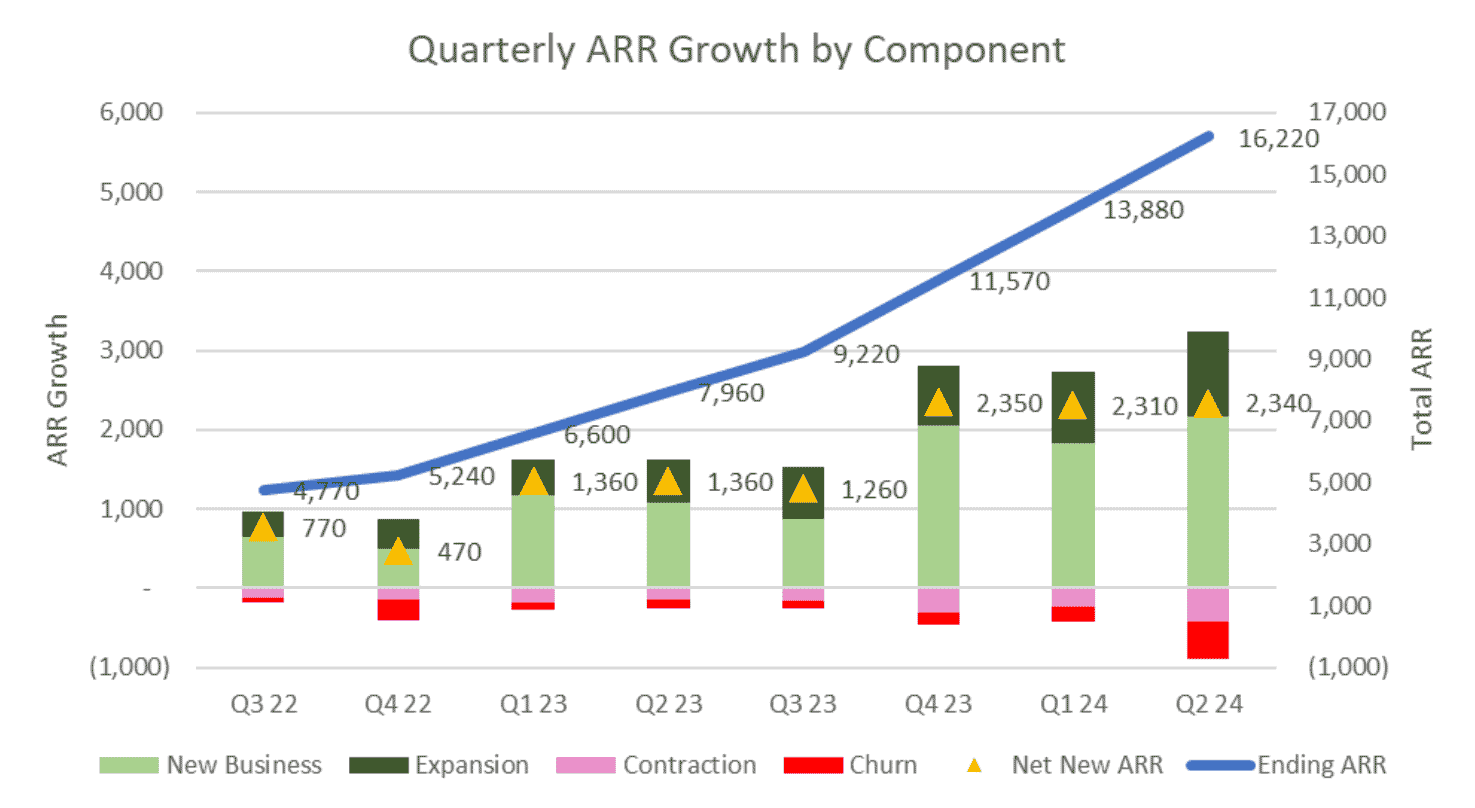

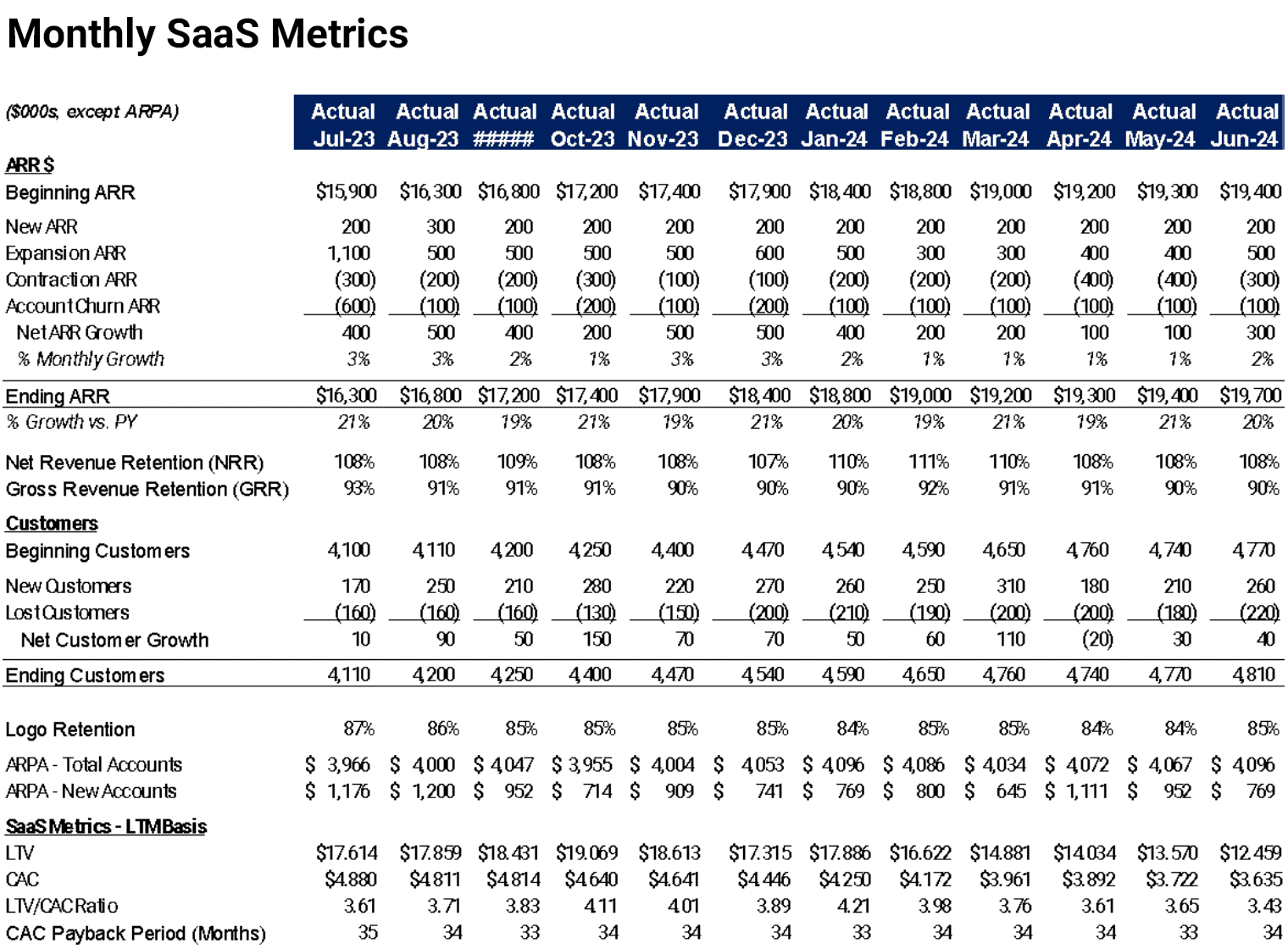

For SaaS companies, it’s often better to look at ARR than Revenue, and it can be helpful to break out the components of ARR growth (e.g. new business, expansion, contraction, churn)

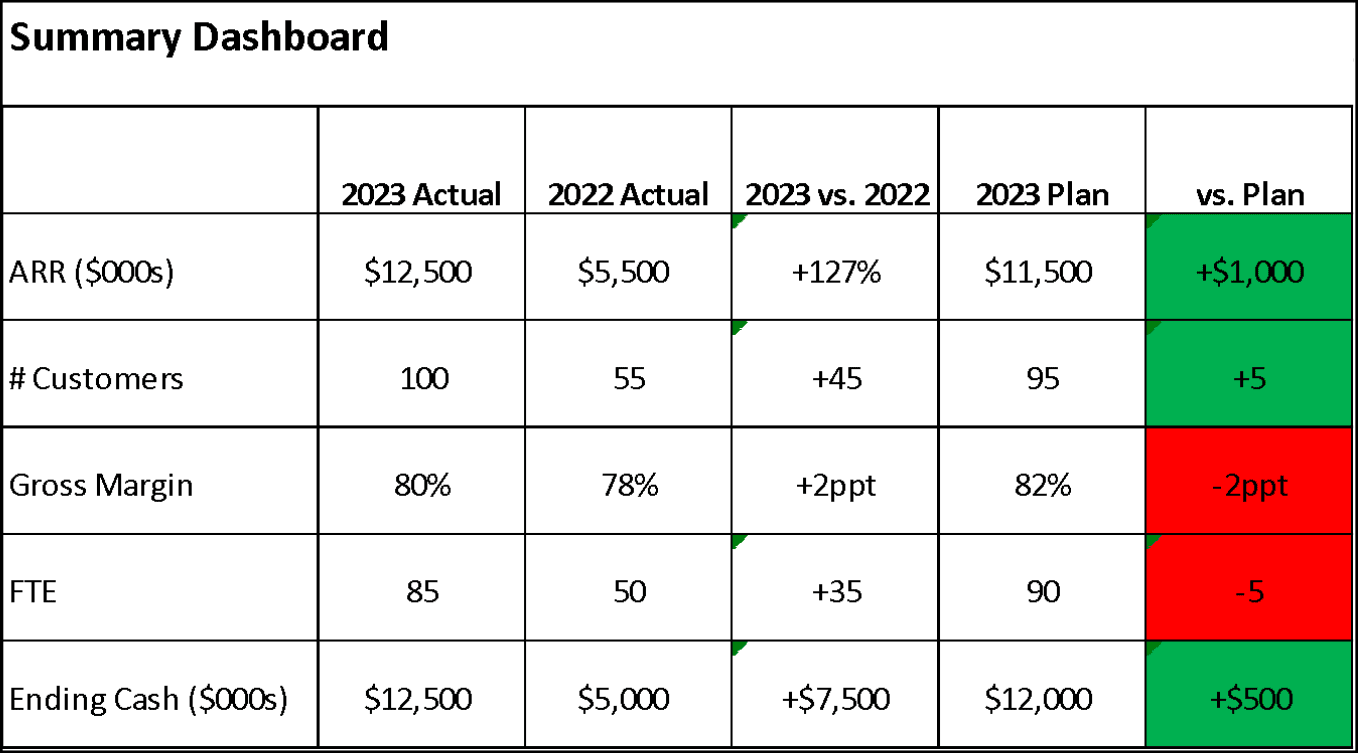

5. KPI / Summary Dashboard

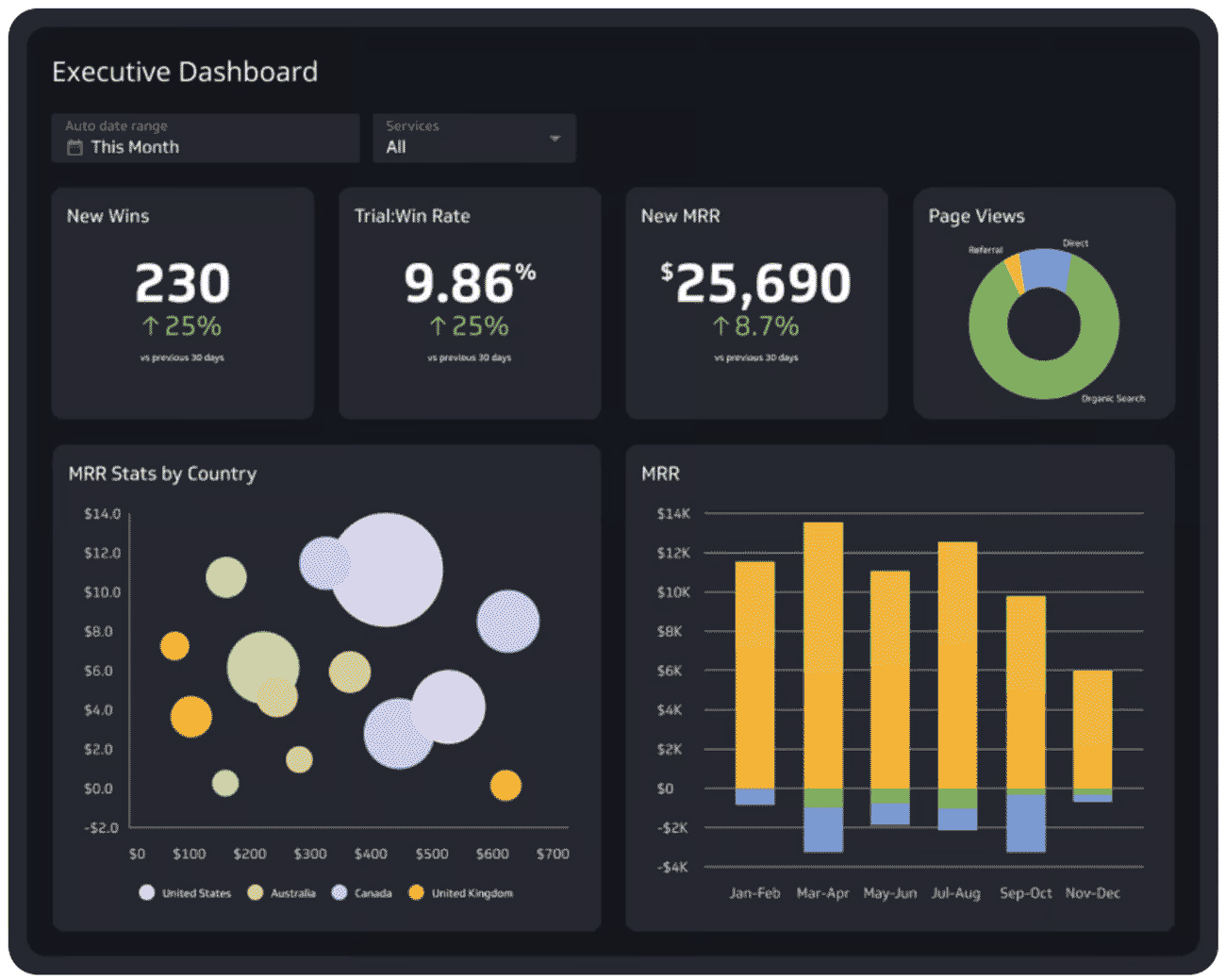

As your company grows, it becomes helpful to share KPI dashboards at your board meetings.

If your executive team uses a KPI dashboard, it is helpful to share that with the board.

It can be helpful to include a summary dashboard of performance against the most important KPIs in the introduction to the board deck or at the beginning of the finance reporting section.

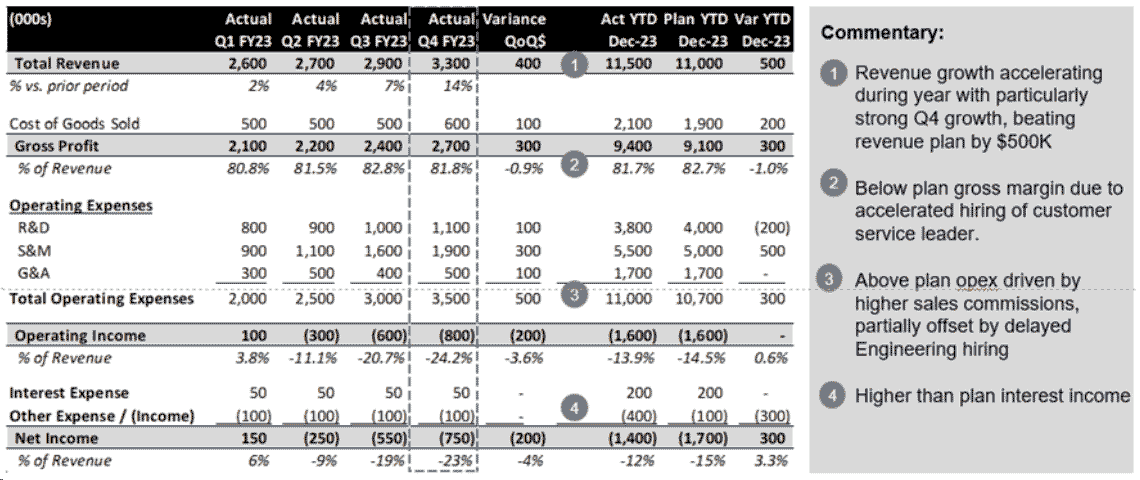

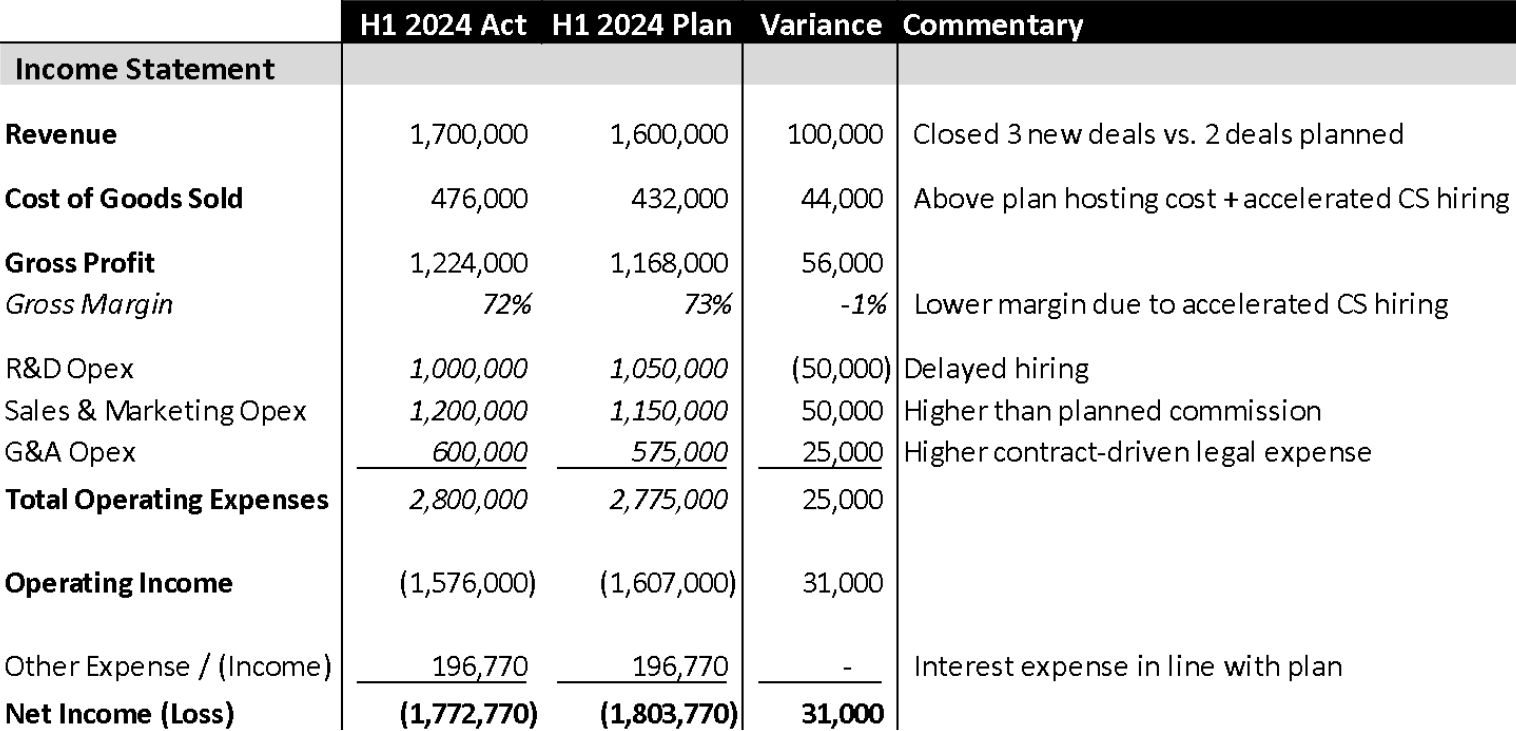

6. Budget vs. Actual (BVA) Reporting

If your company has a financial plan (budget), it can be useful to review financial performance YTD in comparison to the YTD plan and explain the drivers of variances.

Quarterly P&L and FY P&L vs. Plan

If you update your full-year forecast intra-year, it’s also helpful to compare the updated full-year forecast to the plan. It typically makes sense to include BVA reporting on your income statement. It can also be helpful to show BVA for cash flow or at least ending cash balances.

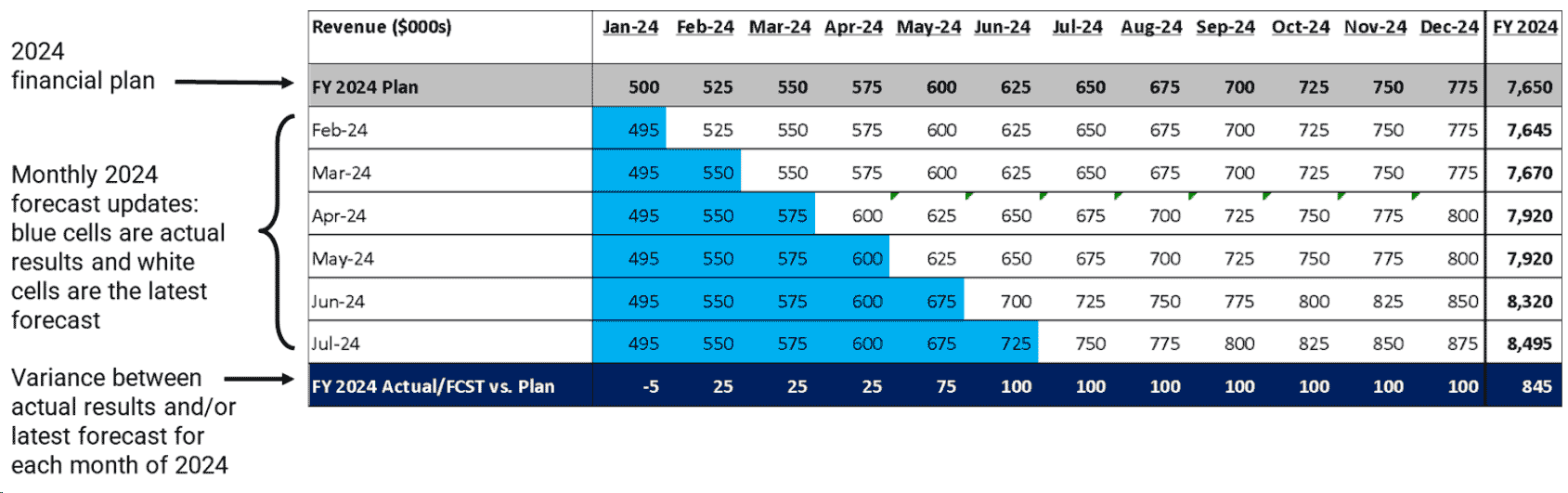

A waterfall analysis is another variant of BVA reporting that tracks monthly/quarterly performance and forecast movements over time. It’s helpful to prepare waterfall schedules for key financial metrics (e.g. ARR, Revenue, Expenses, Cash).

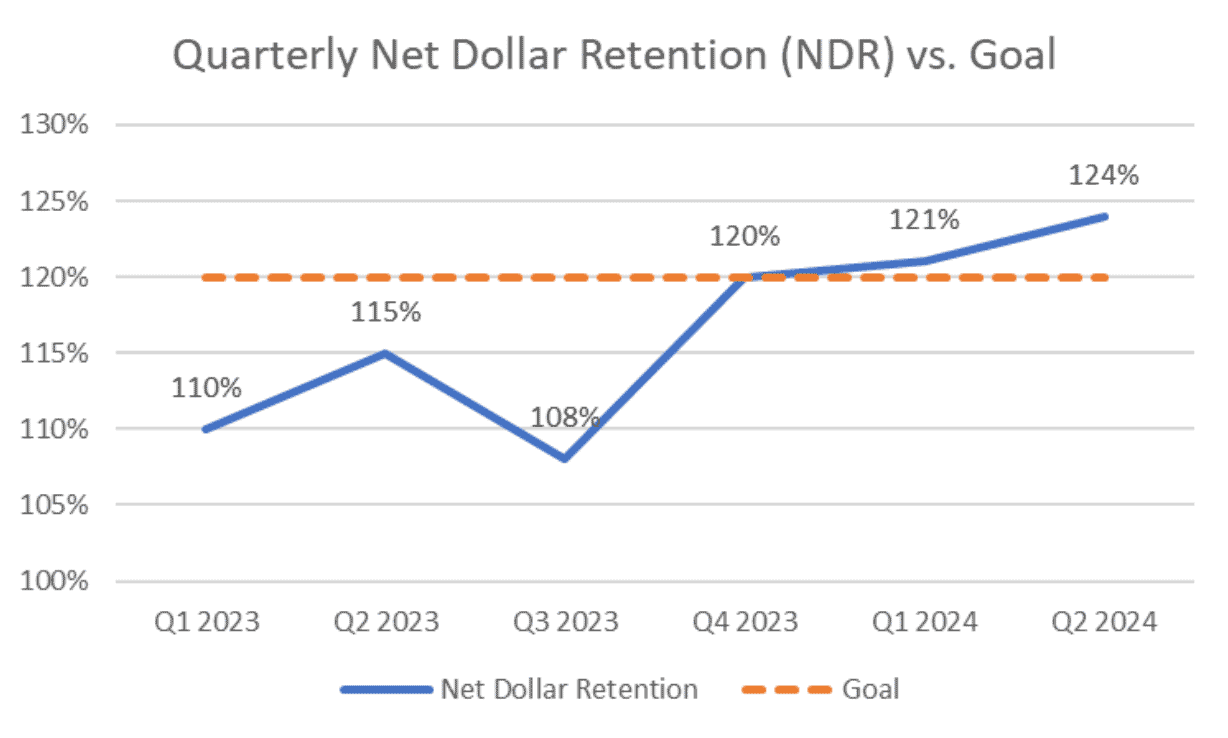

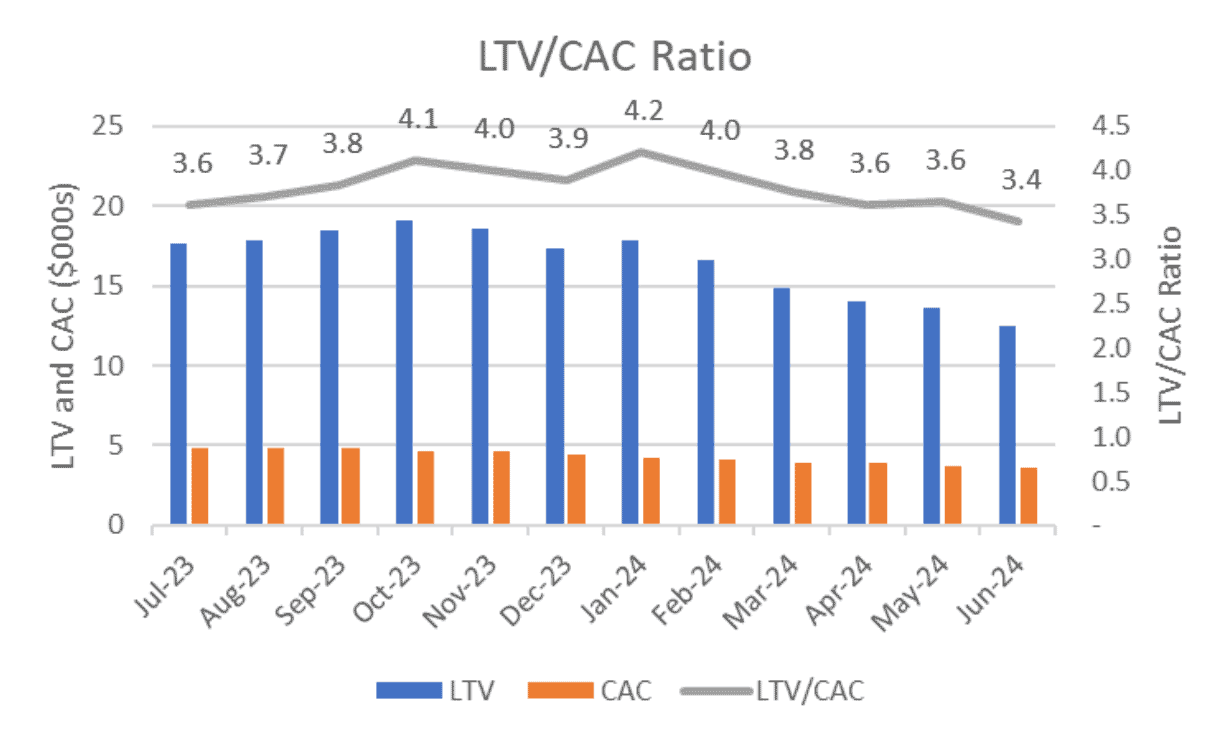

7. Key Metrics Reporting

Finally, be sure to present trends for other key metrics relevant to your company and industry.

Ensure your board meetings are as effective and impactful as possible by partnering with Burkland’s fractional CFO services. Our team of experienced financial experts will help you streamline your financial reporting, maintain consistency, and present data in a way that drives strategic decision-making. Whether you need support in aligning management and board reports, preparing detailed financial analyses, or simply ensuring that your financial section is both accurate and clear, Burkland has the expertise to elevate your board presentations. Contact us to learn how we can help you optimize your financial reporting and keep your board fully informed and engaged.