What is changing with the taxability of SaaS?

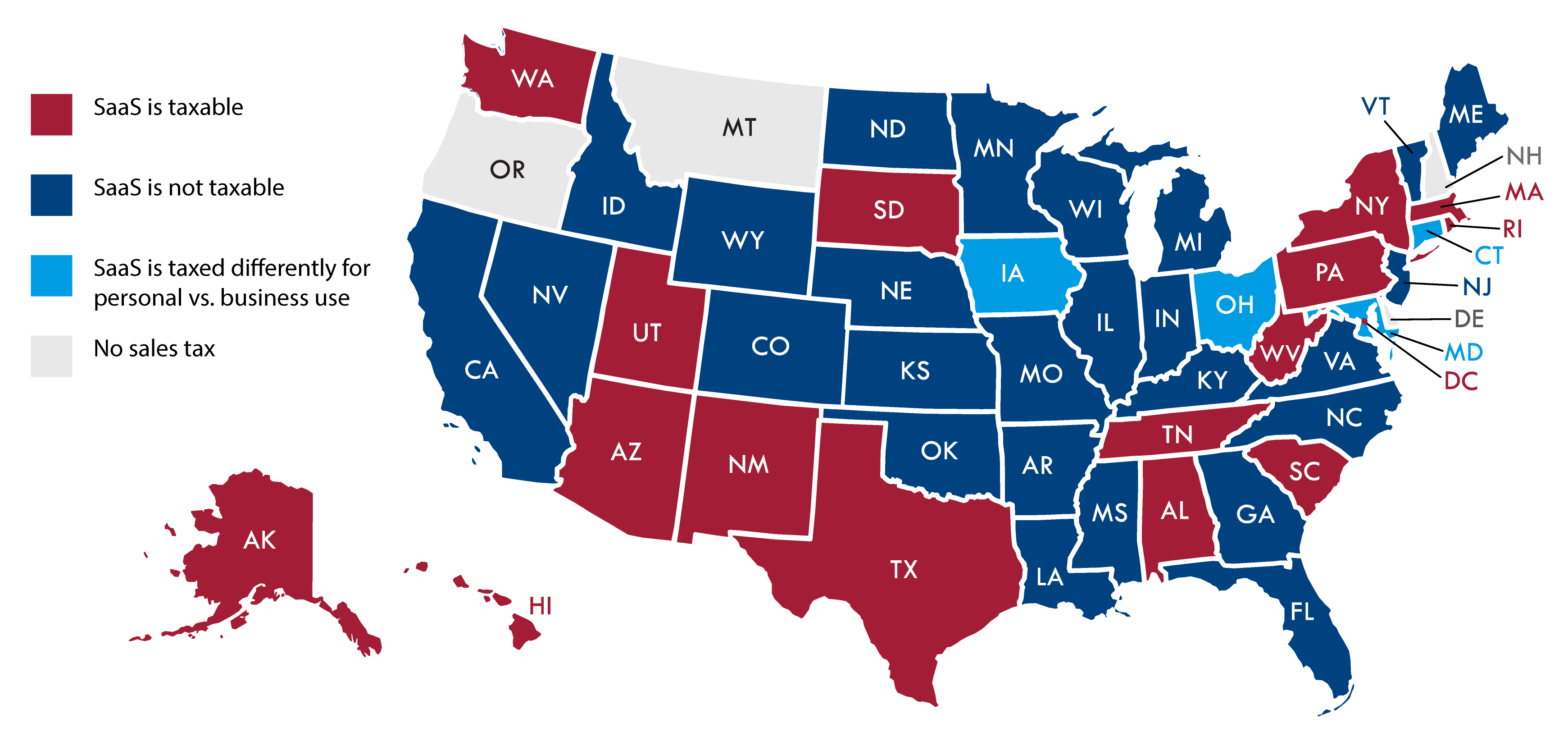

Statistics estimate 80% of businesses plan to make all their systems SaaS by 2025, and the state legislatures are ‘trying’ to capture lost revenue in this area. Some states view SaaS as a software while others as a service. Four states (HI, NM, SD & WV) tax all services while over twenty tax SaaS in some format.

*AL & MS taxability varies, AK & CO have local tax

See Tax Jar’s guide to sales tax by state.

When do startups become taxable?

Sales tax nexus defines the level of connection between a taxing authority and an entity. Until this connection is established, the taxing authority cannot impose its sales tax.

A sales tax nexus can be physical or economic:

- Physical [Quill Corp v North Dakota, 504 US 298 (1992)] Maintaining, occupying, or using permanently or temporarily, directly or indirectly, an office, place of distribution, sales or sample room or place, warehouse, server, storage place, or other place of business. Employee, representative, agent, or salesperson working in the state under the authority of the company on a temporary or permanent basis.

- Economic [17-494 South Dakota v Wayfair, Inc. (06/21/2018)] Any seller not having physical presence in the state shall remit sales or use tax, if the seller meets a set level of sales or number of transactions within a state.

Which startups are affected?

Everyone is affected, from those selling tangible and nontangible goods as well as services. At Burkland, we work with our startup clients to show them what they might consider nontaxable, but states could consider taxable. Even though only 40% of states tax SaaS, legislature continues to become more aggressive in taxing nontangible goods and services. Here are ways jurisdictions see SaaS / digital services differently:

- Bundling hardware and software

- Data processing services

- Digital goods, subscription

- Information services

- Online training, in-person or prerecorded

- Professional services

- Custom programming, mandatory or optional

- Security

- E.g., Recent case in NY ruled IT Security Services fall within the definition of taxable protective and detective services (N.Y. Tax App. Trib. Feb. 17, 2022).

- Server location: in or out of state

- Storage

- Web hosting services

- Not SaaS by definition rather IaaS or PaaS

- End-user B2B or B2C affects international sales

5 ways to protect your startup from a tax exposure

- Do not assume your product or service is nontaxable.

- Determine where you have physical and economic nexus. Contact Burkland Tax for a Nexus Study

- Typically states source the taxing destination of SaaS sales by the customer’s use of the software (this could result in multiple jurisdictions). With limited information provided by your customers there are alternates. Most states will accept proper documentation supporting the purchase address of your customer if accepted in good faith as the sourcing address of the sale. If using Apple or Google apps, they will collect and remit sales tax on your behalf. These sales are still reportable on your business’s sales tax returns as nontaxable sales to the taxing authorities.

- Do not forget use tax. When making taxable purchases and the vendor does not collect tax, use tax still applies. (One area I have seen this missed within the SaaS industry are tech purchases made overseas and shipped to the US.)

Why should I know (or care) about this?

Startups, especially in the tech industry can begin making revenue quickly and across multiple jurisdictions. Awareness, investors, and the marketplace all draw visibility to the company’s growth, causing higher visibility for audit. Companies with a higher profile and higher revenues tend to be chosen for audits more often.

- Registering for other taxes like payroll, income, etc. brings visibility to your business within a state.

- Potential sales and use tax liabilities affect fundraising, due diligence, and M&A.

- Most aggressive SaaS states include NY, PA, TX, WA.

- Even in states where SaaS is nontaxable, they can find areas to audit.

- E.g., CA currently sending nonregistered businesses letters to conduct self-audits. This results in new registrations and revenue for the state if liabilities are found during the review.

- In FY2019-2020 CA audited 1% of their active sales and use tax accounts and found $576 million in tax deficiencies.

Where can Burkland Tax help?

Burkland’s Tax Services group helps startups keep current on the latest tax updates and avoid surprises with services including:

- High-level Exposure Evaluation

- Nexus Study and/or Risk Assessment

- Sales and Use Tax State Registrations

- Sales/Use/Gross Receipts Tax Compliance

- Resale/Exemption Certificates

- Software Analysis, Integration, and Training

- Tax Consulting – product, invoicing, procedures

- Tax Planning