This article is the first installment of a two-part series on cash management and supply chain challenges of startups. In the second installment I outline an S&OP process for startups to help alleviate the challenges outlined in this article.

“We’re growing fast. We’re stocked out on a bunch of products, and we’re frustrating – maybe even losing – some of our customers.”

“Our warehouse is full of stuff, but apparently not the right stuff.”

“We’re getting low on cash, and we’re squeezed between covering expenses to expand and ordering materials for production.”

“Our salespeople are screaming at operations – ‘we don’t have any stuff to sell’ – and operations is pointing the finger back at sales – ‘why aren’t you selling what we’re making.’”

“Greater uncertainty throughout our supply chain has made things enormously more complex in the last 24 months.”

“We’re going to grow our way into bankruptcy!”

Managing a supply chain is a balancing act. For startups dealing with physical products, effectively managing working capital (often driven by inventory) is essential for both survival early on and the ability to scale.

In my almost two decades of experience with a Fortune 500 manufacturing company, we had the complexity of a global footprint, multiple sites, and thousands of products. But, we also had lots of resources, established products with reasonably good historical sales data, and sophisticated tools to help manage the process.

For the last ten years working with early-stage / entrepreneurial companies it’s been a familiar challenge but a much different situation. On the one hand, startups often have a simpler overall supply chain and fewer products. However, startups have their own unique challenges in managing a supply chain.

Supply Chain Challenges of Startups

- Startups often offer new products with little to no sales history.

- Resources are limited, and teams are small, with everyone wearing multiple hats.

- It’s often difficult to get payment terms from suppliers to ease the working capital strain.

- There is a high sensitivity to cash needs. Negative cash flow early on is common, and slim cash reserves pose an existential threat to the company if you run out of cash.

- Add to all this that in the last 24 months, so much of what we thought we could predict around supply chains has been tossed out the window, and it’s now become an even more daunting challenge.

Working Capital “Cash Squeeze” is Often a Challenge for Early-stage Companies

In the Burkland team’s roles as startup CFOs and advisors to founder teams, we are often at the intersection of our clients’ financial, strategic, and operational challenges. Helping an organization achieve the right balance in managing its supply chain means understanding and quantifying these challenges. The initial steps, which can yield enormous benefits for early-stage companies, can be difficult, but they don’t have to be complicated.

Initial Steps to Reduce Supply Chain Challenges

- Getting accurate information

- Getting alignment around sales forecasts, financial forecasts, demand plans, and production plans

- Establishing company practices around communication, particularly between customer-facing (sales, marketing) and internal operations (production, supply)

- Understanding implications around business risk and cash management

- Equipping CEO leadership for decisions dealing with business trade-offs and strategic and operational objectives.

Of course, as a company scales, more sophisticated tools, analytics and practices can be added. However, if the basic planning, communication, and analysis disciplines are well-established early on, these next-level tools will almost certainly be more effective.

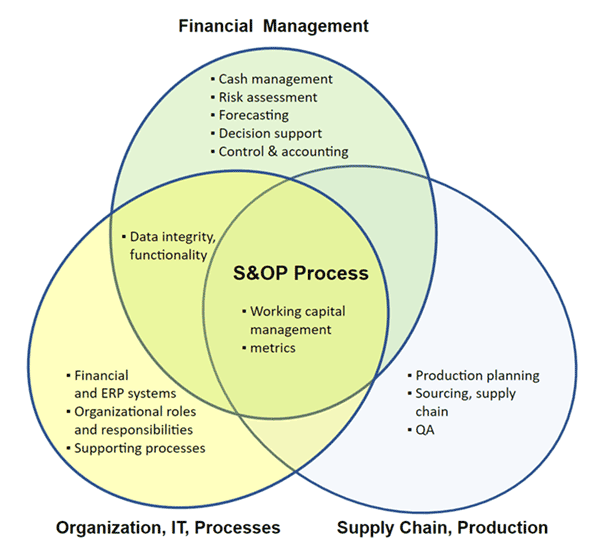

Sales & Operations Planning (S&OP) is at the Intersection of Finance and Operations

Startups with inventory should consider implementing an S&OP process early in its business stage – often before sales even ramp up, depending on the complexity of the supply chain and customer fulfillment goals. S&OP is an integrated planning process that aligns demand, supply, and financial planning, and is managed as part of a company’s master planning. S&OP is designed and executed to support executive decision-making related to approving a feasible and profitable material and financial plan.

S&OP Helps Startups Answer Questions Like:

- How do I manage risk (such as lost sales due to inability to fulfill; too much inventory; obsolete inventory; supplier uncertainty)?

- How much cash should I be tying up in inventory? How much should I be forecasting?

- Who is responsible for managing inventory levels? How do I balance demand uncertainty with supply uncertainty?

- How do I reconcile my sales forecast, financial forecast with my production plan and materials ordering?

- What metrics do I use to manage the business and incentivize various parts of the organization?

Read the follow up to this article where I explore the S&OP processes in detail, and provide an overview of the monthly S&OP cycle and a format for its implementation.

Burkland can help startups manage and reduce supply chain challenges and implement a scalable S&OP process. I and others on our CFO team have deep experience in supply chain and cash management, and this experience is critical when scaling your startup. Burkland also has a dedicated inventory team to help with inventory challenges. Contact us for more information.