“Plans are worthless, but planning is everything.” – Dwight Eisenhower

Developing a financial plan is one of the most beneficial exercises you can do as an entrepreneur when starting a business. A financial plan is like a spec for your company; it forces you to translate business strategy into a concrete business plan and establish an operating roadmap that identifies the timeline for your key business milestones. As you develop your plan, your team and your investors will align on the goals and objectives to move your business forward. A financial plan is also an essential tool to measure your business performance over time and track your growth over time against your goals.

A financial plan is like a spec for your company…

A financial plan is also crucial for raising capital. Your projections enable you to determine your business’ funding requirements and communicate the business model and unit economics to investors. In discussing your plan with prospective investors, you can demonstrate the financial literacy investors expect from executive teams.

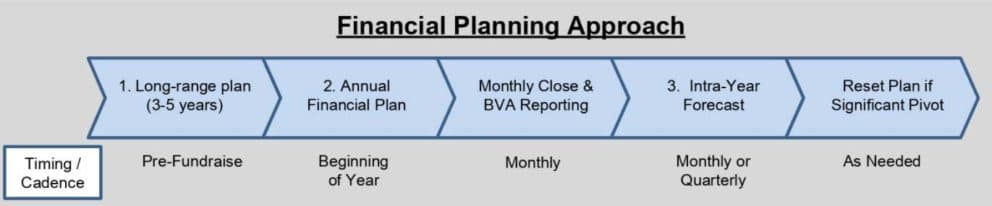

There are three types of financial plans that every startup needs:

- A Long-Range Financial Plan

- An Annual Financial Plan

- An Intra-Year Forecast

The exhibit below highlights how each of these three plans fit together within a financial planning process, and it also outlines the typical timing and cadence to prepare these plans. I will describe the three types of plans in more detail below.

1. Long-Range Financial Plan

A Long-Range Plan is typically the first financial model that a startup builds. It should include a 3-5 year outlook, with the number of years determined by how long it will take to prove and scale your business model. You should build the plan with monthly detail for the first 3 years, and you can plan the remaining years annually.

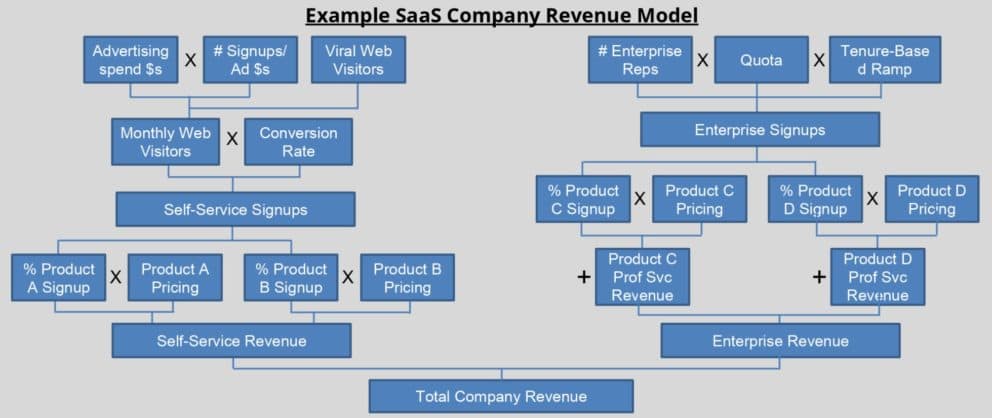

The Long-Range Plan should set your vision for the business model and help you to test the sensitivities of your key business drivers. At the early stages of a startup, long-range planning helps companies to validate their revenue model. Startups need to understand their key revenue drivers and validate their underlying growth assumptions. Revenue drivers are unique for each company, but they often include the sales and marketing funnel, product line and pricing, and expected distribution of new customers between different products. Companies should also factor in the expected net retention of customers over time – particularly for SaaS and other subscription-model companies focused on a “land and expand” strategy. The exhibit below shows a simplified example of a revenue model for a SaaS company that has both a Self-service (SMB) and Enterprise revenue model.

Financial modeling helps startups to understand their unique revenue drivers and validate their underlying growth assumptions. Key revenue drivers become important financial metrics to closely monitor.

Traditionally, most startups build their first long-range plan models prior to a Series A fundraise and refresh the model prior to subsequent fundraises. Given a traditional 18-24 month lag between fundraises, the long-range model is often not updated every year.

However, the immediate post-Covid-era significantly heightened the focus on long-range planning, as investors initially guided their portfolio companies to manage cash tightly and extend their cash runway. During this initial period of uncertainty, many companies prepared scenario plans to anticipate a range of different outcomes and the associated business response. Seed stage companies that previously had limited or no financial modeling capabilities were asked to prepare multiple versions of their long-range financial plan. Many companies built these scenario models in Spring 2020. While many startups have fared better than initially anticipated in the subsequent post-Covid months, many companies continue to refresh their longer-range outlook at a more frequent cadence than in the past.

2. Annual Financial Plan

The second type of financial projection you should prepare is an Annual Financial Plan, which is a detailed monthly plan for the coming year. I outlined a simple 3-Step Approach for building Annual Financial Plans in a recent blog. In general, the Annual Plan should be approved by your Board of Directors before the beginning of your next fiscal year. For companies with a December fiscal year-end, you should currently (around November) be knee-deep in building your financial plans and getting prepared to present to your Board at a December meeting. Companies that have recently built a long-range plan may streamline the annual planning process with a deep dive refresh of the next fiscal year within the plan.

Once your Board approves your Annual Plan, it becomes your North Star to measure performance throughout the year. As reflected in the Financial Planning Approach exhibit above, companies should close their accounting books monthly and compare the results against the plan, commonly referred to as budget vs. actuals analysis, or “BVA.” I recommend you share your Annual Plan with the entire company to ensure everyone aligns with the organization’s goals (although some executives prefer to omit sensitive details, such as the timing of cash running out).

Given the fluid nature of many early-stage startups, some startups choose to reset their financial plan mid-year if they have had a significant pivot or another factor driving significant variance to the original plan. For example, many companies updated their financial plans in the immediate post-Covid era.

3. Intra-Year Forecast

As its name suggests, an Intra-Year Forecast is simply an update of the Annual Financial Plan completed during the year to reflect actual performance to date and an updated view of what the company expects for the balance of the year. An Intra-Year Forecast is an important tool to manage your cash and make the necessary adjustments to stay as close to the Annual Financial Plan as you can. Some startups update their forecasts monthly, and others choose to update forecasts on a quarterly basis.

As the quote at the beginning of this article says, “Plans are worthless, but planning is everything.” In general, reality significantly deviates from your plans. By having a plan, you will quickly identify when business and market conditions have diverged from expectations, and you will be prompted to react and adapt quickly. One of the most useful things that on-demand CFOs can help you with is to develop Long-Range Plans, Annual Financial Plans, and Intra-Year Forecasts to help you plan, monitor, and grow your business with confidence.