One ramification of the COVID-19 downturn is increased pressure on startups to perform rigorous financial planning and analysis.

In this current environment, startups need to ‘up their game’ on finance and accounting.

From Aggressive Growth to Cash Conservation

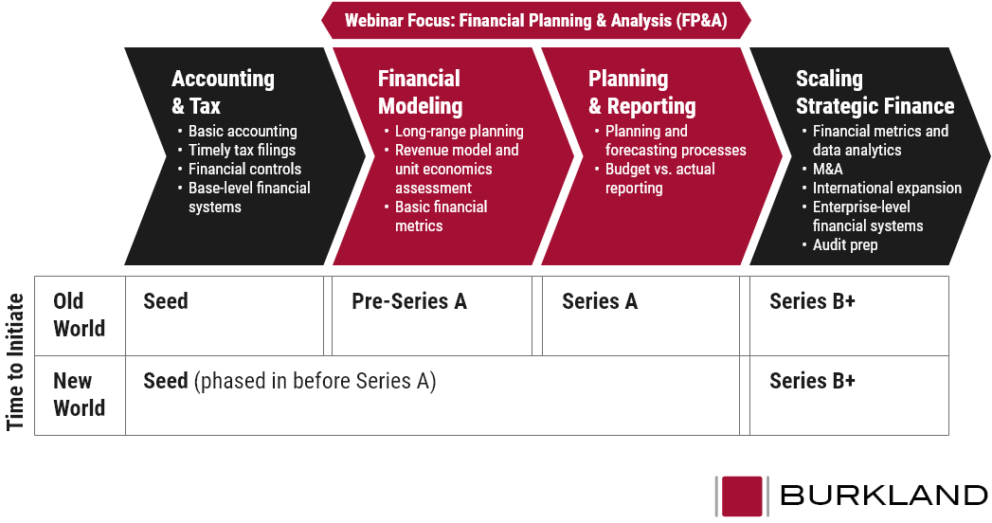

We have shifted from an “Old World” with record levels of VC funding and a primary focus on aggressive growth to a “New World.”

This New World is marked by a falloff in VC funding, uncertainties around timing of economic recovery, and a shift in focus to cash runway conservation. Startups need to implement more robust finance practices at earlier stages to support their cash management efforts.

In the Old World it was sensible for Seed stage startups to lay the foundation for accurate accounting practices, but hold off on more extensive financial modeling and analysis until their business model was more developed, closer to the Series A timeframe.

In the New World, Financial Planning & Analysis Can’t Wait

In the New World, startups at all stages are building scenario models and tightly managing cash to extend their cash runway. It is important to note that these activities are not a “one-and-done” activity. Startups need to continue to be diligent with their financial planning and analysis efforts to continue navigating through the uncertainty.

Startup Finance & Accounting in the New World

The exhibit above highlights some of the key financial planning and analysis activities that startups need to employ earlier and at an elevated level. These activities include financial modeling, financial planning, and reporting.

Increased board reporting and scrutiny are key themes with which startups are grappling in this new environment. As startups face more questions and reporting requirements from their boards, these activities will provide the information needed.

I have written a detailed presentation that highlights how startups should implement each of these activities. Contact us to request a private office hour for your startup or portfolio companies.