A well chosen board: collective wisdom that will will take you places.

Do You Really Need a Board?

Legally, every company is required to have a board of directors. It could be just one person (i.e. you), but building a well-functioning board is an opportunity to increase your startup’s chances for success. The board is responsible for authorizing major decisions like senior executive hiring and compensation, issuing debt and equity (including stock, options) and approving budgets/strategic plans, major expenditures and significant transactions.

Many founders we’ve met are focused on their percentage ownership in the company as the primary measure of control, with 51% often the magic number. But the reality is that very few decisions require a shareholder vote – generally, raising money or selling the company. As noted above, far more decisions (including those that require a shareholder vote) require board approval, making your board at least as, if not more, important to controlling the fate of the company.

A good board helps you refine your strategy, improves your decision-making and adds stability to your company. It should also help you recruit senior managers, secure customers and partners and raise capital. Board members can and should make introductions to relevant parties and sometimes help you close the deal. Having the right people on your board also increases your credibility with these parties, allowing you to punch above your weight. You can use positions to attract highly-experienced talent that would otherwise not be interested, available or affordable.

How Do You Build the Board?

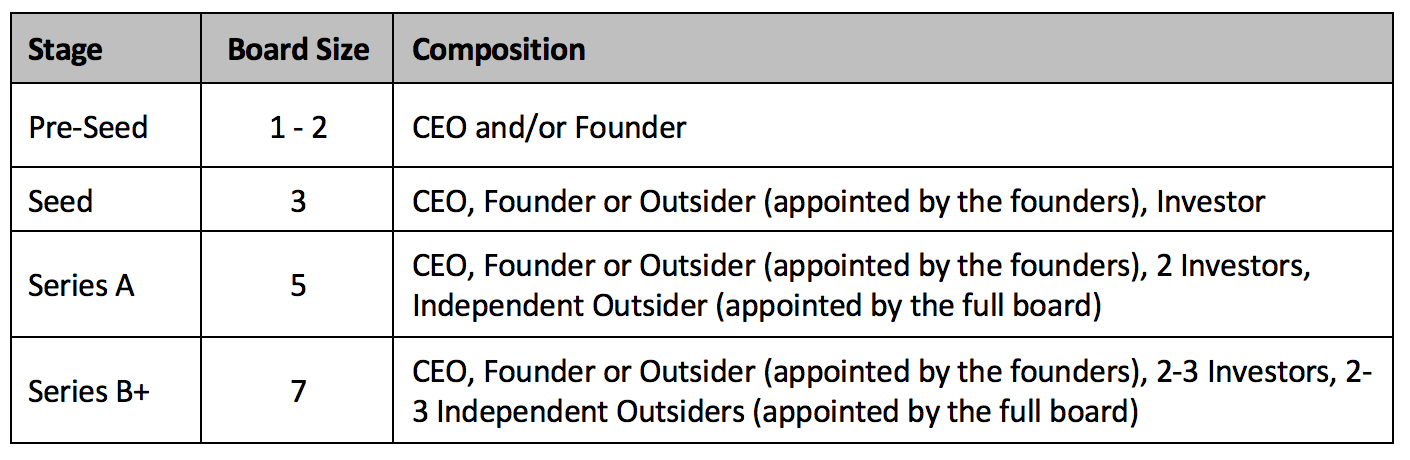

The ideal size and composition of your board can and will change over time depending on the stage of the company. As a general rule of thumb, smaller is better and an odd number is often preferable so there is no potential for a tie vote that is the same as a “no” vote (in practice, this is quite rare, however). Given the importance, be very thoughtful about who you add to your board. Each board member should add some unique value or perspective and be able to work effectively with the other board members and the senior management team.

Initially, just you and/or your co-founder is probably sufficient to make sure you can move quickly and get your company set up the way you want. The CEO should definitely be on the board and lead the meetings. If the founder is not the CEO, it may be appropriate for him or her to have a seat as well, but beyond that I don’t recommend having anyone else from the management team on the board. They will pretty much always vote with the CEO and don’t bring much fresh perspective. The remainder will be made up of investors and independent “outside” directors.

Often, your board will expand or change each time you raise a round of financing. Investors should hold seats that are roughly proportional with their ownership of the company. For example, if an investor (or group/series of investors) owns 20% of your company, then one seat on a five-person board is appropriate. In order to maintain this relationship, early investors may need to give up their seats to later investors. Smart investors bring a lot of value to your board given that they have broad experience with similar companies and business models as well as relationships with industry players and potential follow-on investors. That said, the marginal value of adding additional investors to your board goes down quickly and investor-dominated boards are not ideal.

Your outside directors are a tremendous opportunity to add talent and guidance to the company. Given the math below, it makes sense for the early outsiders to be people you know and trust so that you can rely on them to not only help guide the company but to be aligned with your vision should there be critical early decisions to be made. That said, resist the urge to appoint them based solely on the reliability of their vote and instead pick people who bring real industry knowledge and contacts to the table. As the company grows, you will likely add outsiders who lack a personal connection, but if you choose individuals with wisdom and integrity, you can be assured they will act in the best interests of the company and its shareholders (including you). This may not always be in your best interests as a manager, but this needs to be OK as your goal should be to maximize the value of your equity not to protect your compensation or perks.

See below for the ideal board based on each stage:

Resist the urge to expand your board beyond seven people until you are much larger or publicly-traded as it makes scheduling and decision-making more difficult. One way to accomplish this goal is by appointing “Board Observers” who have the right to attend meetings and receive information but don’t have a formal board seat/vote and/or by allowing people (e.g. the larger management team) to attend meetings by invitation.

How Do You Compensate BoD Members?

In an early-stage company, it is generally not necessary to compensate management, founder or investor board members. Each of these individuals typically already earn cash compensation based on their management roles and own a meaningful equity stake in the company. Some companies provide a small stipend to their outside directors (often paid on a per-meeting basis) but the primary compensation is usually via participation in the management equity plan. For an early-stage company, each independent director might receive 0.5-2.0% of the company, which gets diluted over time. The company should reimburse the directors for their out-of-pocket expenses incurred while attending meetings or otherwise discharging their responsibilities.

The bottom line is that a good board makes you more effective and increases your company’s probability of success. A bad board not only does the opposite but can make your life miserable. Be thoughtful about how you assemble your board and seek the advice of experienced mentors and advisors to ensure you do it right.